Milan Cacic

December 08, 2023

Financial literacy Social media Economy Commentary Trending Weekly update Weekly commentaryWHAT A DIFFERENCE A MONTH MAKES!

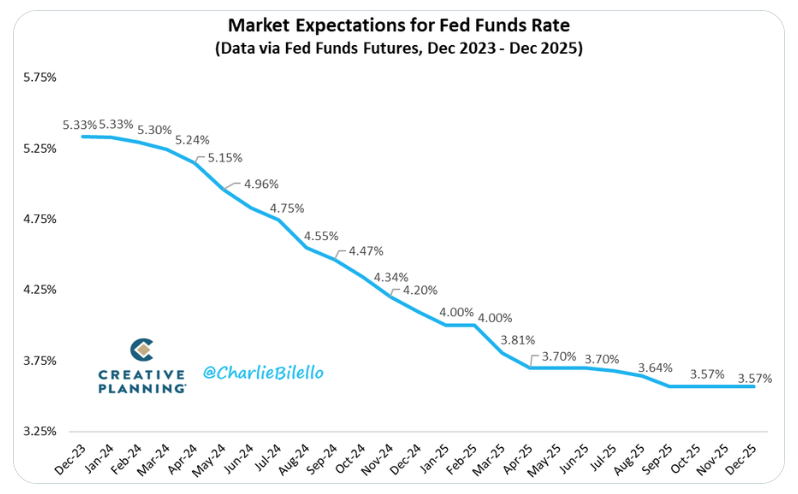

Just one month ago, many analysts were predicting that the US Federal Reserve would not cut interest rates until the end of 2024 (and some even suggested there would be no rate cuts until 2025). After some lower-than-expected jobs data and milder inflation numbers, the market is now predicting that there's a 65% chance that the Federal Reserve will cut rates as early as March 2024.

As you can see from the chart below, the market is now expecting that the Federal Reserve will start cutting rates in March of next year and will continue to cut five more times before the end of the year. This is important for many reasons. As we said in previous notes, the Federal Reserve cutting interest rates is the equivalent of swimming with the stream for the stock market. It is also much easier for companies to make business decisions when they know their borrowing costs are going down and gives them more certainty when planning out any business expansions.

Source : Charlie Bilello, X

Lower future interest rates are also a boost for consumer spending. We have discussed in previous notes about upcoming mortgage renewals that will be taking place at much higher rates and the significant effect this could have on the economy. Maybe falling rates next year could provide some reprieve for people that have to renew their mortgages in 2024.

I've also included a piece from our CIBC Economics team entitled "Bank of Canada toasts some small victories”.

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan