Bram Houghton

April 09, 2024

Economy Commentary Weekly update Weekly commentaryMarket Update - April 5, 2024

MARKET UPDATE – March 25th – April 5th , 2024

In a Nutshell: Global markets were choppy over the past two weeks despite hitting record highs as economic data suggests that interest rate cuts may not come as soon as markets had anticipated. Volatility spiked on the mixed news as the Volatility index (VIX) increased by 18% throughout the week.

U.S. Labour Markets

Continuing resilience in the labour market and further robust employment numbers this week has caused investors to rein in their rate cut expectations. Markets as well as policymakers had pointed to a mid year rate cut, which is looking less likely given economic resilience.

U.S. job openings held steady at higher levels in February, while the number of people quitting their jobs rose marginally. Job openings, a measure of labor demand, edged up 8,000 to 8.756 million on the last day of February according to the monthly Job Openings and Labor Turnover Survey, or JOLTS report.

Initial claims for state unemployment benefits rose 9,000 to a seasonally adjusted 221,000 for the week ended March 30, the highest level since late January. Economists polled by Reuters had forecast 214,000 claims in the latest week. Claims had bounced around between 210,000 and 212,000 for much of March.

U.S. private businesses unexpectedly hired 184,000 workers, beating the forecast of 148,000 job gains in March, the largest in eight months. U.S. private payrolls also increased more than expected in March, pointing to continued labor market strength.

Wages for workers remaining in their jobs increased 5.1% on a year-on-year basis, after a similar gain in February.

U.S. Economy

Robust economic activity in the U.S. continued to create uncertainty about the rate cuts occurring mid this year.

Orders for durable goods increased by a more than expected 1.4%, though January was revised lower to show orders falling 6.9% instead of 6.2% as previously reported.

U.S. manufacturing grew for the first time in 18 months in March as production rebounded sharply and new orders increased, but employment at factories remained subdued and prices for inputs pushed higher. The Institute for Supply Management (ISM) manufacturing PMI increased to 50.3 last month, the highest and first reading above 50 since September 2022, from 47.8 in February.

U.S. services industry growth slowed further in March, while a measure of prices paid by businesses for inputs dropped to a four-year low, which bodes well for the inflation outlook. The Institute for Supply Management (ISM) non-manufacturing PMI fell to 51.4 last month from 52.6 in February, the second straight monthly decline in the index since rebounding in January.

Canadian Economy

While lagging the U.S in economic strength, Canada showed positive signs. This should give policymakers some flexibility in their interest rate policy over the coming months.

Canada's gross domestic product strongly rebounded in January exceeding expectations and February's preliminary estimates point to another expansion.

The economy grew by 0.6% in January, its fastest growth rate in a year and February's GDP is also likely to have grown by 0.4% with main contributions from mining, quarrying and oil and gas extraction, though other industries will also likely contribute.

Canadian manufacturing activity moved towards expansion in March to ending a lengthy period of contraction as employment rose alongside a slower downturn in new orders. The S&P Global PMI rose to a seasonally adjusted 49.8 in March from 49.7 in February, posting its highest level since April.

The downturn in Canada's services sector deepened in March as higher prices and elevated borrowing costs crimped customer demand. The headline business activity index fell to 46.4 from 46.6 in February.

A reading below 50 indicates contraction in the sector. The index has been stuck below that threshold for ten straight months, the longest such stretch in three years.

Eurozone and U.K. Economy

While still facing economic challenges U.K. and Eurozone are showing signs of recovery and cooling inflation. It has been confirmed that Britain entered a recession in Q4 2023, while the EU’s largest economy Germany is still showing signs of turning the corner despite the road being bumpy.

Britain's economy entered a shallow recession last year, official figures confirmed this week. Gross Domestic Product shrank by 0.1% in the third quarter and by 0.3% in the fourth, unchanged from preliminary estimates, the Office for National Statistics (ONS) said on Thursday.

German retail sales unexpectedly fell in February, quashing hopes that private consumption could help Europe's largest economy to recover in the first quarter. Retail sales decreased by 1.9% compared with the previous month in real terms. Analysts polled by Reuters had predicted a 0.3% increase in February.

Preliminary data showed inflation fell in six economically important German states in March, suggesting that national inflation will continue its downward trajectory. The inflation rate in North Rhine-Westphalia, Germany's most populous state, fell to 2.3% in March from 2.6% in February.

