David Ricciardelli

February 20, 2023

Money Financial literacyThe Benefits of Investing Early in Life

We are often asked by younger investors what they should be doing in their financial lives. They often look disappointed by our simple advice to “Save as much as you can!” We also provide guidance on how to make saving a habit, and life hacks to save your hard earned money in a manner that doesn’t give you an opportunity to spend it. The overarching theme is to start building their savings. The charts and animation below try to illustrate the importance of saving early in life.

The animation below highlights the wonders of compounding. For an investor who starts saving only $250 per month in their twenties, at age 65, 56% of their $1.3mm in savings will be the compounded growth of money they saved in their twenties.

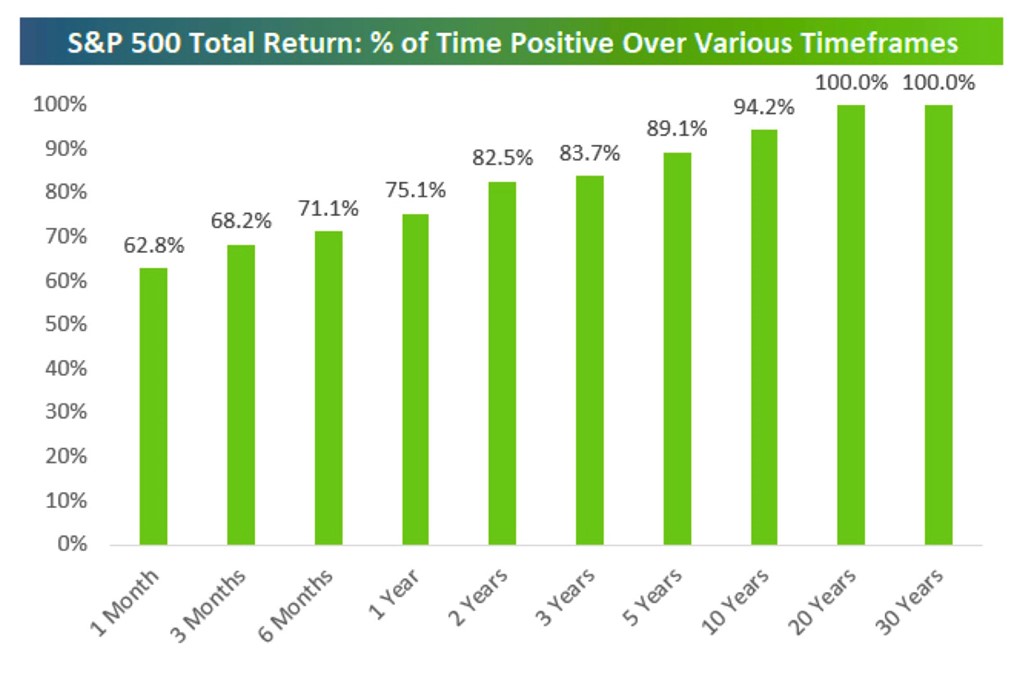

The longer you are invested, the higher your probability of a positive return.

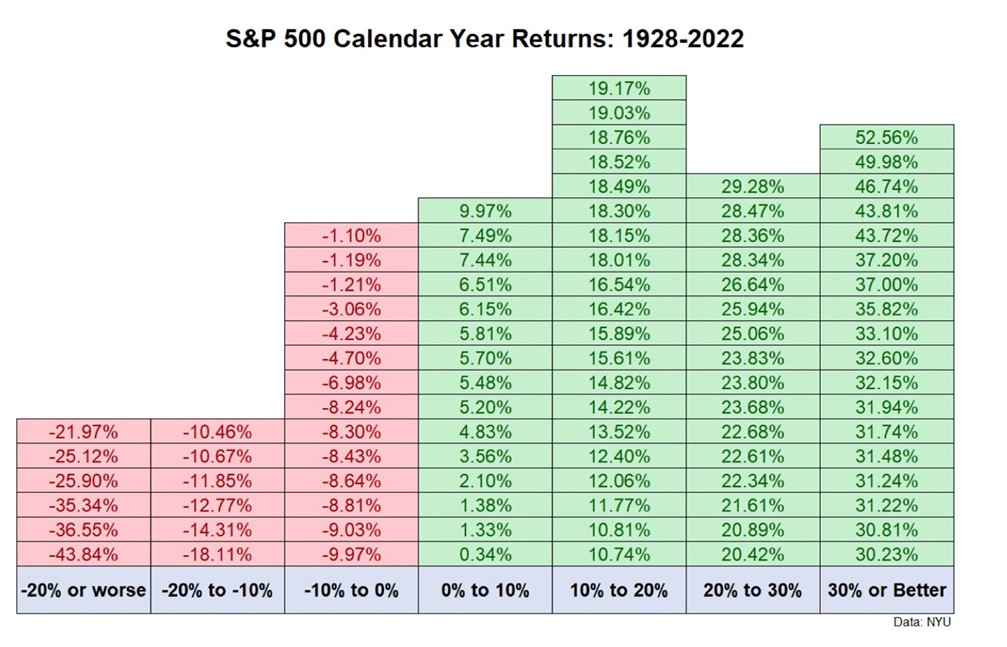

While the average annual return for the S&P500 is about 10%, actual return is rarely 10%.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2023.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.