Peter White

July 23, 2024

2024 Mid-Year Update

As we turn the page on the second half of 2024, we thought we’d pause for a moment to take stock of where we stand and where we might head to from here.

The past 18 months have consistently defeated expectations of a pronounced market pullback. At mid-year, most global stock markets had posted single-digit returns. The standouts were Japan (through to the end of the June, the Nikkei 225 was up 18.28% in local currency terms) and big-cap tech stocks (the Nasdaq rose 18.13%). If you back out the performance of the “Magnificent 7” from the broader U.S. market (the S&P 500), the remaining 493 companies have delivered only a 5% return year to date, in line with most other global markets. Only the Shanghai Composite was in negative territory. Commodity returns were mixed, and the USD$ remained resilient amongst global currencies. Copper and gold posted double digit returns, while oil and natural gas prices languished.

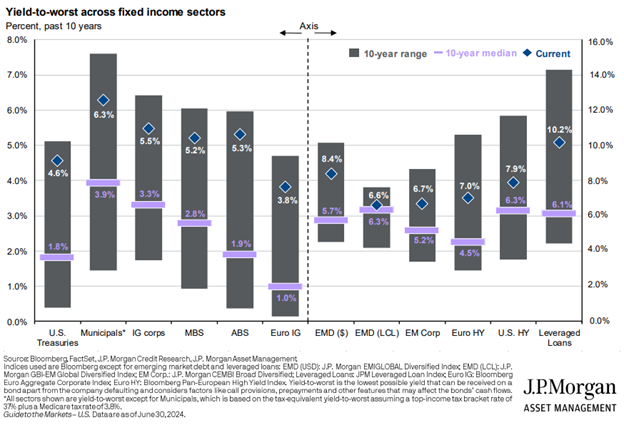

Bonds generated limited returns during the first half of the year, but still offer some of the highest yields in almost 15 years, with yields of 4-6% for government, structured credit (mortgage and other asset-backed securities), and investment grade bonds, and 7-10% for higher risk high yield (“junk”), leveraged loans, and emerging market bonds, as you can see from the chart below.

Investors have chosen to look past a stubbornly inverted yield curve (usually a sure sign that a recession was in the imminent future), building pressures in the housing and office real estate markets, declining consumer spending, an uneven geopolitical backdrop, and focused on improvements at the margin.

Inflation is clearly plateauing, and the price increases of the past few years have given way to price wars in U.S. fast food restaurants and Chinese electric vehicles. At the same time, unemployment is levelling off and in key markets like the U.S., starting to modestly rise as job openings continue to fall. This gives room for central banks to cut benchmark borrowing rates, supporting rising asset prices across stocks, bonds and real estate. Fiscal policy also remains loose and populist governments around the world show little interest in addressing the deficits that usually accompany them. So the policy supports for the continued strength in stocks and bonds are clear.

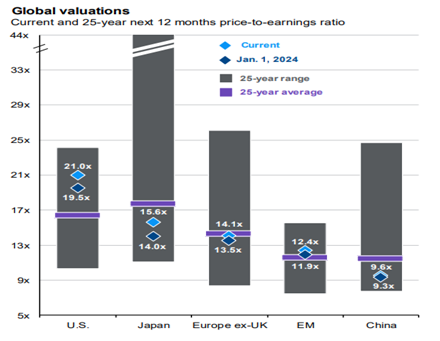

The growth backdrop is also reasonably constructive. While growth is decelerating in key economies like the U.S., they still should avoid a recession, at least in the near term. At the same time, other key economies like Japan, as well as Emerging Markets like India, Korea and Taiwan are seeing a re-acceleration in growth as stimulus measures put in place over the past few years take root. Mainland China continues to languish, but the government continues to steadily ramp stimulus there in the hopes of staving off a Japan-style period of stagnation. It seems ironic to us that Japan appears to be exiting a prolonged period of economic malaise while China may be entering one, and yet both markets are undervalued relative to historical norms, as you can see from the chart below.

Turning closer to home, Canada is expected to avert a recession by the skin of its teeth (CIBC Economics sees growth troughing at 0.80% in Q3 of this year, source: Forecast Update July 18, 2024) and the Bank of Canada will continue to cut rates but is in a tricky position as high rates worsen the housing crisis (as new development projects have a higher hurdle rate to be profitable) and risks a spike in foreclosures, but lower rates caused the problem in the first place. Against this backdrop, good quality companies such as the Canadian banks and utilities offer dividend yields in the 4 - 6% range, plus consistent growth of those dividends, so investors are receiving healthy compensation for these short-term risks.

Exogenous risks remain the key threat to this constructive economic outlook, and should be monitored closely. Protectionist movements (tariffs, trade wars, de-globalization), military conflict (such as the shipping attacks in the Red Sea) and climate change (severe weather events like drought or hurricanes) all threaten the stability of global supply chains. Threats to supply chains could provoke a further round of accelerating inflation which, in turn, could force central banks and governments to remove stimulus. Unfortunately, exogenous events are difficult to predict, so a flexible approach where tactical shifts can be made quickly is best suited to this environment. Illiquid investments like real estate, private mortgages, equity and credit were the asset classes du jour for the past decade, and while significant opportunities continue to present themselves in those asset classes, investors currently receive attractive compensation and much more flexibility in traditional asset classes like stocks and bonds.

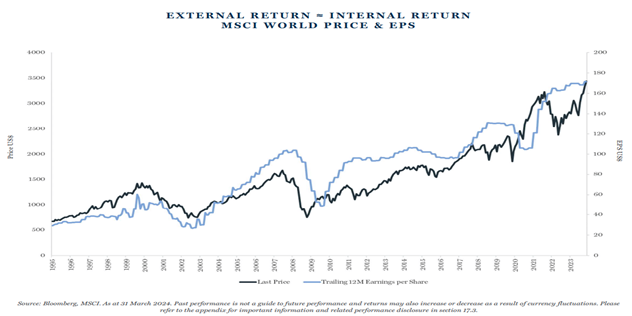

As always, we’ll remain vigilant and flexible in our approach to building our client’s long-term wealth, and focus on hitting singles rather than winning the home run derby. We’ll end with a brief rumination on stocks (and the baseball analogy), since bonds already offer an above-average return profile (the singles we like so much to hit). The current cyclical bull market (which began in October 2022) may be in its early days, but the “secular trend” of above-average returns from stocks shows little signs of abating, despite the odd shot across the bow from the “perma-bear” crowd (which seem to be getting more airtime in front of the U.S. election). The drivers of long-term returns are simple: internal returns (earnings growth) beget external returns (stock price appreciation and dividend growth), as elegantly illustrated by Walter Scott below. This is our primary focus when picking stocks or managers that invest in stocks.

The drivers of the above-average stock returns (>11%) that the U.S. market has enjoyed since the credit crisis of 2008-2009 are more nebulous. Ultimately, they are driven by internal returns (earnings growth) and external factors (sustained p/e expansion – investors paying additional dollars for each dollar of earnings). Jurrien Timmer, the vaunted chief strategist of Fidelity has given his take on why this has happened: “above-average returns have been driven by several factors, including falling interest rates over much of that period, rising margins, and buybacks and M&A (merger and acquisition) activity that has reduced the supply of shares. Buybacks, in particular, have been a powerful driver of higher P/Es. On a cumulative basis since 2009, the issuance of shares has totaled about $2.7 trillion, while the reduction in shares has totaled about $21.3 trillion. That's a huge supply-demand imbalance against a US market cap of about $44 trillion.” (Source: Fidelity, “Midyear stock outlook: Room to Run,” June 17, 2024) He ends that note by postulating that while the current super-cycle may not be “over its skis” quite yet, the current high valuations may lead to “below average” (ie. below 11% returns) from U.S. stocks. We would note that the last time valuations were this high, the 25 year return on the S&P 500 was still >7% (annualized). Not a bad return for those looking to hit singles, and maybe the odd double to get a runner home.