The number of people out of work in Germany rose less than expected in March, with officials confirming that the number of unemployed grew by 4,000 in seasonally adjusted terms to 2.719 million.

Asian Economy

China has seen some strong data form it’s manufacturing sector, suggesting that rate cuts are beginning to inspire recovery, while Japan’s road to recovery might take longer than anticipated.

China's manufacturing activity expanded at the fastest pace in 13 months in March, with business confidence hitting an 11-month high, driven by growing new orders from customers at home and abroad. The Caixin/S&P Global manufacturing PMI rose to 51.1 in March from 50.9 the previous month, above analysts' forecasts of 51.0 and marking an expansion for the fifth consecutive month.

Japan's factory activity in March contracted for the 10th consecutive month though the downturn was the least pronounced in four months, aided by softer contractions in output and orders. The final au Jibun Bank Japan Manufacturing PMI was at 48.2 in March, the highest level since November.

Japan's jobless rate in February rose to 2.6% from 2.4% in the previous month.

Gold

Gold is trading near all time highs even in the face of expectations that the Federal Reserve will be slow to lower interest rates. The shift to lower interest rates is broadly expected to be bullish for gold as the precious metal will become comparatively more attractive compared to bonds.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.8% | 0.4% | 0.8% | -0.3% | 0.7% | 3.2% | 3.6% |

| Last Week | 0.4% | -1.0% | -2.3% | -0.8% | -1.3% | 4.3% | 4.6% |

Market data taken from https://www.marketwatch.com/

Macro Memo March 26 - April 8, 2024 by Eric Lascelles Link to Article

Soft landing narrative remains intact

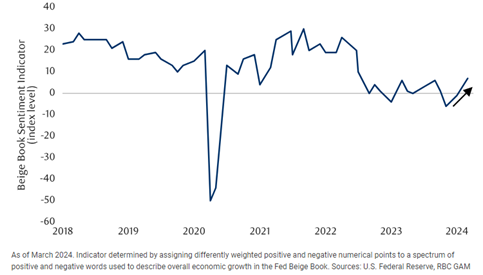

With the current state of economic activity, a soft landing is looking more and more likely. The Fed's Beige Book, which previously suggested a recession based on flat or declining business activity in many regions, has now shown an impressive rebound. The indicators reflect this rebound, with eight out of 12 regions reporting rising activity. Future growth prospects are described as positive, marking a significant improvement from previous negative assessments. Indicators such as the New York Federal Reserve's weekly economic index and low initial jobless claims support the notion of continued economic growth. The Atlanta Federal Reserve's GDP nowcast predicts a 2.1% annualized GDP growth in the first quarter of 2024, which is lower than previous rates but still considered satisfactory given the rapid growth experienced earlier.

Beige Book Sentiment Indicator shows an impressive rebound

Inflation and Inflation Expectations

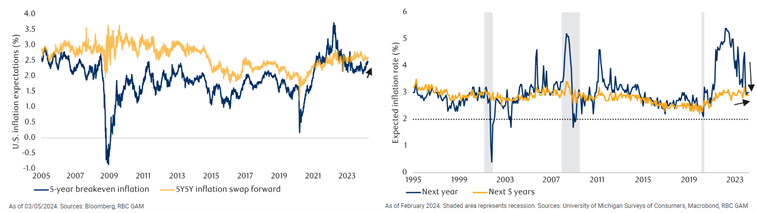

Inflation in the U.S. remains around 3%, which is an improvement from its peak of 8-10% but still above the 2% target. The U.S. Consumer Price Index (CPI) for February showed some mixed results, with Core CPI year-over-year decreasing slightly to 3.8% and Headline CPI at 3.2% YoY.

Inflation expectations are important in predicting future inflation trends. There are various methods used to gauge inflation expectations in the U.S., such as bond market break-evens and consumer/business surveys, each providing a slightly different perspective.

Without a significant event (such as a recession) to reset corporate pricing power and wages, and with structural factors like pandemic effects, de-globalization, worker empowerment, and climate change influencing inflation, inflation may trend higher than before. Alternatively, if central banks persist in targeting lower inflation rates, real interest rates may need to be higher, potentially leading to weaker economic activity.

