Bram Houghton

May 06, 2024

Economy Commentary Weekly update Weekly commentaryMarket Update - May 3, 2024

MARKET UPDATE – April 22nd – May 3rd, 2024

In a Nutshell: Markets experienced a volatile two weeks as warm inflation data rained on the parade of equity markets. The inflation reads in April further reinforced that it is much more likely that rate cuts start later in 2024 than markets have anticipated.

U.S. Labour Markets

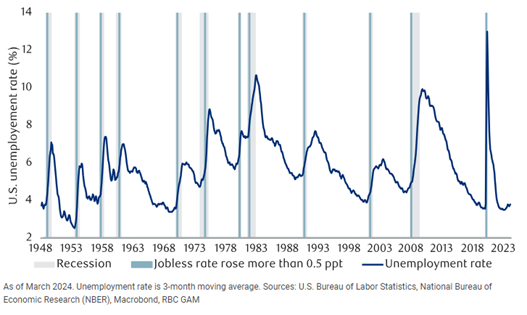

Continued mixed signals from the U.S. labour markets means that the FOMC will be compelled to look at other data when making crucial decisions on the U.S. interest rate policy. Recent Inflation data has suggested that the anticipated interest rate cuts will happen no earlier than the back half of 2024, later than many market expectations.

Job growth slowed more than expected in April and annual wage gains cooled as employers in the U.S. added 175,000 jobs last month; below economists' expectations for an 243,000 increase. Wages increased 3.9% in the 12 months through April, below expectations for a 4.0% gain after rising 4.1% in March.

Job openings fell to a three-year low in March, while the number of people quitting their jobs declined, signs of easing labour market conditions that over time could aid the Federal Reserve's fight against inflation. Job openings, a measure of labour demand, were down 4% on the last day of March, the lowest level since February 2021.

The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, pointing to still tight labour market conditions. Initial claims for state unemployment benefits dropped 5,000 to a seasonally adjusted 207,000 for the week ended April 20, the Labor Department said on Thursday.

The U.S. private sector added far more jobs than expected in April, pointing to continued strength in that will likely impact how Federal Reserve policymakers approach potential interest rate cuts this year. Private sector employment increased by 192,000 jobs last month, with many forecasts expecting growth of 179,000. March's job gains were revised up to 208,000 from 184,000.

U.S. Economy

The U.S. economy remained resilient, though softer than expected Gross Domestic Product (GDP) and business activity data may support the case for rate hikes in the coming months, despite the fact that the consumer and inflation are continuing to create uncertainty.

Overall, inflation accelerated by more than anticipated on an annualized basis in March, while underlying price pressures remained stubbornly elevated. According to data from the Bureau of Economic Analysis, the Personal Consumption Expenditures (PCE) price index sped up to 2.7% from 2.5% in February. Economists had expected the figure to climb to 2.6%.

Advanced GDP results for Q1 came in at 1.6% Quarter on Quarter (QoQ) annualized growth, below the consensus estimate of 2.5%. The core PCE price deflator for the U.S. came in at 3.7% QoQ annualized, compared to the forecast of 3.4%.

U.S. business activity cooled in April to a four-month low due to weaker demand, while rates of inflation eased slightly even as input prices rose sharply, suggesting some possible relief ahead. S&P Global Flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, fell to 50.9 this month from 52.1 in March.

Canadian Economy

In Canada the economy has shown clear signs of a slowdown based on the most recent data. Combined with cooling inflation this could provide sufficient evidence for the Bank of Canada (BoC) to start lowering its key interest rate from nearly a 23-year high of 5%.

Canada's gross domestic product increased by 0.2% in February, less than market expectations, and the economy likely expanded at a 2.5% annualized rate in the first quarter. Analysts polled by Reuters had forecast a 0.3% GDP growth in the month. January's growth was downwardly revised to 0.5% from 0.6% reported initially.

Canadian manufacturing activity slowed in April, as output and new orders fell at an accelerated pace and inflation pressures picked up. The S&P Global Canada Manufacturing PMI fell to a seasonally adjusted 49.4 in April from 49.8 in March, staying below the 50 threshold for the 12th straight month.

Canada's economy likely weakened in the first quarter, bolstering expectations that the Canadian central bank would have more reason to cut interest rates in June. Canada's GDP rose 0.2% in February, less than analysts' estimates, while growth in March likely remained muted.

