Milan Cacic

April 26, 2024

Money Financial literacy Economy Commentary News Trending Weekly update Weekly commentary Annual commentaryCOMMODITY SUPERCYCLE??

There are four stages to any economic cycle: expansion, peak, contraction, and trough – followed by another expansion to mark the beginning of a new cycle. These cycles typically last approximately 5.5 years, however, they can be as short as 18 months or as long as a decade…

A “Supercycle” can be defined as a sustained period of expansion, usually driven by robust growth in demand for products and services. A Supercycle is usually associated with long periods of growth that see a significant rise in the price of both commodities and the stocks that represent those commodities.

The last major economic Supercycle began in 2002 when China had an extended period of growth. China's economy fueled a Supercycle in the commodities market. Copper, aluminum, iron ore, crude oil, coal, and natural gas all benefited from the massive amounts of demand generated in China. That Supercycle ended in 2015 when the country's economic growth started to slow and the demand for these materials started to decline.

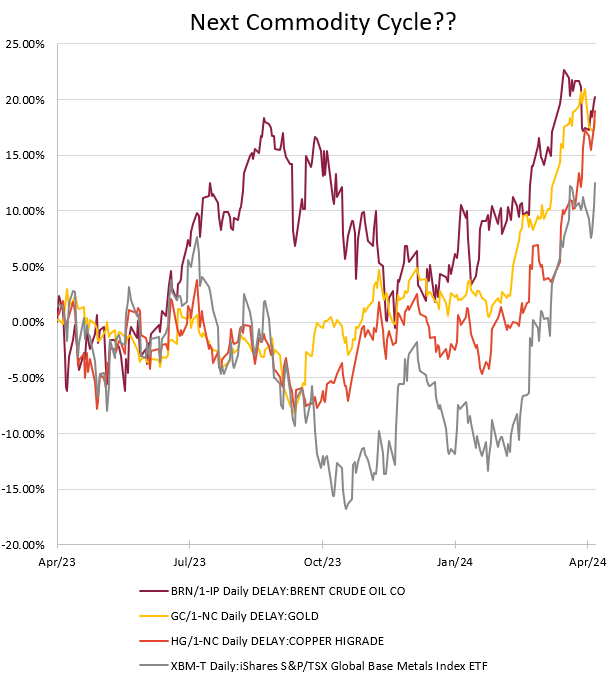

Commodity Supercycles are normally driven by broader economic growth and rising demand for raw materials. However, they can also come about when supply becomes too constrained. We are currently seeing constrained supply because it is very difficult to develop new mines in most jurisdictions. Combine this with significant investments being made in renewable energy, the adoption of electric vehicles, and the expansion of data and electrical infrastructure, and you begin to realize that we may be on the cusp of another commodity Supercycle. Just look at the chart below:

Source: ThomsonOne data as of Apr 25, 2024

The benefactors of the current cycle are: copper and steel (for the solar panels and wind turbines), cobalt, lithium, magnesium, nickel, and graphite (for the adoption of electric vehicles), and rare earth metals, zinc, and molybdenum (for the expansion of data infrastructure). Not to mention the significant amount of electricity and power (natural gas, coal, and oil) that will be required to build and maintain these infrastructures.

What is interesting about the potential of a commodity Supercycle this time is that the increase in demand for all of these materials is because society as-a-whole is concerned about the environment. This same concern about the environment is also making it more difficult to produce the commodities needed to save the environment. Quite the conundrum!

I'm not sure how it ends but it definitely will make for an interesting next 10 or 15 years!

I've also included a piece from our CIBC Economics team entitled “Are we too well-housed for our own good??” .

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan