Calvin Tenenhouse

July 19, 2023

2023 Mid Year Review and Outlook

Hello everyone! We hope you have settled into your summer routines and have had the chance to get out and enjoy some of this beautiful weather. We would like to take this time to recap some of the market drivers from the first half of 2023 and share our outlook on the markets for the remainder of the year:

Canada

- The Canadian economy grew 3.1% over the first quarter, significantly ahead of the Bank of Canada’s 2.3% forecast.

- This year, Canada’s population reached a milestone of 40 million. This helped relieve labor-force tightness and raised total spending, in turn supporting economic growth. However, new folks entering the country need a place to stay, which explains why the housing market has remained solid despite a rapid increase in mortgage rates, and consumption trends have been more robust than anticipated.

- Housing affordability is now worsening in major regions like Ontario and BC, which also happen to be top destinations for immigrants. Our economy has clearly benefited from a record surge in immigration that may be masking underlying fragilities.

- With roughly 20% of mortgages up for renewals annually, the full effects of prior rate hikes have yet to be completely processed. Given outstanding credit card balances, increased usage of home equity lines of credit, and decreased pandemic savings we believe credit risk has increased but is still not a large threat to our economy.

The United States

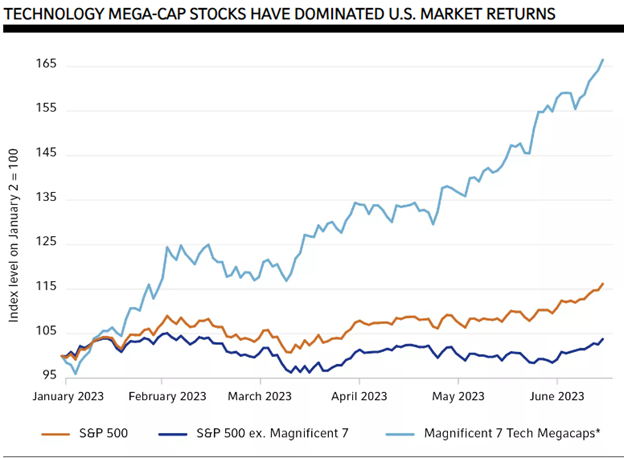

- Mega cap stocks are once again dominating the performance of the U.S. equity market. This time it is driven by excitement around generative artificial intelligence technologies such as ChatGPT which we wrote about here.

- The year-to-date return of the top seven technology stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla.) through June 15 has been 65%. Nvidia has posted a 190% return and Apple’s market capitalization now exceeds that of the entire small-cap Russell 2000® Index.

- The S&P 500 has returned 16.2% so far this year. However, excluding the seven stocks listed above, the return has been just 3.8% with large swaths of the market sitting well below their early 2022 highs.

The Rest of the World

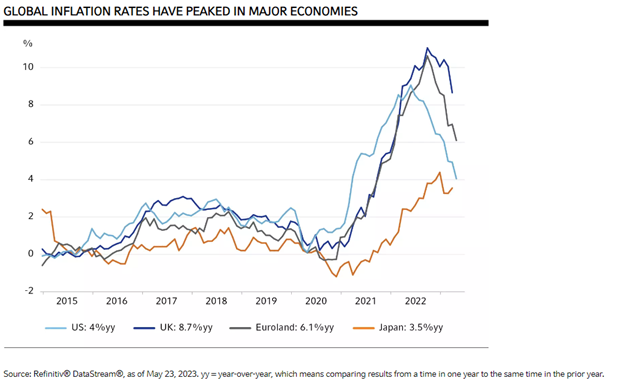

- In the first half of this year, Europe recovered from the energy and geopolitical shocks of 2022, but growth stalled in core economies like Germany and inflation remains stubbornly high at a time of record low unemployment (6.5%), prompting further rate hikes from the European Central Bank and Bank of England. This could further pressure growth in the months ahead. Of note, valuations for this region (and Japan) remain well below long term averages and their North American peers, reflecting that some of these concerns are already priced in.

-Despite relaxed Covid-19 measures, China's economic recovery has been less impressive than anticipated, with a weak industrial recovery and lower-than-expected demand for oil impacting global prices. Trade relations between China and the U.S. are still on edge though clearly the recent formal state visits by key senior officials are in an effort to mend the rift.

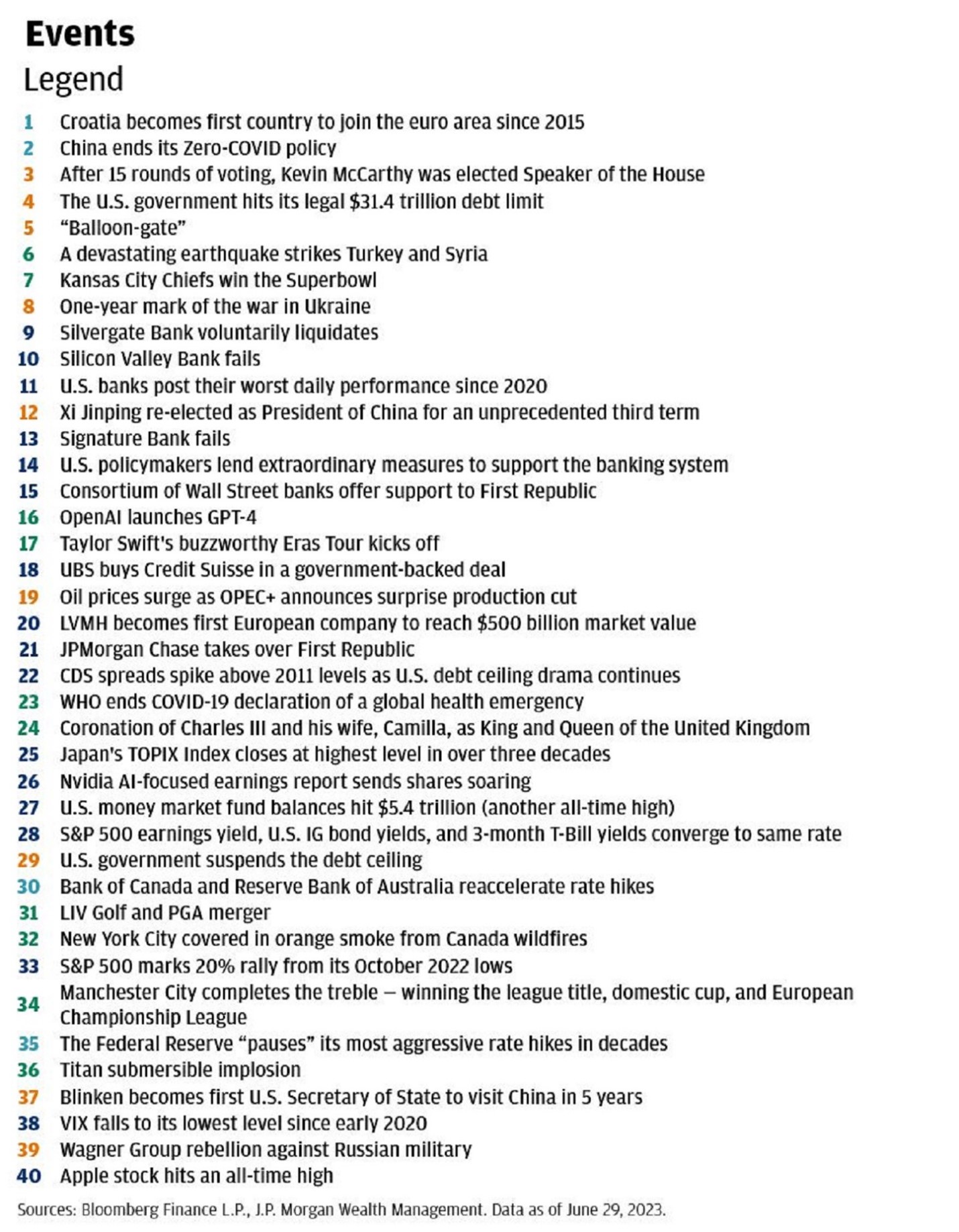

A full recap of major world events for year-to-date 2023 is available at the end of this posting.

Observations on the markets

Reasons for Optimism

Wall Street Analysts do not like to admit when they are wrong. Especially when their forecasts for recession keep failing to come true. Strong jobs growth? It is a late-cycle sign that the end is near. Housing picking up? It is only because inventory is low.

According to the headlines, 2023 should have been a continuation of 2022, which was a very difficult year for bonds, stocks and even real estate. But the U.S. markets (as measured by the S&P 500) is up +14.82% so far year to date, marking the fourth-best first half in the last 25 years alongside 2013, 2019, and 2021. At first it was just Big Tech making the comeback we anticipated last November (see here). However, the rally has broadened recently to include semiconductors, cruise lines, airlines, automakers, homebuilders, and hardware companies, which are some of the best performers over the last month (Source: J.P. Morgan).

There may be challenges ahead, but economic indicators continue to point to a resilient economy that was heavily cushioned by pandemic savings. In the 21 other instances since 1950 that the S&P 500 has been up at least 10% or more in the first half, it has rallied further in the second half 17 of those times, with the full year up on average +25%. (Source: J.P. Morgan).

Reasons for Caution

The massive monetary stimulus of 2020 to deal with the impact of the COVID lockdowns came home to roost in 2022. The Fed’s unprecedented increase in its balance sheet from $3.8 trillion in early 2020 to $7.1 trillion by the end of 2022 provided the fuel to raise prices across the board and the antidote will lead to decreased corporate earnings and layoffs.

Recession indicators such as an inverted yield curve, central bank tightening, slowing manufacturing activity and eroding consumer confidence readings are all potential warning signs. Meanwhile, measures of real economic activity such as job growth and household spending are only gradually moderating, keeping inflation firm and forcing central banks to continue raising borrowing rates. Over the last six months, four U.S. banks were forced to be rescued, alongside Credit Suisse in Europe (though this is a testament to the resiliency of the banking system). The U.S. went back and forth on the debt ceiling drama; geopolitical uncertainty is still running high (Russia/Ukraine, China, France protests); and central banks across the globe have held the position that there is still more work to do against inflation.

Finally, with short term bond rates at ~5% and inflation moderating, investors have an alternative to stocks and other asset classes to generate real returns for the first time in several years.

What we think

The tipping point will come when corporate earnings pressures force firms into serious decisions such as layoffs and capital expenditure delays. If consumers continue to draw down their savings to their current pace, it is reasonable to expect that their pandemic savings to have been exhausted within the next 6-12 months and households will respond by cutting back on discretionary spending. The industry consensus, as surveyed by Reuters in June, has a slowdown starting in the final quarter of 2023. We suspect that the impact of the sharp increase in borrowing rates over the past year to the financial system will take some time to show up in the data. It can take up to two years for the rise in rates to eventually impact employment, like how it took over a year for pandemic stimulus to lead to increased spending and sustained inflation. The good news is a delayed recession could be less drastic, as by next year inflation will have cooled meaningfully enough to allow central bankers to aggressively cut rates.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.

Calvin Tenenhouse is an Investment Advisor with CIBC Wood Gundy in Toronto. The views of Calvin Tenenhouse do not necessarily reflect those of CIBC World Markets Inc.