Eurozone and U.K. Economy

The U.K. and Europe are showing clear signs of recovery from a mild recession with business activity and GDP growth on the rise across the continent, while inflation remains stable. The Bank of England and European Central Bank (ECB) should be seeing everything they need to begin rate cuts as desired.

Eurozone inflation held steady as expected in April but a crucial indicator on underlying price pressures slowed, solidifying an already strong case for the ECB to cut interest rates in June. Inflation in the 20 countries sharing the euro currency was 2.4% in April, the same as in March and matching expectations for a steady reading in a Reuters poll of analysts.

The Eurozone economy grew by more than expected in the first quarter of 2024, buoyed by a return to growth for Germany and strong expansion in Spain, preliminary data from the European statistics agency Eurostat showed on Tuesday. GDP increased by 0.3% quarter-on-quarter for a 0.5% year-on-year rise, compared with market expectations that both would expand by 0.2%.

British businesses recorded their fastest growth in activity in nearly a year this month, according to preliminary data that points to a bigger rebound from last year's shallow recession. The U.K. Composite PMI for the services and manufacturing sectors jumped to an 11-month high of 54.0 in April from March's 52.8, above all forecasts in a Reuters poll of economists.

Overall business activity in the euro zone expanded at its fastest pace in nearly a year this month as the preliminary composite euro zone (PMI) bounced to 51.4 this month from March's 50.3, well ahead of expectations in a Reuters poll for 50.7 and marking its second month above the 50 level separating growth from contraction.

Germany's private sector unexpectedly returned to growth in April, driven by a solid rise in activity in the country’s service sector, with the German Flash Composite PMI rose to 50.5 this month from 47.7 in March. That was above a Reuters poll forecast of 48.5 and the first reading above the 50 mark that indicates expansion in 10 months.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.7% | 2.7% | 0.7% | 4.2% | 1.9% | 0.9% | -2.8% |

| Last Week | -0.1% | 0.5% | 1.1% | 1.4% | -1.0% | -6.9% | -1.6% |

Market data taken from https://www.marketwatch.com/

CIBC Economics – Canadian GDP (Feb, Mar adv.): Momentum fading quickly (Econ Flash) by Andrew Grantham Link to Article

The Canadian economy experienced a slowdown in momentum during the first quarter of the year, with February GDP showing only a modest 0.2% gain and the advance estimate for March indicating stalled activity. This slowdown was anticipated due to the easing of previous supply constraints and the positive impact of favourable winter weather at the beginning of the year.

While GDP growth in February was slightly below expectations, it followed a revised increase in January. The mining, oil & gas, transportation, and public sectors were the main drivers of growth in February, offsetting declines in utilities and manufacturing. The advance estimate for March suggests stagnant GDP growth, with declines in manufacturing and retailing contributing to this. Despite the current growth tracking close to the Bank of Canada's forecast for the first quarter, the weak end to the quarter poses downside risks for the Bank's expectation of 1.5% annualized growth in the second quarter.

Implications

The Canadian dollar weakened against its U.S. counterpart on the based on the slowdown. If growth remains sluggish at the start of Q2 as we expect and inflation doesn't heat up again in April, the Bank of Canada should gradually start reducing interest rates at the June meeting.

CIBC Economics: Fed announcement: Jay-P's data state of mind (Econ Flash) by Ali Jaffery Link to Article

The Federal Open Market Committee (FOMC) decided to keep interest rates unchanged in May, as anticipated. The statement highlighted concerns about the lack of progress in inflation, but also acknowledged the progress made so far. Additionally, the Fed announced a plan to slow down the pace of balance sheet reduction in June.

The main takeaway from the meeting is that the Fed expects the high inflation levels seen in Q1 to subside, while still considering the possibility of rate cuts later in the year. Chairman Powell expressed less confidence in this outcome compared to previous statements and hinted at the likelihood of maintaining rates for a longer period. The Fed aims to carefully monitor economic indicators to determine if the economy is overheating and if this is leading to price pressures.

Powell emphasized the importance of bringing inflation back to 2% without setting a strict deadline. The Fed's cautious approach reflects the complexity of understanding the post-COVID economic landscape and the challenges posed by structural changes in consumer behavior and inflation drivers. Powell's patient and data-driven strategy aligns with the Fed's goal of ensuring economic stability while navigating uncertainties in the current economic environment.

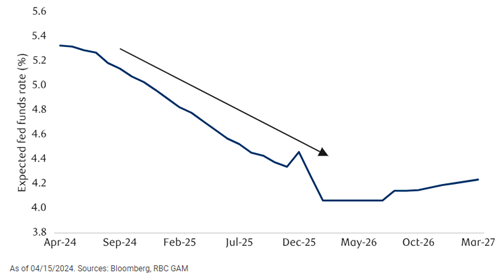

Market still expects rate cuts in 2024

MacroMemo - April 23 - May 6, 2024 by Eric Lascelles Link to Article

Market anxieties

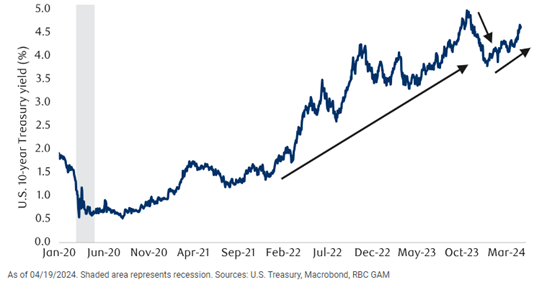

Financial markets are currently concerned about persistent U.S. inflation, which is leading to doubts about the Federal Reserve's ability to lower rates. The narrative has shifted from expectations of rate cuts to expectations of rising yields and delayed cuts, with the possibility of not seeing two 25 bps reductions by the end of 2024.

The higher interest rates are causing worries about the economy's ability to withstand prolonged periods of elevated interest rates. Additionally, the stock market telegraphed worry about the impact of higher interest rates on valuations and earnings, with the S&P 500 experiencing a 5% pullback from its end-of-March high. Earnings season is currently underway, which could potentially boost market confidence.

Bond yields rose on potential rate cut delay as inflations proves sticky

Why growth?

Recent equity market volatility suggests a need to defend economic forecasts predicting further growth amidst recent market downturns. Despite existing economic vulnerabilities such as rising household credit delinquencies and falling small business confidence, the risk of recession is estimated at around 35% for the U.S. over the next year, significantly higher than normal levels.

High interest rates are not expected to trigger a recession on their own, although there are uncertainties regarding various factors and tipping points. The U.S. economy has shown resilience to higher interest rates, with positive indicators such as the Institute for Supply Management (ISM) Manufacturing Index rising above 50 after a period of contraction. Several recession signals have also reversed recently. The U.S. first-quarter GDP is on track for a 2.9% annualized increase, indicating solid performance.

Some factors that continue to suggest growth for the remainder of 2024 are as follows:

- Beige Book was recently released, and the sentiment indicator shows a further strengthening after a period of notable weakness

- An unconventional approach: mentions of ‘recession’ in transcripts for companies listed on the S&P 500 has fallen steadily since late 2022. Companies being less concerned about an impending recession is a positive sign.

- U.S. retail sales rose by a big 0.7% in March, on the heels of a 0.9% gain in February. These are large gains for individual months, confirming that the consumer is still advancing.

- U.S. population growth also continues to be faster than expected.

What happens next?

If a recession has been avoided, what happens next? There isn’t a definitive answer, and RBC GAM’s business cycle scorecard is divided on the subject. The inputs show a mix of both end of cycle and start of cycle characteristics.

Not much room remains for cooling the economy without triggering a recession

It is therefore wise to consider this as the continuation of the cycle. And how fast can growth be over this coming period of expansion? How long can it last? Not that fast, and for not that long.

“A good guess would be that the economy might manage to squeeze out another 2-5 years of growth, but not another decade. That said, we are sympathetic to the idea that the business cycle might be becoming more muted than in the past, creating a tendency toward longer economic expansions, all else equal.”

NOTABLE NEWS

For the first time in eight years, Canada imported more electricity from the U.S. than it exported amid prolonged dry conditions that have reduced hydroelectric power generation.

Canada imported 2.7 million MWh of electricity from the U.S. in February, slightly more than the 2.6 million MWh it exported, marking the first-time electricity imports have exceeded exports since StatCan changed the way it collects such data in 2016.

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to Capital Gains taxation, arguing they will affect doctors’ retirement savings.

Kathleen Ross, the association’s president, says many doctors incorporate their medical practices and invest for retirement inside their corporations. The proposed changes would increase taxes on those investments, something the association says will add “financial strain” for doctors who do not have a pension to rely on.

If you think others may benefit from reading our content, please don’t hesitate to share it with them.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. "CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.