Calvin Tenenhouse

July 02, 2024

A Toronto Condo Update: Where Have all the Buyers Gone?

Hello Everyone,

Typically, our blog posts delve into analyzing public markets and their drivers. However, for this piece, I want to shift our focus to a different asset class: real estate, specifically Toronto's condo market.

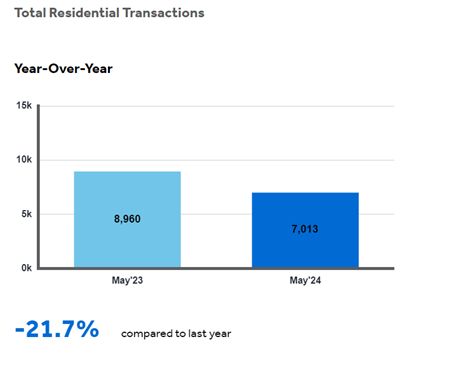

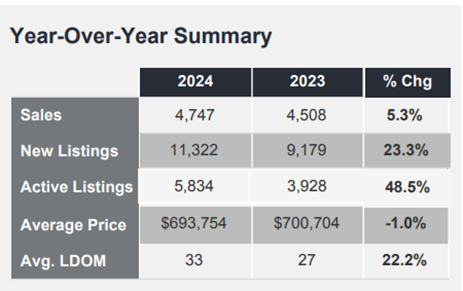

As I sifted through the latest data on the topic, I stumbled upon some staggering statistics from the past year provided by the Toronto Regional Real Estate Board (TRREB) :

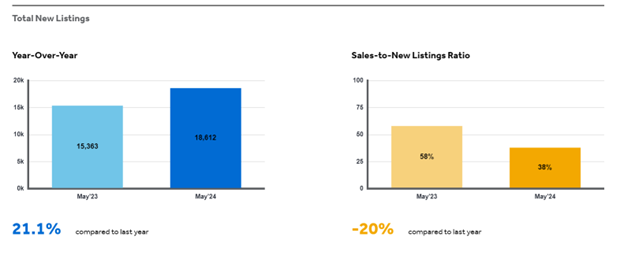

- New listings in the Greater Toronto Area (GTA) have increased by 21.1%.

- The ratio of sales to new listings has decreased by 20%.

- Condos are spending 40% longer on the market.

- Most notably, active listings have surged by 48% compared to last year!

These numbers paint a vivid picture: condos are facing significant challenges in today's market. In this blog post, I aim to explore the reasons behind this phenomenon and address the crucial question: Where have all the buyers gone? And why, in the middle of a housing crisis does nobody want to buy these properties?

(Source: TRREB)

The Investor Impact

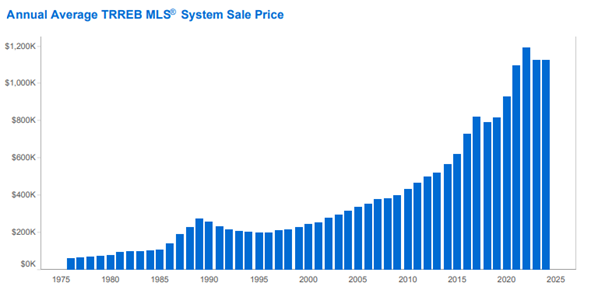

The increased interest in condo investing over the last 20 years has become the key driver of what’s caused this market dislocation. When I refer to ‘investors’ I am not talking about ultra- wealthy real estate tycoons or billion-dollar asset management firms. According to CBC, the average condo investor in Toronto is a “middle-aged, middle-class couple”. The key point to understand about these investors is their intention. Many of these people have no plans of ever living in this space (a critical issue we will revisit later). The goal has always been to earn secondary income by renting out the property and realizing substantial capital gains upon resale. And for many decades, this strategy has been widely successful. Condos were cheaper than detached homes and rents steadily rose as more new people entered Canada. The chart below from the Toronto Regional Real Estate Board shows the average sale price of all residential properties in the GTA since 1975. Capital appreciation on housing in addition to the rents received was assumed. But maybe not anymore.

