Greenwood White Group

December 15, 2023

Year in Review and Market Outlook: An Eras Approach

Inspired by Taylor Swift’s world “Eras” tour, which is projected to become the highest grossing tour of all time, we have decided to take a different approach to our year in review. In sports, fans tend to group periods into eras often defined by a unique characteristic of that time period. For those unaware, in basketball, we are currently transitioning out of the King James era after a glorious twenty-year reign. Looking back at the last 15 years of capital markets we believe that 2008 through 2021 will be known as the ‘Free Money Era’.

The Free Money Era

The Free Money Era began in 2007 with the global financial crisis, sending the economy into a deep recession. In response, the Federal Reserve and other central banks aggressively lowered their borrowing rates, infusing much needed liquidity into the financial system at a time when the flow of money had come to a virtual standstill. The Fed cut its federal funds target from 5.25 in the late summer of 2007 and by the end of 2008 rate cuts were no longer possible as the borrowing rate approached 0%. But labor markets were still quite weak, so they turned to unconventional monetary policy tools to continue to provide stimulus for economic recovery. These tools, known as “quantitative easing,” directly benefited the mortgage market (which was still in the penalty box after ‘08), as it lowered long term interest rates, which mortgage rates are tied to. And well… it worked! Over the next decade between ‘08 and ‘18 the average Canadian home price increased by 56%, Canadian share of home ownership declined, and rent increased by 25% (source rental housing index & Toronto realty blog). The median home price in the US increased by a multiple of 1.95x from $240,000 in 2008 to $468,000 by Q4 2022 (FRED economic data)

.

The Cost of Free Money

Interest rates can be described most simply as the ‘cost of money.’ And as shown in the chart below, it didn’t cost much to borrow over the last 15 years. Naturally, when money is free, people tend to borrow, and with more capital circulating, prices tend to get inflated. As a result, the 128-month period between June ’09 and ’20 was the longest economic expansion in recorded history before coming to an abrupt halt due to a worldwide pandemic (Statista).

Letting the economy grow without triggering inflation had many advantages: new business creation, increased standards of living, and drawing people back into the workforce. But higher aggregate demand brings inflationary pressures, and in response to the rising cost of living, higher lending rates are now here... and here to stay. This change in monetary policy ushers in a new Era, the Smart Money Era.

Smart Money Era

Those who took Economics 101 will remember the four stages of the business cycle, comprised of cyclical upswings and downswings in the measures of economic activity—output, employment, and sales. Those who didn’t will generally know the feeling they get when it’s time to tighten their belts and rein in spending, and when the going is as good as it gets. Determining where we are in the cycle is not as easy as you may think. Many indicators, such as inflation and profits, are like telling someone what the weather was five months ago. But if we are to trust the textbook, then it is likely we are heading into the last act of a four-part play best described by Blackstone’s Economics team. Act One was monetary stimulus in response to the financial crisis of 2008 – 2009 and hyper-charged by the pandemic. Act Two was the long-awaited surge in inflation that came as a result of that stimulus. Act Three was central banks showing up and saying, hey, we've got to put out this inflation fire, we're going to raise rates. And Act Four is the economy slows down as higher rates result in the following:

- Increase in overall borrowing costs;

- Lower total borrowing (due to higher costs);

- Increases the required hurdle rate of return for new projects (making it harder to approve them);

- Shifts the focus from growth at any cost to profitability;

- Encourages saving.

A common theme regarding eras is that they can only truly be defined when looking in the rear-view mirror. But here are a few things we should be keeping our eye on in the Smart Money Era.

-

Wealth Effect. Within the next 25 years, we will see the largest wealth transfer in history. According to CPA Canada, Canadian Baby Boomers will pass an estimated $1 trillion down to their GenX and Millennial heirs making them the richest generation in history. What will they do with these new funds? Many in this group have been locked out of the housing market. Will they invest or spend? Education will be the key. Those prepared to deal with the complexities of receiving a windfall of cash can mean the difference between a financial leg up and the loss of a family fortune.