Medium Term Inflation Expectations rising (Left) while Short Term Inflation Expectations are falling (Right)

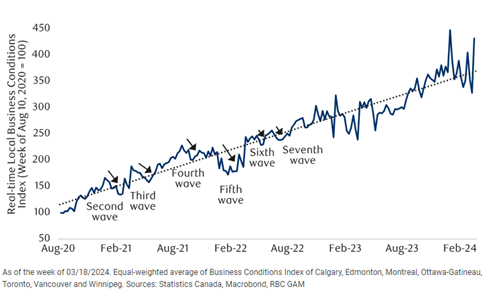

While the Canadian economy has certainly been running cooler than in the U.S., there is also no evidence of a sudden drop. StatsCan real-time Local Business Conditions Index has jumped higher and the economy also added 41,000 new jobs in February. While this number is a little underwhelming relative to the significant population growth, it is more than sufficient to signal economic growth.

Business conditions in Canada have rebounded

A further broadening of the market is in order by Dave McGarel, Chief Investment Officer, First Trust Portfolios Link to Article

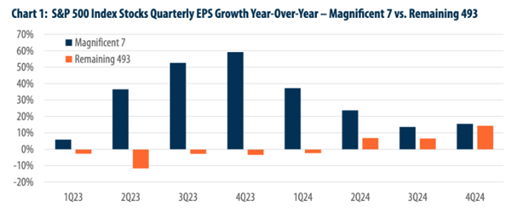

The article highlights the importance of earnings in the stock market, noting that despite momentum and speculation driving the market, investors are still focused on earnings. The performance of the "Magnificent 7" stocks in 2023 was impressive, with these stocks contributing significantly to the overall gain in the S&P 500 Index.

Earnings growth for these stocks was notable, with companies like NVIDIA, Apple, Google, Microsoft, Meta, and Amazon seeing substantial increases in profits. Meta and Amazon rebounded from previous declines in earnings, showing significant growth in 2023. While the first quarter of 2024 is expected to still be dominated by these top-performing stocks, the rest of the market is anticipated to see an increase in earnings growth throughout the year.

Source: S&P Capital IQ data as of March 28, 2024. There is no assurance that any forecasts will be achieved

By the fourth quarter of 2024, the rest of the market is expected to be growing at a similar rate to the Magnificent 7 and Tech+ group. The article suggests that investors should focus on stocks with strong earnings growth and better valuations, as the market is expected to continue broadening based on earnings performance throughout the year.

Finding victories in a confusing first quarter for global markets by Kristina Hooper, Chief Global Market Strategist, Invesco Link to Article

Markets anticipate the start of rate cuts

Despite initial confusion caused by central bank statements, the first quarter of 2024 was overall a "risk on" period. Markets largely ignored disappointing data and hawkish central bank talk, focusing instead on expectations for continued disinflation in Western developed economies, and potential rate cuts by central banks. The markets are also anticipating a soft and brief slowdown in the global economy, followed by a re-acceleration.

The “little” victories

Disinflation, though rocky, continued throughout Q1. Federal Reserve Chair Jay Powell agreed with markets that it was “more along the lines of what we want to see.”

The U.K. and Eurozone see more progress on inflation with the U.K. hitting its lowest level since 2021 and below expectations.

US manufacturing data is better than expected with the ISM Manufacturing PMI surprised to the upside, moving into expansion territory for the first time since September 2022.

NOTABLE NEWS

A new report suggests Canadians' television viewing habits continue to shift toward streaming platforms at the expense of traditional cable and satellite subscriptions, at a time when the federal regulator is considering new rules to help level the playing field across the sector.

The annual Couch Potato Report released Monday by Convergence Research says 42 per cent of Canadian households did not have a TV subscription with a traditional provider by the end of last year. It forecasts that by the end of 2026, half of all households won't be traditional TV watchers.

In just three years, Brazil's hugely popular Pix payment system has become the country's favorite way to pay, replacing cash and wire transfers in many cases and now threatening the dominance of credit cards in the booming e-commerce sector.

The instant payments designed by Brazil's central bank are a boon to online retailers, helping with cash flow in a sector with tight margins, while undercutting the legacy business of banks and fintechs built on existing credit card infrastructure.

If you think others may benefit from reading our content, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Tyler Quinn, CIM, FCSI Bram Houghton, CFA, CFP

Wealth Advisor Sr. Investment Advisor, Investment Advisor

(403) 835 - 4785 Portfolio Manager (403) 690 - 9376

aurie.wicks@cibc.com (403) 299 - 7356 bram.houghton@cibc.com

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.