Calvin Tenenhouse and Peter White

May 10, 2024

2024 Spring Market Update

We hope you are all keeping well and beginning to enjoy the warmer spring weather. From geo-political tension across the globe to major budget changes domestically, and a high-profile court case down south, there has been no shortage of events that have shaped the economic landscape so far in 2024.

The Big Picture

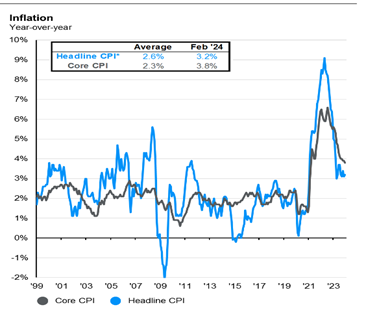

Let’s start with the price increases here on home turf. Inflation in Canada, which represents the cost of goods and services, declined in January and February but rose slightly in March. The Bank of Canada has spent the last two years raising interest rates to bring inflation back to the 2% target, without engineering a recession. It’s not an easy job trying to slow the economy without harmful side effects like increased unemployment and mortgage defaults. To make it even more difficult central bankers have only one tool in their belt to make changes, interest rates. But so far, they have done a pretty good job. Unfortunately, rates are only one piece of a much larger picture. Open immigration policies and higher energy prices, both of which the Bank of Canada has no control over, are not helping to bring prices down. For context, the decline in commodity prices over the past year was responsible for 2/3 of the decline in CPI in the U.S. from a peak of 9.1% in the summer of 2022 to 3.4% by the end of 2023. Oil alone contributed to 3% of the 5.7% decline (source: JP Morgan). That said, overall, we should be reassured that higher interest rates are working to lower inflation across the country (see figure below).

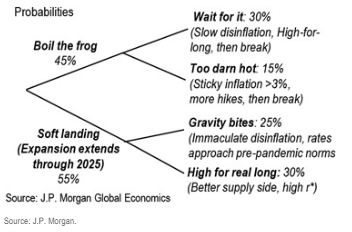

South of the border, there has been continued strength in the U.S. labour and stock market. Therefore, it won’t come as a surprise that Fed officials have downplayed the need for immediate rate cuts. In CIBC Economics’ view, there is a higher probability the Bank of Canada begins to cut rates before the Fed, as a result of Canada's economy and labour market underperforming our peers in the U.S. However, with OPEC and Russia agreeing in March to extend voluntary oil output cuts into the second quarter, this could place upward pressure on crude oil prices, which in turn could keep inflation higher than anticipated. Barring a major downturn in the economy, we still expect borrowing rates to end up at higher levels than what we have become accustomed to in the pre-pandemic Era. Below is a scenario analysis from J.P. Morgan on how the interplay between inflation and rates could impact the North American economy in the year ahead:

Heading overseas, China’s economy is still on track to slow from 2023, reflecting the ripple effects from the oversupply in housing. We touched on the long-term drivers of China’s growth conundrum in our blog post in April. But, by way of background, after the 2008 financial crisis, local governments in China made massive investments in domestic infrastructure betting that property prices would continue increasing. Real estate now accounts for roughly a quarter of China’s GDP. Unfortunately, limited population growth couldn’t support that level of expansion and strict ownership regulation worsened the situation. As a result, there have been a string of bankruptcies of major property developers across the nation. Ghost cities such as the State Guest Mansions outside of Beijing now sit abandoned across the country. Previously announced stimulus measures should help growth this year, but without any real increase in innovation or manufacturing these measures will only be a band aid fix. In the meantime, excess capacity in China’s good-producing sectors is lending a hand to cooling global inflation.

Meanwhile, Japan continues to break out of its’ decades-long malaise. There are good reasons why this is happening:

- Structural changes to the economy (a weak Yen allowing the deflationary spiral to be broken, and supporting exports of Japanese goods)

- Improved corporate governance attracting foreign investors; and

- Cash-rich companies that are inexpensive relative to their global peers with plenty of pure plays on long-term trends like semiconductors and AI, automation, and labour savings, and decarbonization (and neutral political positioning amidst increasing friction between economic powerhouses China and the U.S.).

With inflation eroding Japanese investors’ savings for the first time in decades, and a new Nippon Individual Savings Account allowing a new vehicle for tax deferred growth, perhaps this can finally attract new investors to the markets in a sustained manner.

Markets Recap

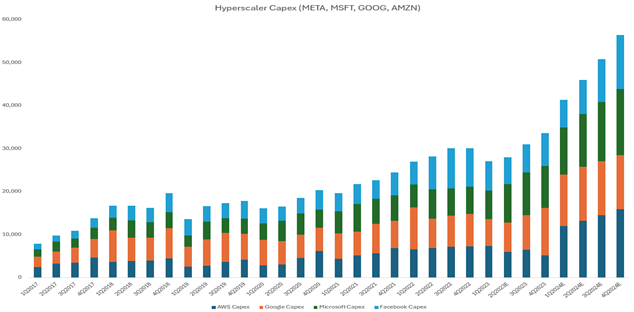

In the first quarter of 2024, North American stocks continued their upward trajectory with nine of the eleven industry sectors in the S&P 500 delivering positive total returns. Artificial Intelligence and its potential applications continued to dominate the headlines and drove market gains during the first months of 2024. Despite concerns over elevated valuations, money continued to flow into AI-related stocks, including most semiconductor stocks. These companies make computer chips which can be found in our phones, computers, cars and basically all “Smart Devices”. We can think of these chips as the brains of modern electronic devices, and logically as our phones get ‘smarter,’ and more of our data moves to the cloud, we need bigger brains to power them and the digital infrastructure to create them. The demand for these products helped the tech-heavy NASDAQ index deliver a total return of 9.3% for the quarter as technology stocks continued to march to new highs. While the AI hype is tied to uncertain future demand, it does appear to be backed by genuine earnings growth (which will need to persist to justify valuations) and many businesses involved in this space enjoy a large competitive advantage over new entrants. A glimpse at the staggering growth in capital expenditures by Amazon Web Services, Google, Microsoft, and Facebook from $10B a quarter in 2017 to $60B a quarter should give you a sense of the scale of spending on infrastructure in the Artificial Intelligence Arms Race – it is little wonder that semiconductor sales are also going parabolic.

However, after an impressive run-up from the market lows last fall, stretched valuations and unproven business models could present a near-term risk for this group. When a stock, strategy or sector can do no wrong, it is usually the time we should exercise the most caution with it – all the good news is already “priced in.” And while some assets, such as U.S. mega cap tech companies, are comparatively expensive, others like biotech, and pharma are still reasonably valued and can potentially benefit from the advancement AI.

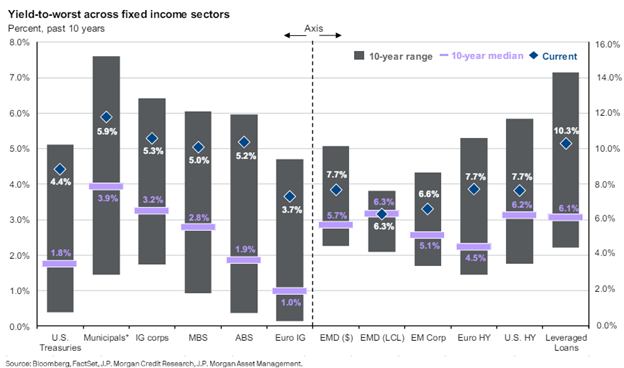

Firming inflation weighed on bond returns during the first months of the year as bond rates rose in response and prices fell as a result. However, as illustrated in the chart below, with effective yields in the 5-10% range (vs. average yields in the 1 - 6% range over the past decade), bonds should be meaningful contributors to returns going forward (current bond yields explain ~90-95% of long-term returns). While the sharp uptick in rates in 2022 was a grim reminder that bonds can have negative returns, bonds have only delivered negative returns in 5 of the last 48 years, and drawdowns are typically much lower than stocks (3.5% average intra-year drops). In short, bonds should still reduce portfolio volatility while delivering attractive long-term returns.

Looking Ahead

The current bull market is a sign of confidence in the durability of the global economy, the continued strength in corporate earnings, and evidence that central banks’ actions to bring inflation under control while not derailing economic growth are having their intended effect. Investors have been relatively unfazed by the sharp jump in borrowing rates over the past year as stocks have continued to march higher.

But it’s not all good news. We will continue to wrestle with:

-

Uncertainty regarding when central banks will cut interest rates;

-

The possibility of less rate cuts than expected (or even worse, a surprise rate hike);

-

Sustainability of the current job market (especially in Canada);

-

Elevated geopolitical tensions.

If rate cuts are delayed, or, even worse, they are increased it would likely derail the recent rally in stocks. Furthermore, a strong rally in equities, led by a small number of nation-sized companies, raises questions on the sustainability of the market’s performance as whole. We hold to our belief that there are still many opportunities to be found in U.S. and Canadian blue-chip stocks but stress the importance of quality stock picking to find companies that can thrive for decades to come trading at discounts to their intrinsic value. Lastly, given higher yields from GICs and quality dividend payers, and the slow erosion of purchasing power from gradually rising prices on goods and services, we believe holding cash throughout this period to be a mistake.

As always, we continue to monitor the existing market conditions to ensure your portfolios are constructed for long term success. If you have any questions, please don’t hesitate to reach out to a member of the team.