-

Bonds are back. For savers and income-oriented investors, a portfolio of quality bonds including government securities, and investment-grade corporate bonds can now yield anywhere from 4% to 5%. The yield provided by these investments has also moved up in real, inflation-adjusted terms. Inflation has finally slowed after peaking in the summer of 2022 at 8.1%. The current rate of inflation now stands at 3.1% and has averaged 3.4% for the past 6 months as you can see here. Higher returns from risk-free investments allow savers to avoid volatile segments of the market to keep up with the cost of living. Further, retirees can support a withdrawal rate from their portfolio that can help with annual expenses without digging into their capital. In many ways, the Smart Money Era is a return to normal, as bond yields are returning to average levels for the first time since 2007.

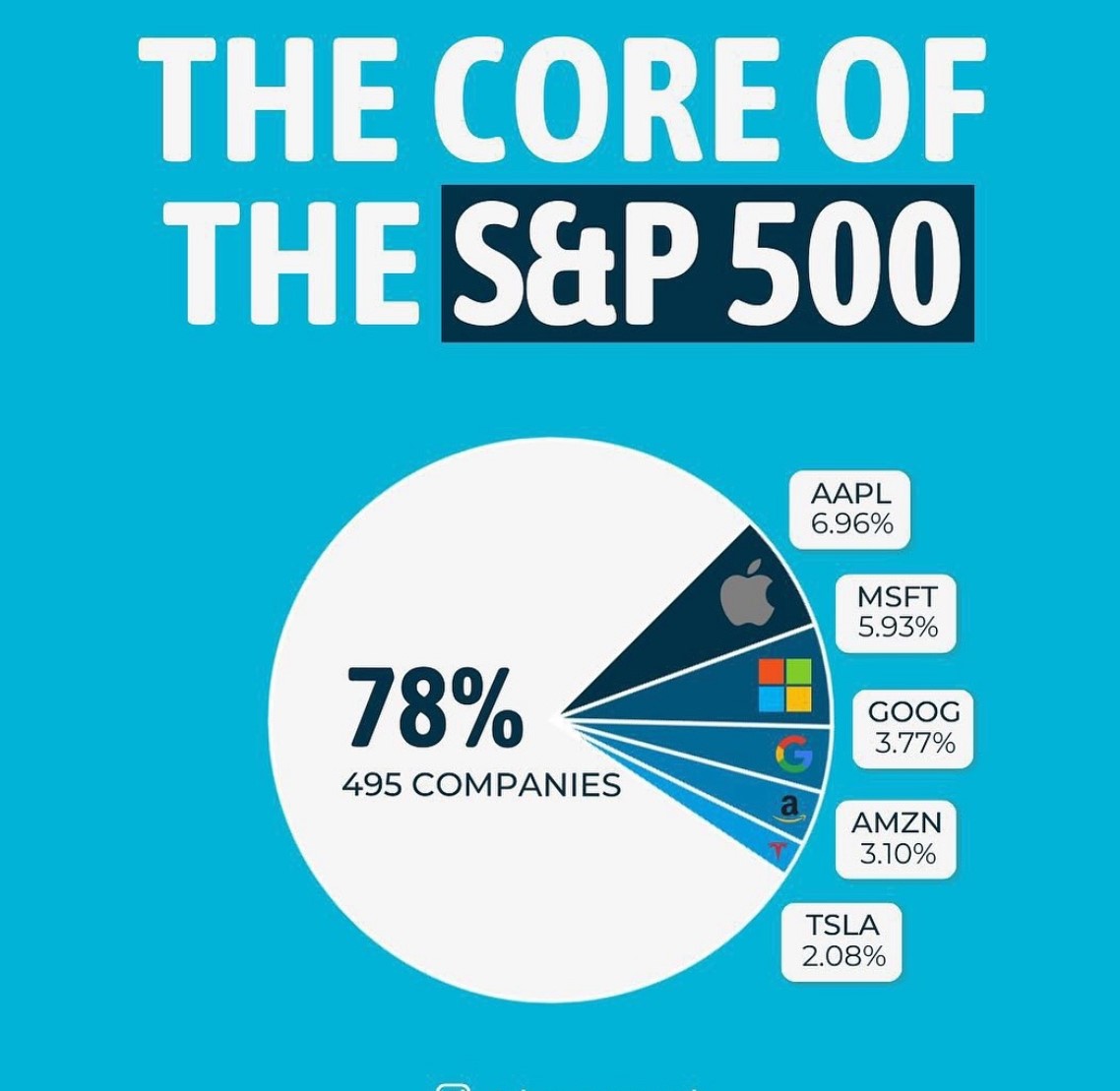

- The Magnificent Seven! For those unfamiliar with the term, the magnificent seven refers to Mega Cap tech companies Microsoft, Apple, Google, Amazon, Nvidia, Facebook and Tesla. These seven companies have a median return of 72.6% year to date and account for almost 30% of the entire S&P500 index (the biggest 500 companies in the U.S.) due to their large market capitalization. The growth of just these seven companies have stretched the earnings multiple on the S&P500 index to 18.6x and these seven companies contributed 77% of the S&P 500’s total return year to date. They also are expensive, with high embedded expectations for future earnings. The equal weighted S&P 500 (0.2% weight for each company) trades for 16.9x earnings, in line with its average since 2010. However, the market-cap weighted index trades for 21x earnings, which is 23.5% higher than its average since 2010. These firms are all armed with tons of cash on the balance sheet, strong cash flows, seemingly insurmountable competitive advantages, and excellent leadership. But valuations still matter. Those that held an equal weighted portfolio of Microsoft, GE, Cisco, Exxon, and Intel in 2000 when they comprised 18% of the index received a return of -6.75% (annualized) over the next decade. For context, Canadian stocks delivered a +5.57% annualized return over the same timeframe. There was a lot of excitement about the internet in 1999, just like there is a lot of excitement about AI now. The question we need to ask ourselves is ‘how much of this future growth is already priced into the stock?’

Final Remarks for 2023

As we prepare for the holidays and some time with friends and family, we would encourage you to shut off your socials and the 24-hour news cycle which can frankly be a bit depressing at times, and to focus all your energy on all that is sparkling and bright. Here are four amazing news stories from 2023 that we can all share at the dinner table this year.

Ozone Layer on Track to Recover by 2040

According to the UN, the ozone layer is officially on track to recovery within four decades! The report presented at the American Meteorological Society’s annual meeting stated that the ozone layer will be back to its 1980 ‘pre-thinning levels’ by around 2040. Learn More Here

Mattel Introduces Barbie Doll with Down’s Syndrome

Mattel has introduced a Barbie doll with Down’s Syndrome as part of its ‘Fashionista’ range, the company’s “most diverse and inclusive doll line” yet. The new Barbie was developed in partnership with the National Down Syndrome Society (NDSS) in the US and has been welcomed by disability rights campaigners, who believe that the realistic representation of the doll will help promote understanding and acceptance of people with disabilities. Learn More Here

AI Detects Breast Cancer 4 Years Before It Develops

AI is being used in cancer screening technology to pick up potential issues long before they develop into something harmful. In March, a computer-assisted detection (CAD) was used in Hungary to detect a woman’s breast cancer four years before it developed. CAD helps review images, assess breast density, and flag high-risk mammograms that may have been missed by radiologists. Learn More Here

Ecuador’s Historic Debt-for-Nature Deal Safeguards Galapagos Islands

Ecuador has achieved the world’s largest “debt-for-nature” deal – converting US$1.6 billion in debt into a US$656m loan from Credit Suisse. Ecuador will repay this loan over the next 18 years while allocating approximately US$17m annually to support conservation efforts in the Galapagos Islands. Learn More Here

On that upbeat note, we’d like to thank you for your business and your continuing support for us by referring your friends, colleagues and family to our growing practice. We wish you and your families all the best for the holidays and a wonderful new year.

John, Pete, Calvin, Emily, Marc, and Lorena