Bram Houghton

April 23, 2024

Economy Commentary Weekly update Weekly commentaryMarket Update - April 19, 2024

MARKET UPDATE – April 8 th – April 19 th, 2024

In a Nutshell: Markets took a turn this past week as the most recent inflation print suggest that it is highly unlikely the Fed will cut rates as predicted in June and may have to wait until at least September. The Canadian government’s Federal Budget 2024 was released making waves for its significant departure from decades on tax policy.

U.S. Economy

The U.S. economy showed signs of heat with the inflation print coming in above market expectations which makes it likely the Fed will wait for longer to cut rates. Despite this the U.S economy appears to be humming along and will likely see Gross Domestic Product (GDP) growth in Q1 2024.

The U.S. labour market continued to remain resilient with jobless claims remaining stable for another two weeks. Despite this fact, we have still likely seen enough notable weakness in other factors such as new job creation and wage inflation that provide enough fuel for the Fed to cut rates as other economic factors permit; largely inflation.

Headline U.S. consumer price growth accelerated in March with the annualized reading of the closely-watched Consumer Price Index (CPI) increased by 3.5% last month, above the pace of 3.2% notched in February and above expectations. Month-on-month, the overall CPI rose by 0.4% in March, staying at the 0.4% uptick seen last month, above the 0.3% expected

U.S. wholesale inventories rebounded solidly in February, suggesting that inventories could contribute to economic growth in the first quarter. The Commerce Department reported that wholesale inventories rose 0.5% as estimated last month. Inventories are a key part of gross domestic product. They dropped 1.5% on a year-on-year basis in February.

U.S. retail sales increased more than expected in March amid a surge in receipts at online retailers, further evidence that the economy ended the first quarter on solid ground. Strong retail sales prompted economists at Goldman Sachs to boost their GDP growth estimate for the first quarter to a 3.1% annualized rate from a 2.5% pace. The economy grew at a 3.4% rate in the fourth quarter.

U.S. consumer sentiment ebbed in April while inflation expectations for the next 12 months and beyond increased. The University of Michigan's preliminary reading on the overall index of consumer sentiment came in at 77.9 this month, compared to a final reading of 79.4 in March. Since January, the sentiment index has remained within a very narrow 2.5 point range, well under the 5 points which the University of Michigan said was necessary for a statistically significant difference in readings.

Canadian Economy

Canadian Economy appears to be even footed at present and the most notable potential impact will be that of the proposed Federal budget which was released this week. There are some significant proposed changes, the most notable being the change to Capital Gains inclusion on income tax.

In a bid to increase revenue to pay for housing and other programs, as well as debt servicing costs which now exceed healthcare spending ($54.1B vs $52.1B) Canada's annual budget on Tuesday proposed increasing the share of capital gains that is subject to taxation to two-thirds from one-half for people with annual investment profits greater than C$250,000 as well as for corporations and trusts.

Canada's plan to raise taxes on capital gains (notably within corporations), is likely to hold back investment, potentially adding to the productivity malaise that has held back economic growth in recent years, say economists. Lower productivity directly impacts inflation and may spell a longer term affordability crisis.

On the personal side, areas to consider are the impact on the sale of real estate not covered by the principal residence exemption and taxes payable by an estate. Further, small business owners, professionals, and contractors who use a corporation’s tax deferral rather than personal RRSPs for retirement savings are significantly impacted.

The Bank of Canada (BoC) kept its key interest rate unchanged at a near 23-year high of 5% on last week and ruled out a cut until it sees more signs that a recent drop in inflation will be sustained. In its quarterly Monetary Policy Report, the bank also hiked its growth forecast for 2024 on the back of strong immigration flows and increased household spending.

Canada’s CPI rose to 2.9% in March from 2.8% in February on a Year-over-Year basis, boosted by higher prices for gasoline. Core CPI slowed to a 2.8% YoY increase, down from a 2.9% gain in February. BoC Governor Tiff Macklem, speaking at an event in Washington, said March data suggested the Canadian economy was continuing to move "in the right direction."

U.K. and Eurozone Economy

The U.K. and Eurozone continue to see signs that enable their central banks to begin to cut interest rates. The U.K appears to have received from their shallow recession and inflation is cooling across the continent.

Britain's economy is on course to exit a shallow recession after output grew for a second month in a row in February, and January's reading was revised higher. GDP expanded by 0.1% in monthly terms in February, in line with expectations while January's reading was revised to show growth of 0.3%, up from 0.2% earlier.

