David Ricciardelli

October 06, 2020

Money Financial literacyPassive Investments, Active Wagers

A Very Narrow Market

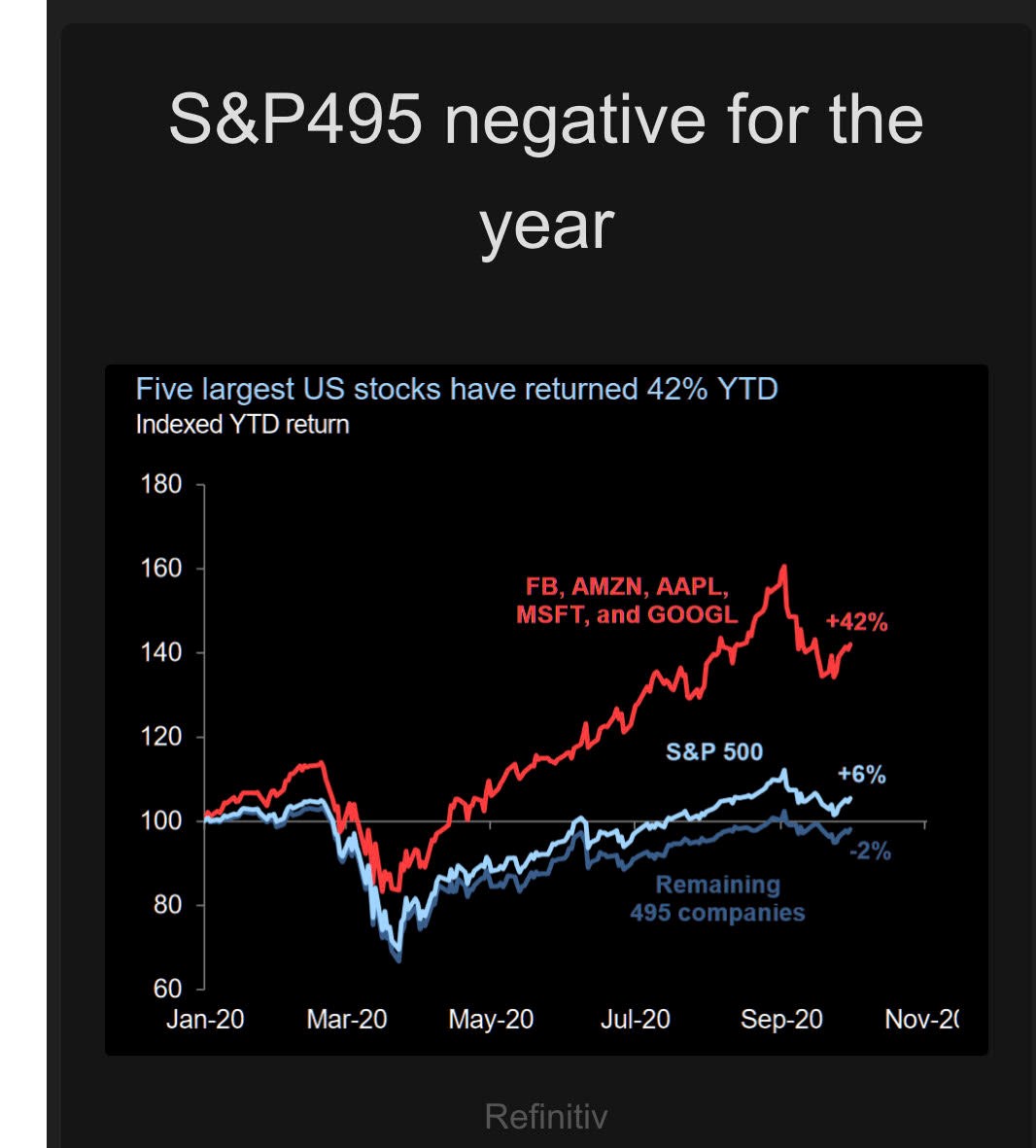

Sometimes I see a chart that does an excellent job of exampling what is happening in the market. The chart below fits into that category.

The chart illustrates how strong returns have been for the five largest companies in the S&P500. If we remove Facebook, Amazon, Apple, Microsoft, and Alphabet (Google’s parent company) from the S&P500, the return of the index would still be negative on the year. A narrow market occurs when the performance of a small number of stocks has an outsized impact on an index or market. Today’s S&P500 is one of the narrowest markets I can remember.

The Dilemma for Active Managers

For an active manager, this can be a very frustrating market. An active manager that is benchmarked to the S&P500 will have a difficult time outperforming in a narrow market. If an active manager has been underweight any of the five largest stocks in the index, they will almost certainly be underperforming year-to-date. On January 1st, the five largest stocks in the S&P500 were 16.6% of the S&P500 vs. 21.5% of S&P500 on October 5th. This increasing concentration further compounds the problem for an active manager since the size of the companies in the S&P500 makes it challenging to be overweight any of the five stocks.

The Dilemma for Passive Investors

This challenge for active mangers is often exploited by ETF manufacturers and advocates for passive investment. The risks of passive management are rarely considered. However, as the concentration is specific stocks or sectors increases, an investor who is purchasing an index like the S&P500 or the S&P TSX Composite may be making a more active bet than they realize. Here are two examples:

In Canada, many passive investors will buy ETFs that emulates the performance of the S&P TSX Composite. The table below shows the weights of individual sectors in the index on January 1st, 2020.

S&P TSX Composite Sector Weights on January 1st,2020

How many of these passive investors were aware of the bet that they were making on Financials, Energy, and Materials? The stocks in these sectors can be relatively volatile. How many investors realized that they had significantly less exposure to Technology, Consumer Staples, Consumer Discretionary, or Health Care relative to their expected consumption?

S&P TSX Composite Sector Weights on October 5th, 2020

Notice the change in sector weights throughout the year. Buying the S&P TSX Composite is an entirely different wager than it was just ten months ago. While the pundits on television often speak about the appreciation in technology stocks, the tables below show that the sectors in the S&P500 are more balanced and have been less volatile than the Canadian benchmark.

S&P500 Sector Weights

January 1st, 2020

October 5th, 2020

It’s rarely mentioned that only two of the five largest stocks in the S&P500 are in the Information Technology Sector. Facebook and Alphabet are Communication Services stocks, Amazon is a Consumer Discretionary stock, and Microsoft and Apple are in the Technology Sector. For an investor, looking at the S&P500, their wager has become more concentrated in the five largest companies in the index rather than on specific sectors.

What’s an Investor to do?

Tactically, I have recommended a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. Fixed income, cash, and alternative investments reduce volatility and provide ballast for the portfolio.

Over the long term, a more practical approach for investors that reduces the need for market timing and ‘hero market calls’ would be to save and invest using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm, across market cycles, an investor will end up buying more securities when the market is inexpensive and buying fewer securities when the market is expensive.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimer: This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2020