Milan Cacic

September 22, 2023

Social media Economy Professionals In the news News Weekly update Weekly commentaryCANADIAN BANKS; TWO LONG YEARS!

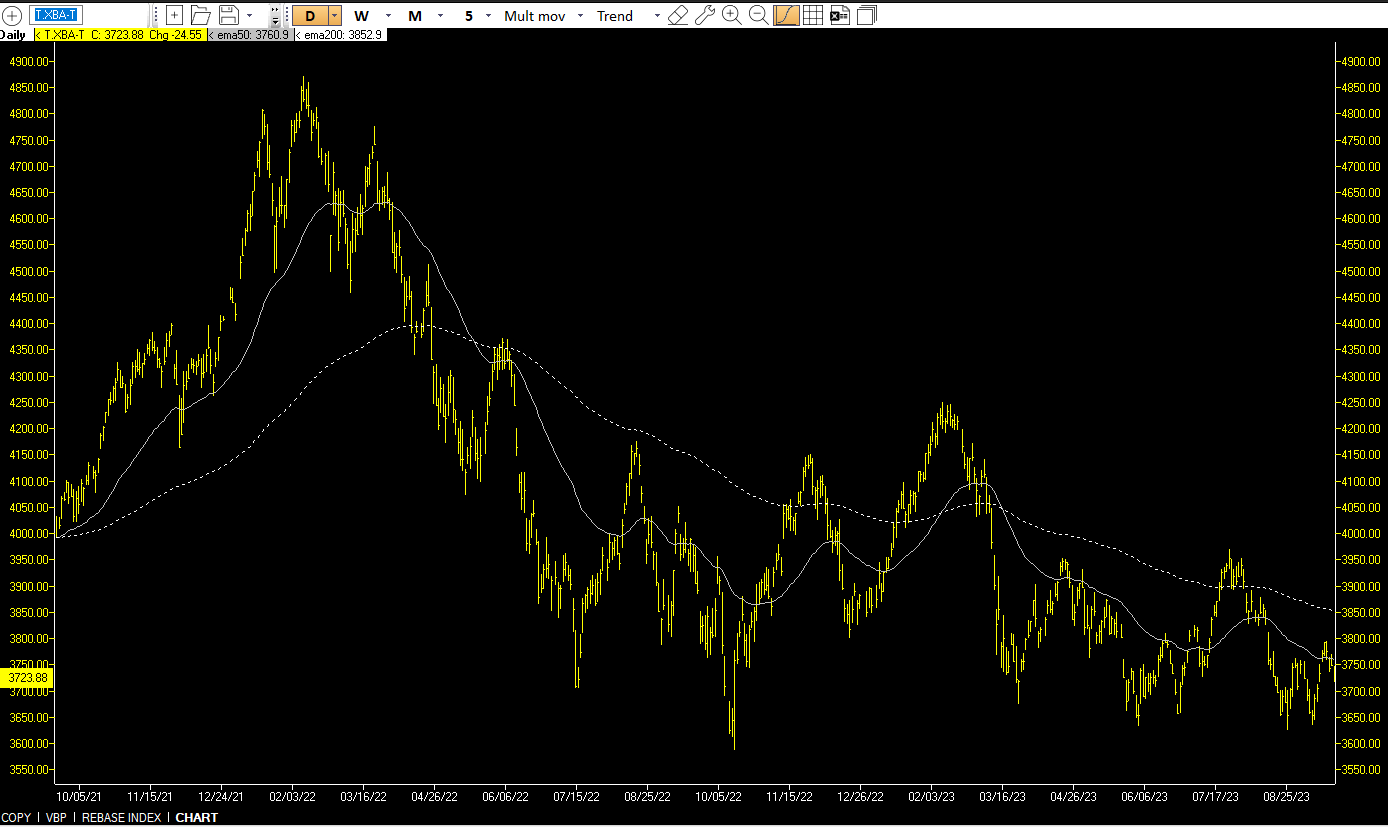

Over the last two years, Canadian banks have performed poorly [see chart below]. To be fair, they've had to deal with the fastest interest rate hike in history, which has caused mortgage rates to increase dramatically, forcing the banks to increase loan-loss provisions. Impressively, the banks have been able to maintain a fairly stable earnings-per-share ratio while revenues have slowed and loan-loss provisions have risen. For the most part this has been done this by cutting costs.

Source: Thompson One(T.XBA)

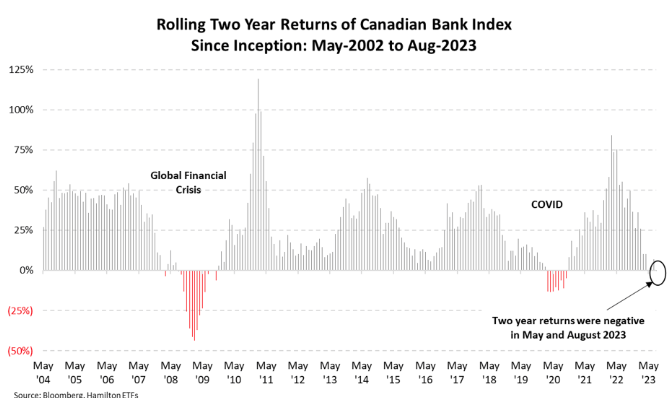

At the end of August, the Canadian banks find themselves in a very unfamiliar position, valued lower today than they were two years prior. The question we ask ourselves is does this create a buying opportunity? As always, the best way to answer that question is to look at what has happened historically.

If we look at the chart above, we can see that there's been 22 instances where Canadian banks have had negative rolling two-year returns out of 232 month-end periods since May 2004. What's even more interesting is that Canadian banks posted a positive one-year return in the year following for 21 of those 22 instances. Now, an argument can be made that this bank downturn is much different than the financial crisis or the Covid pandemic, however, history doesn't care. Historically speaking, we think Canadian banks offer a buying opportunity, not to mention a pretty good yield!

I've also included a piece from our CIBC Economics team entitled "Asl Not What the Fed Can do for you".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan