David Ricciardelli

April 02, 2024

Financial literacyWhy Experts Recommend Passive Investment Strategies

I recently had a conversation with a friend, Jian Koin (not his real name), who got me up on my soap box about asset allocation and active vs passive investing strategies.

Jian continues to enjoy a successful career, has saved diligently, and has maxed out his employer's and the government's matching programs. As a result, he has the means to cover a pair of six-figure bills for his children's education and retire in his early fifties. Jian is one of those rare individuals who can devise a plan and stick to it for decades. From an investment perspective, Jian's plan has been to use low-cost globally diversified Exchange Traded Funds (ETFs). He rebalances annually (or whenever he has larger inflows) so his equity exposure is 110% minus his age. For example, at age 45, his asset allocation would be 65% (=110-45) equity and 35% fixed income. This is a success story, and Jian deserves to be congratulated.

Jian lives in a country where it would be challenging for us to collaborate directly on his investments but when asked for suggestions, there are two suggestions I would put in the 'low-hanging fruit' category for him and one suggestion that is much more involved. The last suggestion is complex enough that it may be one of the reasons why experts default to recommending passive investing strategies using low-cost ETFs, even though the same experts often use different investment strategies to compound their own wealth.

The Low Hanging Fruit

The two suggestions from the 'low hanging fruit' category:

- consider active vs passive investments for fixed income allocations, and

- as money moves from registered to non-registered accounts consider containers that allow you to shape distributions to reduce tax friction.

Actively Managed Fixed Income

Unlike equities, the universe of active managers in fixed income have a structural advantage over passive vehicles, like index ETFs. Passive fixed income ETFs struggle to replicate their benchmarks due to the large number of securities and a lack of liquidity in many bonds. Further, if issuers think that interest rates are artificially low, they will issue more and longer duration bonds to take advantage of low rates. These longer duration bonds may not find their way into actively managed strategies, but they end up in passive fixed income indexes because of index construction rules. According to JP Morgan Asset Management, over the past twenty years, even the bottom decile of active fixed income managers have outperformed the passive U.S. Aggregate Bond Index, with top active managers generating significant alpha (outperformance) for clients.

Containers That Shape Distributions

Many asset management firms provide containers that can wrap securities with dividends and interest, so the distributions are taxed as a capital gain upon sale. Some of these securities can even be configured to return capital to the unit holder monthly which can be used to fund consumption. A Return of Capital is an untaxed distribution that lowers the book value of a security and results in a larger capital gain in the future. Tax deferrals become more critical when a more significant proportion of an investor's assets are in non-registered accounts and when investors live off the distributions from their portfolio.

The two suggestions above are easy to articulate and are reasonably easy to implement. The next suggestion is a much more involved discussion.

There's More to The Investing World Than Stocks and Bonds

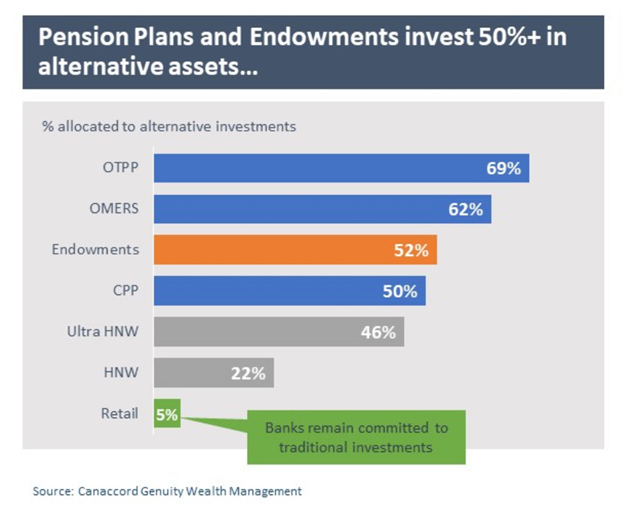

There are asset classes beyond stocks and bonds, which can enhance the after-tax risk-adjusted returns for a portfolio. The chart below illustrates the asset allocation for large pension funds, endowments, and individuals with different levels of net worth.

Large pension funds and endowments allocate more than 50% of their investments to alternative investments. The reason why these institutional investors use alternative investments is straightforward. As indicated in a study from iCapital, Trading Places: Mapping the Impact of Alts in a Traditional Portfolio, adding a 20% allocation of alternative investments to a 60/40 stock bond portfolio improved returns and reduced volatility in more than 98% of the scenarios modelled.

In the past, accessing alternative investments was extremely difficult for retail investors, but over the last five years the asset class is increasingly being democratized. However, adding alternative investments to an individual investor's portfolio requires a thoughtful approach that is almost impossible to articulate to the masses.

Morgan Housel's book The Psychology of Money is a great read. Morgan is exceptional at taking subjects that create anxiety and making them easily digestible. In the book, he advocates a globally diversified portfolio of stocks and bonds that is constructed using low-cost ETFs. It's good advice, but likely not the best advice. Unfortunately, it is the only advice that Morgan and other thoughtful financial experts can give without losing their audience and having the size of their books explode. As a thought experiment, imagine if Morgan tries to help his readers thoughtfully add private equity, private credit, private real estate, venture capital, hedged equity, hedged credit, commodities, structured products, and multi-strategy funds to their asset allocation. He'd end up publishing the equivalent of the course material for a specialized financial graduate degree. The alternative for Morgan would be to try to educate people on how they can find professionals to help them add these asset classes to their portfolios. However, only 5% of retail investments are allocated to alternative investments, so finding advisors who are knowledgeable of these products and can add them to a portfolio thoughtfully is a different and equally significant challenge. As a result, Morgan sticks to the advice that he can communicate, even if it isn't the 'best' advice.

Considering Alternative Investments

Democratizing access to alternative investments has been a focus of the Ricciardelli Investment Group since its inception. This focus was driven by necessity since many of our clients are capital market professionals whose annual income is tied to market performance. As a result, they wanted their investment portfolios to be less correlated with markets. The result was a need to provide appropriate and thoughtful access to alternative investment strategies for these professionals.

While we welcome an opportunity to discuss alternative investments in more detail, below we have flagged a few elements that investors should keep in mind when considering alternative investments:

- Investment Thesis. Have a clear idea of why an alternative investment sub-asset class is being added to your portfolio and the specific security (or securities) used to gain exposure to the asset class. Understand the environments where the particular strategy should be expected to struggle or deliver its most robust performance.

- Correlation. Have a clear understanding of a given strategy's correlation with markets, how adding the security will change a portfolio's correlation with markets, and how this relationship may change over time and during periods of market stress.

- Liquidity. Alternative investments generally have long time horizons and aren't intended to be traded. As a result, securities can be significantly less liquid than equities and often can't be margined. Allocations should be appropriate for an investor's liquidity requirements and investment horizon.

- Concentration. A common challenge we see when evaluating portfolios that use alternative investments are concentration risks caused by the selection of securities or strategies that overlap (a lack of diversification), are all from the same or similar asset managers (style or manufacturer risk), or all the investments in the securities were made at the 'same' time (vintage risk).

- Net After-Tax Returns. Alternative Asset Managers often execute strategies that are difficult (or impossible) for an individual investor to execute on their own. For example, most investors aren't going to buy private companies, improve their operations, optimize their capital structures, and sell the companies to new owners. Investors are outsourcing these activities to the fund manager and should expect to pay fees to have professionals execute these activities on their behalf. While being fee-aware, investors should focus on historic and expected after-tax returns for a specific security.

We've just scratched the surface of a complex topic. There is a lot to consider.

What's an Investor To Do?

In our view, investors should use a barbell strategy where high-quality companies exposed to secular themes are used to provide exposure to equity markets. The other side of the barbell is cash, actively managed fixed income, and alternative investments that reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus expands to optimize the tax efficiency of distributions.

Don't hesitate to get in touch with me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers :

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.