Milan Cacic

July 22, 2022

Money Financial literacy Social media Economy Good reads Entrepreneurs In the news News Weekly updateWHEN BAD NEWS IS GOOD NEWS!

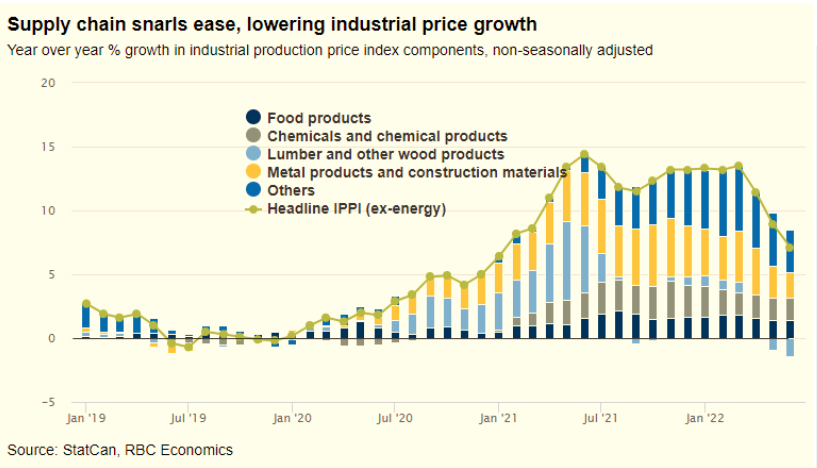

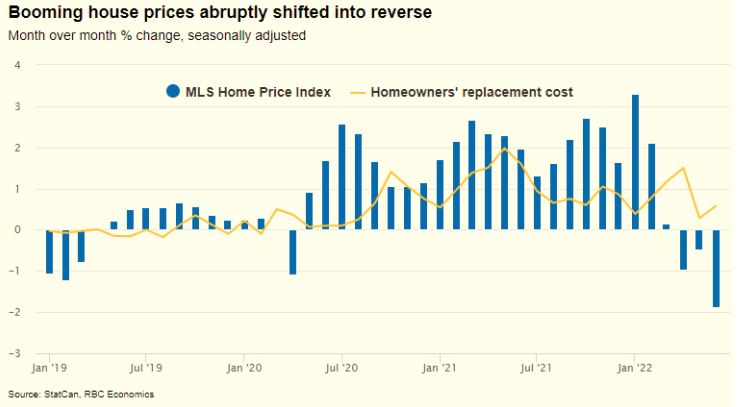

We are starting to see the trajectory of price increases start to come down. The year-over-year growth of components for making products is starting to decelerate and month-over-month changes in home prices are starting to drop. This is important because as Newton's first law states, "An object in motion stays in motion with the same speed and direction until acted upon". We can only assume that the trajectory of these price increases will continue to decelerate which will cause inflation to subside. Although this might seem like bad news in the sense that the economy is starting to slow down, it is very good news with regard to inflation. If inflation starts to subside the Federal Reserve will likely stop increasing interest rates.

I mentioned in my weekly note a few weeks ago that once inflation peaks and starts to roll over we will likely see a rotation out of value and cyclicals and back into growth. I also mentioned that once we see peak inflation, we will likely have experienced the bottom of the market. This week we have started to see some green shoots with regards to inflation peaking and the rotation back into growth. If this is the case, it should be verified over the next four weeks which will make for an interesting second half of 2022. I should also note that we added both Canadian Banks and NASDAQ-listed securities to the models this week.

I've also included a piece from Benjamin Tal and our CIBC Economics team entitled "Summer 2022 economic outlook." Please click here to watch the full video or click here to read the video transcript.

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan