Milan Cacic

May 10, 2024

Money Economy Commentary Monthly update Monthly commentary Weekly update Weekly commentaryMIXED MESSAGES! FED TIGHTENS AND GOVERNMENT LOOSENS

If we had listened to the economic forecasters over the past few years, we probably wouldn’t be in a very good place right now. For the most part, they have been consistently wrong. Most analysts were convinced that the US was going to head into a steep economic recession by late 2022. This was then followed by 2024 forecasts, which had the Federal Reserve cutting interest rates seven times during the calendar year. Neither of these predictions were even remotely close to happening. To be fair, the economists making these predictions have had to deal with an abnormal economic cycle influenced by the pandemic and post-pandemic spending. The question you may ask yourself is: how did these forecasters get it so wrong?

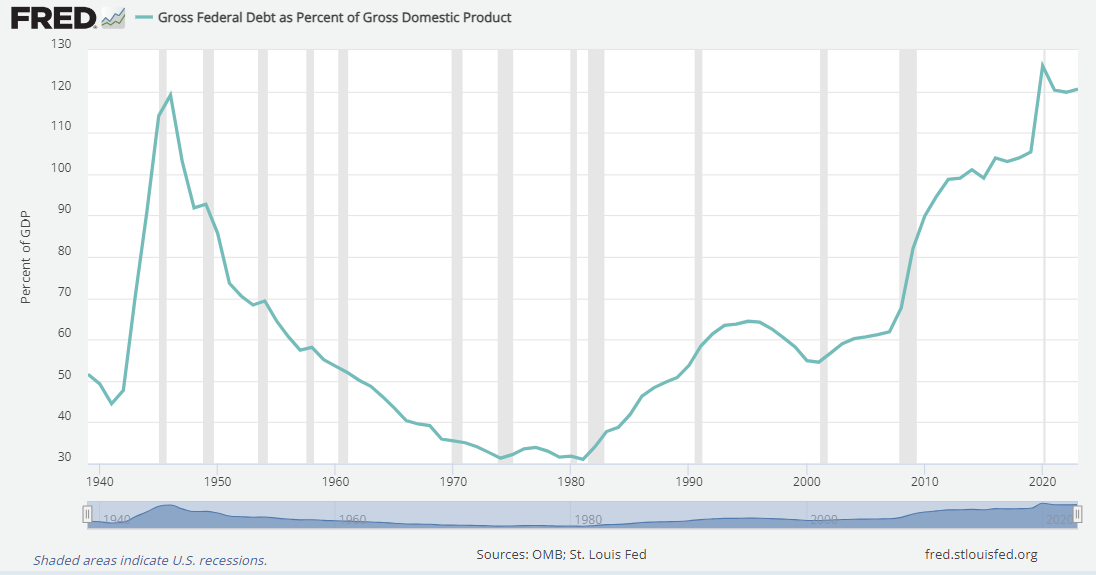

If we look at previous cycles, there have historically been economic declines after periods of significant monetary tightening [Federal Reserve raising rates]. 10-year government bond interest rates have gone from under 1% to over 4.5% in the last three years. Mortgage rates have gone from 3% to 6.5% and corporations are now rolling their debt over to significantly higher interest costs. So why is the US economy still doing so well?

The simple answer is: the federal government. As the Federal Reserve and Bank of Canada raised interest rates to slow down inflation, the private sector responded by slowing growth and decreasing their leverage. However, the governments maintained large fiscal deficits. As a matter of fact, not only did the governments maintain their pandemic-era spending, but in some cases, they have increased it. Talk about mixed messages!

Fiscal stimulus during a period of economic growth is historically abnormal. As you can see from the chart below, the last time we saw this pattern was during World War II. No wonder the economists were so wrong this time! This is why a properly diversified portfolio that is never excessively overweight in any one sector is paramount.

Source: retrieved from FRED https://fred.stlouisfed.org/series/GFDGDPA188S May 6, 2024.

Source: retrieved from FRED https://fred.stlouisfed.org/series/GFDGDPA188S May 6, 2024.

I've also included a piece from our CIBC’s Investment Strategy Group entitled "Monthly World Markets Report”

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan