Calvin Tenenhouse

January 17, 2023

Money Financial literacy Economy Monthly updateBonds are Back!

Happy New Year! We hope everyone had a fun and relaxing holiday season with friends and family. After what was a volatile 2022 to say the least, today’s blog post is written with the overall theme of positivity and optimism for the year ahead! With the recent changes in the federal funds rate, the humble bond, which has long been the foundation for a balanced portfolio is back and will once again offer conservative investors a reliable, low risk income stream from their portfolios. For the first time in over a decade, bond yields will be high enough for income-oriented investors to support a 4%+ withdrawal rate from their portfolio without dipping into their capital pool. The increase we have seen in the risk-free return rate offers a tremendous opportunity for retirees and low risk investors to lock in a consistent stream of cash flow for the foreseeable future.

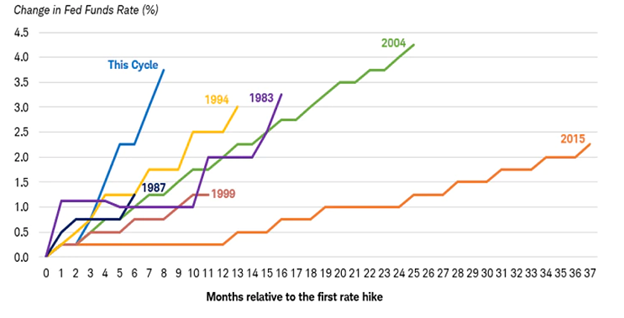

2022 saw one of the worst years on record for fixed income portfolios. The traditional Institutional portfolio mix of 60% equities and 40% bonds fell more than any year since 1937. Entering 2022, short term rates were still at a “pandemic-era” low as central bankers held real rates below -50 basis points to avoid a covid induced recession. As inflation began to move into the forefront of our economy due to supply chain constraints and increases in energy prices the federal reserve shifted their focus from stimulating the economy to fighting inflation through what has now come to be the fastest interest rate hike cycle on record.

For those wondering why bond prices are negatively impacted by interest rates allow me to explain. Bonds are loans made by an investor who in return, receives regular income, called coupon payments. Bonds are issued at a fixed coupon rate which is calculated based on a spread above the federal funds rate (see chart above). When interest rates increase, new bonds being issued will pay you more. Therefore, if you and I hold a bond from the same institution (meaning we both made loans to a company or government), but they pay you more than they pay me, logically my bond must be worth less than yours. Furthermore, if the bond is going to continue to pay me an inferior rate for the next 10 years, my loss is going to be much greater.

There are two reasons that we are optimistic for the future of fixed income investments.

- For the first time since 2009, investors can earn a solid return on these investments. A portfolio of quality bonds—including government securities, and investment-grade corporate bonds can now yield anywhere from 4% to 5%. The yield provided by these investments have not only moved up in nominal terms, but in real terms as well. Two-year Treasury real yields now exceed the 2019 peak level, while five- and 10-year real yields are at the highest levels since 2009 (source: Schwab). High inflation adjusted returns in risk-free investments allow for investors to avoid volatile segments of the market in order to beat inflation and retirees can support a withdrawal rate from their portfolio that can help with annual expenses without digging into their capital.

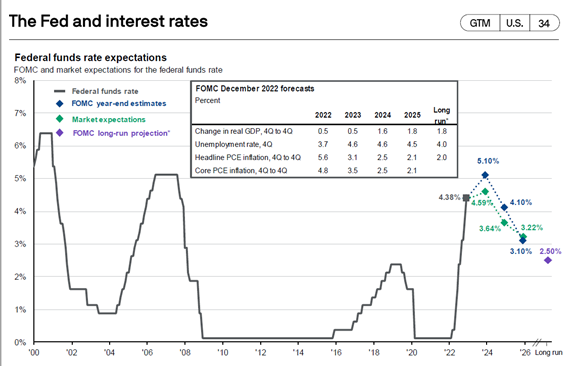

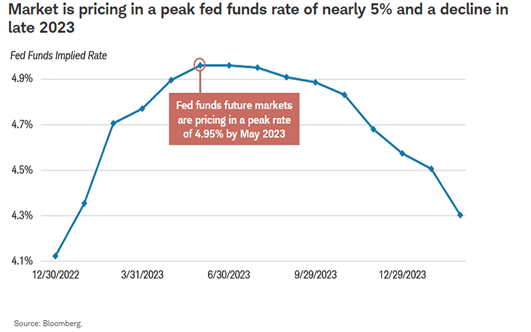

- There is a real opportunity for capital appreciation for bond traders. Economists are predicting that we are much closer to the end of this rate hiking cycle than the start (see chart below). The National Association for Business Economics has reported that both sales and profit margins are declining, which is the goal of the fed. As inflation concerns wain and the economy slows, the constant rate hikes will hold steady and then reverse. As explained above, lowering rates would increase bond prices offering the potential for capital appreciation in addition to already attractive yields.

Final Thoughts

After 15 years of lackluster opportunity in the fixed income space we are optimistic about the opportunities that bonds present. Investing in this space offers numerous benefits including diversification from the stock markets, capital preservation, and income generation.