Milan Cacic

August 15, 2025

Money Economy Commentary Trending Weekly update Weekly commentaryCANADA’S HOUSING MARKET... A FEW RED FLAGS

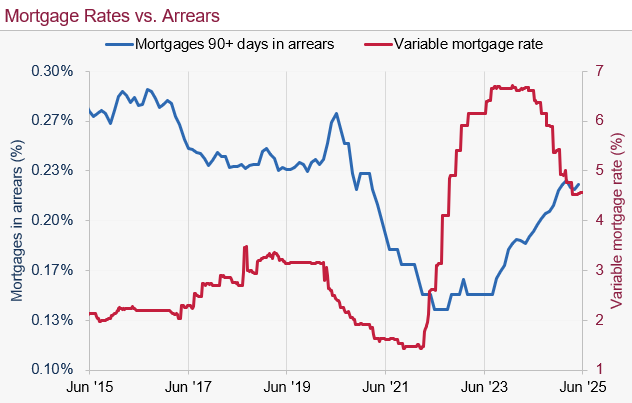

| In September 2023, I put out a note entitled “Canada's housing market… So far so good?”. The chart in 2023 showed mortgage rates skyrocketing while mortgages in arrears held steady. Today, that chart doesn't look nearly as good.

More recent data shows a shift from the 2023 trend. As you can see from the chart below, mortgage rates have started to come down a bit, however mortgages in arrears have jumped up dramatically. As we have stated many times in the past, movements like this can be likened to Newton's first law: an object in motion stays in motion until acted upon. It is likely that the rate of delinquent mortgages will continue to increase unless something changes.

Source: Bank of Canada Variable Mortgage Rate Total. Canadian Bankers Association Residential Mortgages 90+ days in Arrears. Data as of June 30, 2025.

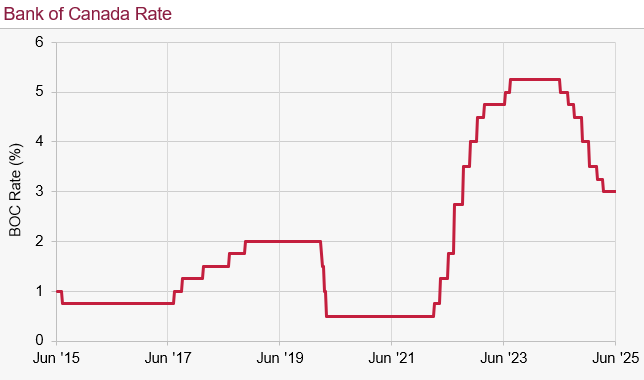

One force that could act upon this downtrend in delinquent mortgages is the Bank of Canada rate. As you can see below, the Bank of Canada rate has been coming down. Unfortunately, it has not come down nearly enough to offset the significantly higher mortgage rates (and payments) borrowers are dealing with, compared to the same mortgages from five years ago. As I mentioned back in 2023, either the bank of Canada lowers rates enough for people to afford their mortgages, or house prices would come down. It appears a little bit of both has happened.

Source: Statistics Canada. Data as of August 6, 2025.

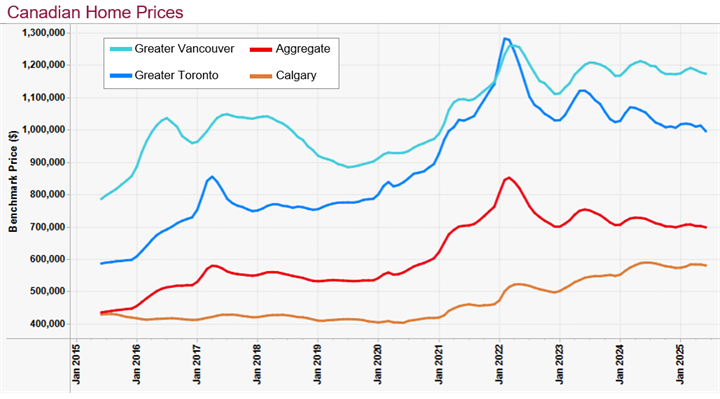

As you can see from the next chart, most cities in Canada had peak housing prices in early 2022. Since the peak, Toronto (GTA) housing prices have dropped 22.3%, while Vancouver housing prices have dropped 7%. The overall Canadian composite price has dropped 18%. I should point out that Calgary home prices have actually gone up 11% since February 2022.

Source: Canadian Real Estate Association, Benchmark Home Price. Data as of June 2025

These price declines are the combination of cracks in our Canadian economy as well as high interest rates. What this tells us is that the Bank of Canada (and the US Federal Reserve) will have no choice but to cut rates. It is now expected that the US will cut rates at least two times between now and the end the year, and it is likely that Canada will do an equal amount or more. It’s either cut the bank rate or drive the economy into recession. Politically speaking, cutting the Bank of Canada rate is the least painful solution. By the way, this has the potential to be very favourable for the stock market – especially tech companies.

I've also included a piece from our CIBC Economics team entitled "A Fast and Furious Fed?".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan |