Bram Houghton

October 21, 2024

Commentary Weekly update Weekly commentaryMarket Update - October 18th, 2024

MARKET UPDATE – October 7th - October 18th

In a Nutshell: Markets continued a positive trend through October as the beginning of the rate cutting cycle improved sentiment and economic data showed resilience, particularly in the U.S.. Markets have also begun to bet on a further 50bps rate cut at the next FED policy meeting.

U.S. Labour Markets

After the number of Americans filing new applications for unemployment benefits surged last week, Initial Jobless Claims came in at 241,000, steadying from last weeks’ 258,000. This is a positive sign for the U.S. economy, as it suggests that more people are finding and keeping jobs. The data suggests that while the U.S. labour market has weakened, it is showing signs of resiliency and people are still finding jobs.

U.S. Economy

Headline inflation in the U.S. slowed on an annualized basis in September, though it was faster than expectations. Consumer Price Index (CPI), a crucial gauge of U.S. headline inflation, decelerated to 2.4% annually. This was down from 2.5% in August, but Economists expected 2.3%. U.S. producer prices remained flat in September, potentially pointing to a cooling inflation picture. U.S. retail sales also grew at a hotter-than-anticipated pace in September, rising by 0.4%, accelerating from an unrevised uptick of 0.1% in August.

For the purpose of considering FED rate cuts, the economic data is mixed and possibly skews towards a 25bps cut rather than 50bps, as the U.S. consumer shows some fight while inflation remains a little sticky.

Canadian Economy

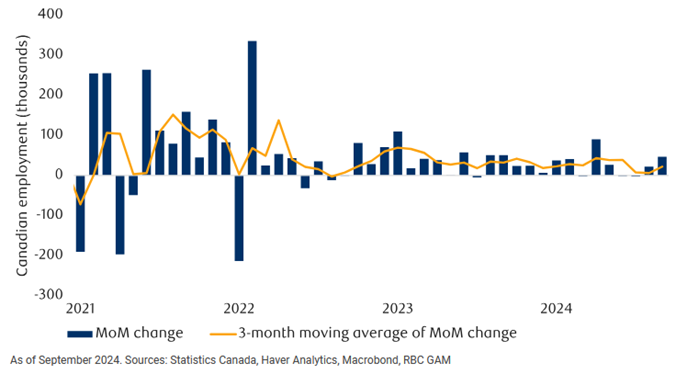

The Canadian economy added 47,000 jobs in September, while the unemployment rate declined for the first time since January to 6.5%. Youth and women aged 25 to 54 drove the gains, while full-time employment saw its largest gain since May 2022. Canada's annual inflation rate also slowed more than expected to 1.6% in September. The easing of inflation, which was mainly led by a huge drop in the price of gasoline, was the smallest annual increase in consumer prices since February 2021.

Inflation finally falling below two percent prompted markets to bet on a 50bps rate cut next week, while the economy adding jobs supports the soft landing narrative.

Eurozone and U.K. Economy

Britain's economy grew in August after two consecutive months of stagnation, with economic output rising by 0.2% monthly (2.4% annualized growth rate). German exports and industrial production rose by more than expected defying expectations of further weakening, and buoying industrial production across the entire region.

French inflation fell to it’s lowest level since early 2021 and Spain’s inflation rate also fell below 2%. However, Economists still expect Eurozone inflation to remain above 2% with Germany and Austria leading the charge. Despite clear economic and industrial weakness overall, sticky inflation may cause ECB policy makers some headaches when deliberating over rate cuts.

Asia

China's average daily home sales during the Golden Week holiday was up 23% (by floor area) from the same period last year. Overall, the real estate market has been in a slump since 2021. The Chinese governments support policies have clearly begun to work, improving sentiment as well as purchasing activity.

Energy

Oil prices are on track for the biggest weekly loss since early September as China's slowing economy weighed on prices, amid threats to supply as a result of the conflict between Israel and Iran. Data also showed this week that U.S. inventories of Crude also shrank over the past week, offering some demand optimism for the world’s biggest fuel consumer.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| Last Week | 1.3% | 1.1% | 1.2% | 1.1% | 1.3% | 1.6% | 0.3% |

| This Week | 1.5% | 0.9% | 1.0% | 0.8% | 0.00 | -8.2% | 2.2% |

Market data taken from https://www.marketwatch.com/

ECONOMIC FLASH! Canadian CPI: Room to accelerate by Andrew Grantham Link to Article

In September, inflation in Canada fell below the 2% target, allowing the Bank of Canada to consider accelerating interest rate cuts. Headline prices decreased by 0.4%, with the annual inflation rate dropping to 1.6%, below market expectations. Gasoline prices were the primary contributor, falling 7.1%.

Other areas also showed signs of disinflation, with overall goods prices (excluding food and energy) declining for the fourth consecutive month, indicating weak consumer demand. Shelter prices, though cooling, continued to exert inflationary pressure, with rents rising only 0.2% and the annual rate decreasing to 8.2%. Mortgage interest costs increased by 0.9%, but the annual rate fell to 16.7%.

Forecast & Implications: Overall, the data suggests a potential for a 50 basis point rate cut at the upcoming October meeting, while the forecast for the overnight rate remains at a low of 2.25% by mid-2025. The Canadian Dollar weakened on the news while bond yields dropped, pricing in the greater chance of a 50bps rate cut.

MacroMemo - October 15 – 28, 2024 by Eric Lascelles Link to Article

Falling recession risk

The likelihood of a U.S. recession has been cut again by GBC GAM, reducing the probability from 30% to 25%. This figure remains above the typical 10-15% risk seen in average years, influenced by high interest rates and recession indicators like inverted yield curves and rising unemployment. However, the decrease in recession probability is viewed as progress, suggesting a potential soft landing for the economy. Recent U.S. economic data has shown improvement, with job growth exceeding expectations, along with positive revisions. This marks a significant turnaround from previous negative trends in job revisions.

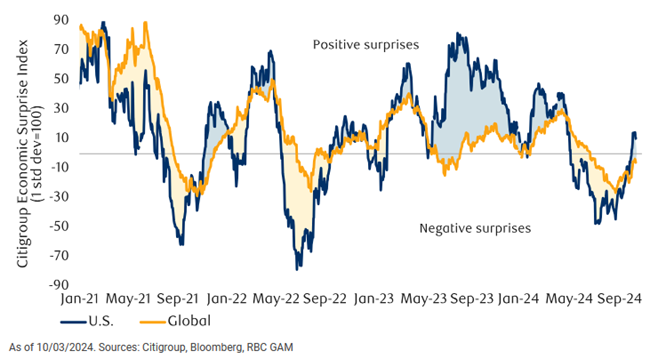

It is also interesting to note that investors are shifting back to a “Good News is Good News” perspective, as inflation concerns have eased, contrasting with earlier periods when strong economic data raised fears of inflation.

Economic Surprises have to rebound

Smaller Federal Reserve rate cuts

With the Federal Reserve entering their rate-cutting phase, it was significant that they begun with a 50 basis-point cut, and arguably suggests they believe they started slightly late. However, there are concerns that the market may have overestimated the extent of future rate cuts, as further cuts are not guaranteed. Recent economic indicators, including strong U.S. payroll data and a slightly higher-than-expected Consumer Price Index (CPI), suggest that the economy remains robust. Although year-over-year headline CPI has decreased and shelter inflation is slowing, the core inflation's month-over-month increase highlights that inflation pressures are still present.

Canadian economic update

In September, Canada experienced a significant increase in job creation, with 46,700 new jobs added, surpassing the expected 27,000. This marks a positive trend in hiring, especially in the private sector. The unemployment rate decreased from 6.6% to 6.5%, providing some relief after a previous upward trend. However, total hours worked decreased by 0.4%, indicating that businesses are not utilizing their workforce more despite the increase in job numbers. It was also notable that hourly wage growth decelerated from +5.0% annually to +4.6%, finally dropping below the 5% mark it was stuck at for some time. This is a data point that the Bank of Canada closely monitors for policy rate changes.

Canadian hiring back positive territory

Autumn Reflections: October 14, 2024 by Jurrien Timmer, Director of Global Macro, Fidelity Investments Link to Article

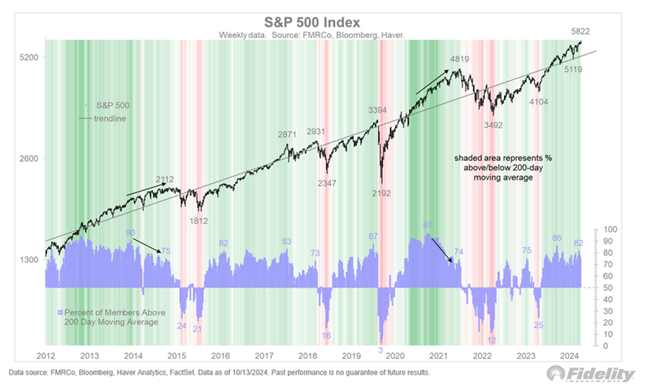

The cyclical bull market began two years ago on October 13, 2022, and recently reached another all-time high. As we transition from the weaker seasonal period of the year to the typically stronger November-April phase, the broad market continues to achieve new highs, despite ongoing fluctuations among mega-cap stocks.

Currently, the market is considered to be in the "7th inning" of its cycle, as the median bull market lasts about 30 months and yields a 90% gain. Although the cap-weighted S&P 500 index is trading above its trendline and at high valuations, such conditions can persist without a significant catalyst. Notably, 80% of the stocks in the index are above their 200-day moving average, indicating they are in long-term uptrends.

S&P 500 Index is sitting above it’s trend line..

In 2021 as much as 97% of S&P 500 companies sat above the trendline – we currently sit at 82%

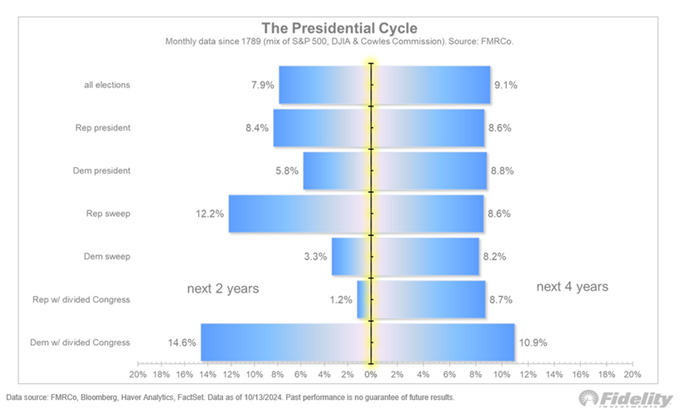

There is the potential for the upcoming election to have an impact on the markets also. The below table highlights that the most favorable market outcomes post-election are a Republican sweep or a Democrat President with a divided Congress, which may explain the markets' calm during this election season. However, over a full four-year election cycle, the winner's impact on the economy is minimal, given the substantial size of the US GDP and stock market. Historically, the election cycle tends to remain bullish, particularly in the first year of a new administration, although growth may be slower in the second year. Overall, there appears to be potential momentum as the next administration begins.

However, for cycles when the mid-term year was down (like 2022), year “5” was typically a corrective year. Regardless, it seems likely we will lose some momentum entering 2025.