Euro zone inflation slowed across the board last month, reinforcing expectations for a European Central Bank interest rate cut in June, even as rising energy costs and a weak euro cloud the outlook, final data from Eurostat showed on Wednesday. Inflation in the 20 nations sharing the euro currency slowed to 2.4% last month from 2.6% in February, in line with a preliminary estimate released earlier this month.

German exports fell more than expected in February, as exports to EU countries dropped, data from the Federal Statistics Office showed on Monday. Exports declined by 2% month-on-month in February and were lower than the forecast for a 0.5% decrease in a Reuters poll. Imports were up 3.2% on the month.

Consumer prices in France, rose 2.4% year on year in March which was caused mainly by a seasonal increase in manufactured goods prices. On a monthly basis, prices rose 0.2% in March, having risen 0.9% in February.

Asian Economy

China saw a set back in its recovery this week with imports contracting sharply and GDP growth slowing annually from last year. Signs of recovery are emerging but it won’t be a swift turn around.

China's economy is expected to have slowed in the first quarter as a protracted property downturn and weak private-sector confidence weigh on demand, maintaining pressures on policymakers to unveil more stimulus measures. Data on Tuesday is forecast to show GDP grew 4.6% in January-March from a year earlier, slowing from 5.2% in the previous three months and hitting the weakest since the first quarter of 2023, according to a Reuters poll.

China's March exports contracted sharply, while imports also unexpectedly shrank, both undershooting market forecasts by big margins, customs data showed on Friday, highlighting the stiff task facing policymakers as they try to bolster a shaky economic recovery. Shipments from China slumped 7.5% year-on-year last month, marking the biggest fall since August.

Energy

Oil prices held near a three-week low this week as investors weighed mixed U.S. economic data, U.S. sanctions on Venezuela, and tensions in the Middle East. Brent Closed on Thursday at the lowest level since March 27th and Wednesday WTI also closed at its lowest since March 27th.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -1.6% | -1.6% | -2.4% | -0.5% | 0.3% | -1.4% | 1.2% |

| Last Week | -0.4% | -3.0% | 0.0% | -5.5% | -1.1% | -2.8% | 1.2% |

Market data taken from https://www.marketwatch.com/

A note from the WQH team: There are conflicting views on the direction of inflation globally and most importantly in the U.S. Below we present some of the opposing arguments that represent this debate.

Why the uptick in inflation isn't the start of a new trend by Larry Adam, Chief Investment Officer, Raymond James Link to Article

Higher-than-expected inflation has dampened market expectations for rate cuts, with projections for 2024 rate cuts decreasing from six at the beginning of the year to around two currently. However, Federal Reserve's preferred inflation measure, Personal Consumption Expenditures (PCE), may not be as impacted by certain factors driving up CPI, such as shelter and auto insurance costs, which could result in downward pressure on PCE inflation. As economic activity moderates, the labor market stabilizes, and inflation trends downward, the Fed may still cut rates three times in 2024.

Economic growth should start to simmer down

Factors contributing to this anticipated slowdown include a decrease in small business optimism, an increase in businesses reporting poor sales, and rising borrowing costs due to higher interest rates. With mortgage rates above 7.0%, credit card rates near record levels, and increased interest rates on short-term business loans, spending is expected to be dampened. Additionally, a softening labor market, decreasing savings, high credit card balances, and rising delinquencies suggest a potential slowdown in consumer spending as well.

Labor conditions will gradually ease

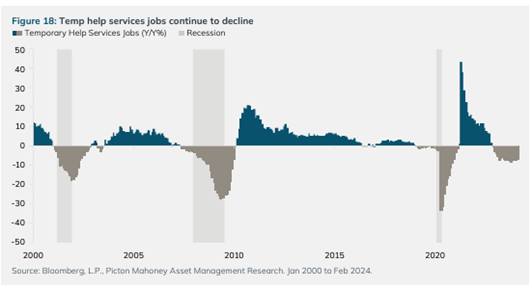

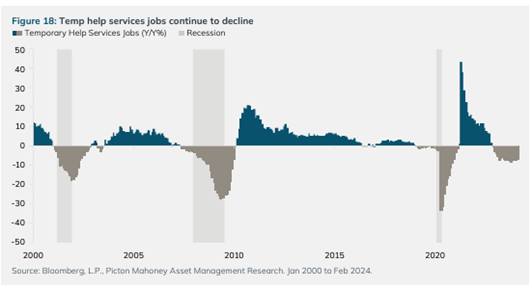

The job market currently appears strong, with 303,000 jobs added last month and a consistent unemployment rate at or below 4% for 28 months. However, there are signs of potential weakening in labor conditions. Employment subsectors in both the ISM Manufacturing and ISM Services Indices have entered contractionary territory, small businesses are scaling back hiring plans, and temporary help services have been declining for over a year, which are the first labour market to weaken. While significant job losses are not expected, these indicators suggest a softening labor market, which may limit wage growth and impact consumer spending.