(Source: TRREB)

The Math Doesn’t Add Up

In 2016 The average cost of a 1-bedroom condo in Toronto was $300,000 (Source: CBC). With a posted lending rate of 2.7%, your monthly mortgage payment would be approximately $1,100 monthly. With the average rent at $1,600, that condo is essentially breaking even while the owner builds up equity. But today the math is different. The average price is closer to $550,000. With rates at 6.8% your mortgage payment is likely north of $3,000 a month. After property taxes, maintenance fees, insurance etc. your monthly costs can run closer to $4,000 and the average rent, $2,400. As a result, most investors will be short $1000 a month. So…raise the rents? Turns out landlords have, and renters can no longer afford to pay. This brings us to our current situation, where the investment opportunity does not look as profitable on paper as it used to. This is precisely why we are seeing inventory grow.

(Source: TRREB)

Misalignment with Long-Term Home Ownership

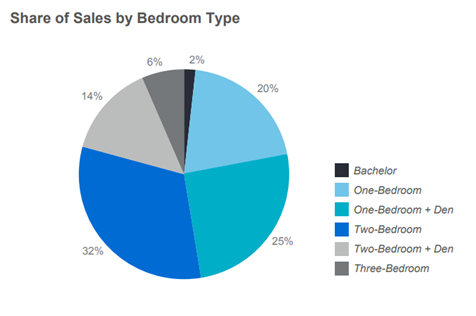

The logical question we should be asking now is “Isn’t this great news for people who want to own their first home?” In theory it should be. Excess supply should push prices down to meet market demand. But the issue is this – these units were not designed for home ownership; they were designed for renting. In 1980, the average new condo size was just over 1,000 square feet. This allowed enough space for a couple in their 20-30’s to start a family, have a home office, a guest bedroom etc. By 2016 the average condo brought to market in Toronto was about half the size at just over six hundred square feet (stats Canada). These smaller units were cheaper for “average investors,” and easier to qualify for. The problem arises when these smaller condos prove inadequate for raising multiple children, owning a large pet, having guests over, or working from home alongside a partner. Home ownership is about much more than interest rates and rent prices. It’s about comfort, location, and a space to live with loved ones. Unfortunately, recent construction trends have overlooked these essential factors. 47% of condo sales over the last year were units that had one bedroom or no bedroom. In fact, of all the condos built in Toronto after 2016, only 45% are owner-occupied (stats Canada). That is a mind-blowing statistic – less than half of condo buyers are purchasing with the intention of actually moving into the unit! And these small condos are the majority of what’s sitting on the market as investors just aren’t interested. In summary, many of these units that are now sitting on the market were never intended to be long term homes and undersized condos remain vacant as investors hesitate to engage.

(Source: TRREB)

Investment Implications and Final Thoughts

Despite the challenges, as a recent Toronto condo owner-occupier myself, I feel inclined to share that there is room for optimism! The Chief Market Analyst of Toronto’s real estate board is predicting a resurgence in buying activity for the following reasons:

-

As the cost of borrowing decreases in 2024 and into 2025, inventory will be absorbed, and market conditions will tighten. As a result, increased competition between condo buyers will result in upward pressure on selling prices.

-

Renters will become fed up with further rent increases and consider purchasing their first home. These first-time home purchases will likely need to be a smaller unit in the $400,000 to $600,000 price range.

-

Canada will continue to welcome over half a million newcomers each year who will need somewhere to live. Those in a position to take advantage of buying these properties at a discount can be confident that finding tenants will not be an issue.

There are also investment implications to be drawn from the above that our team continues to monitor. Here are a few opportunities that we are observing:

- Firms involved in real estate development and construction are benefitting by acquiring excess inventory or failed projects at discounted prices. Developers with strong balance sheets and proven track records should be able to turn these projects into profitable ventures. The same argument can be made for many Canadian REITs

- Financial institutions who provide loans to developers may see increased deal flow as they fund projects aimed at repurposing excess inventory.

- In the tech space, companies are beginning to offer web-based solutions directed at real estate management, marketing and sales. Some of these products include virtual tours, digital marketing platforms and online property management software.

In conclusion, while the Toronto condo market faces challenges rooted in investor dynamics and changing financial landscapes, opportunities for recovery and growth remain on the horizon.