Forward-looking metrics point to more downside

The article discusses how despite high inflation rates, there are indicators suggesting a downward trend in inflation. Services prices have remained high but the prices paid subsector within the ISM Services Index has decreased, indicating a potential deceleration in services prices in the future. Additionally, goods prices are expected to stay low as supply chains normalize and manufacturers report high inventory levels. Factors such as additional Amazon selling events and slowing demand for motor vehicles point towards further discounts in the goods sector, making a significant acceleration in inflation unlikely.

Is the Fed Tight, or Not? By Brian S. Wesbury – Chief Economist and First Trust Economics team Link to Article

There is an ongoing debate in the realm of economics regarding whether U.S. Federal Reserve policy is tight or not. One could use a two-part test to determine if monetary policy is tight: first, whether the economy has weakened to below trend growth, indicated by falling GDP or rising unemployment; and second, whether inflation has persistently declined.

Real GDP growth has been around 2.0% annually, with unemployment remaining below 4.0%, suggesting no economic slump consistent with tight money. In terms of inflation, CPI inflation fell to 3.1% in mid-2023 but has since stabilized.

Traditional measures of monetary policy signal tightness, such as the M2 money supply (the expansion of money available through borrowing) decreasing and an inverted yield curve (longer term rates are lower than current rates), but the federal funds rate has been roughly neutral compared to inflation.

Interest rates should be roughly equal to nominal GDP growth, which is higher than the current federal funds rate, indicating that monetary policy may not be as tight as perceived. This could lead to a longer period of higher inflation and interest rates, potentially resulting in more economic challenges than anticipated.

** This graph serves as a reminder that the U.S. Federal Reserve needs to remain vigilant in their mandate to curtail above target inflation, and consider all economic indicators in their decision making process over the coming months.

Live Long And Prosper! by Dr. Ed Yardeni Link to Article

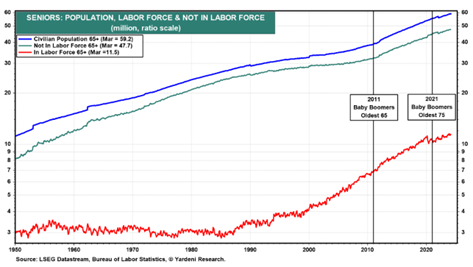

American consumers have remained resilient as interest rates increased over the past 18 months with strong consumption of goods and services, particularly with the demand for services. This increased consumption has led to a surge in employment in major service industries, resulting in higher purchasing power and spending among consumers.

The retiring Baby Boomer generation, known as the wealthiest senior citizen cohort in US history, has played a significant role in driving these trends. The population and labor force of seniors aged 65 and older have seen substantial growth, with a significant number of seniors no longer in the workforce, likely due to retirement.

This demographic shift has contributed to a record household net worth of $156.2 trillion, with Baby Boomers holding a substantial portion of $76.2 trillion. The spending habits of retired and retiring seniors have led to increased expenditures in sectors such as air transportation, hotels, food, and healthcare services, resulting in record-high employment levels in these industries. This consumer-driven spending has helped maintain the resilience of the economy and prevent a consumer-led recession over the past two years.

NOTABLE NEWS

At Calgary's Centre for Newcomers, where Kelly Ernst is chief program officer, staff have been — in Ernst's words — "run off their feet." The non-profit organization, which offers services and language training to immigrants and refugees in Alberta's largest city, served an eye-popping 50,000 clients last year. It was a dramatic increase from the prior year, and also a huge uptick from pre-pandemic times.

Former Bank of Canada Governor David Dodge has few nice things to say about the federal government’s latest budget and instead argues it will hurt large swaths of Canadians and the country’s economy.

“That's unfortunate,” he told BNN Bloomberg in a television interview on Thursday. “The big problem is that most of what the minister did was to concentrate on raising current consumption rather than promoting investment in machinery, equipment and intellectual property, which is really necessary in order to provide workers with the capital that will allow them to be more productive.”

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor. Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.