Calvin Tenenhouse

September 13, 2024

Elections and the Markets: Your Questions Answered

For the past five years, it has been common to hear situations described as ‘unprecedented’. As if a typical election year were not volatile enough, this year's cycle has already produced many extraordinary headlines. On July 13, Donald Trump survived an assassination attempt in Butler, Pennsylvania. Less than two weeks later, Joe Biden announced that he would not seek re-election, opening the door for Kamala Harris to become the Democratic nominee.

US elections can be divisive and unsettling. Shifts in government can substantially impact public policy, societal trends, and the companies that we choose to invest in. With intense emotions on both sides of the political divide, it is natural to assume that the election’s outcome could have major impacts on consumer sentiment and prices in financial markets. Given this uncertainty, this post will answer the most frequent questions I have been hearing from clients.

1. Which US political party will be better for my portfolio?

2. What typically happens in the markets during election years?

3. Can we position the portfolio to outperform during election season?

4. Where should I invest right now?

Which US political party will be better for my portfolio?

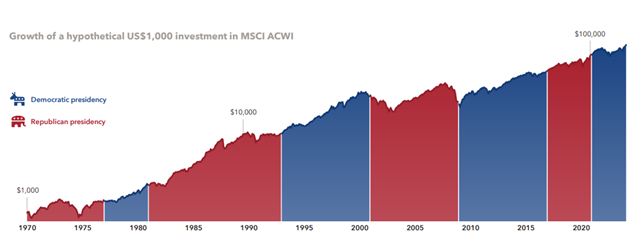

The toughest part about answering this question is that politicians frequently make promises that, once elected, they do not keep. Given the difficulty of trusting candidates statements made prior to taking office, I believe the best way to address this question is to review the historical records. Since 1970, the party of the sitting president has had virtually no impact on public equity markets. More importantly, an investment in the MSCI World in 1970 of $1,000 would have grown one hundred times by 2020 (Figure 1).

Figure 1 provided by Capital Group

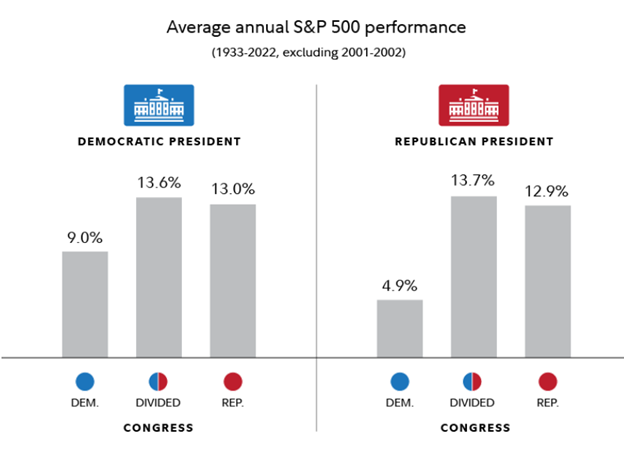

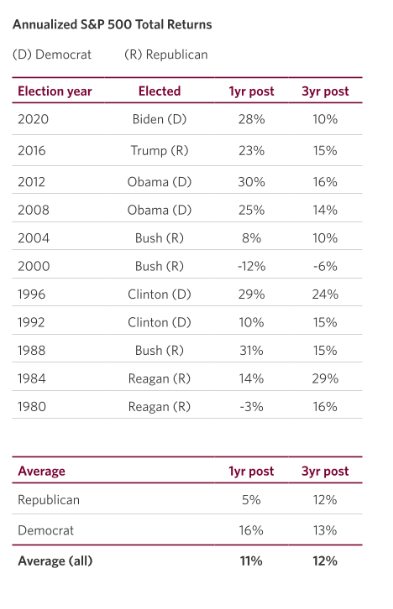

The historical evidence is clear: markets are nonpartisan. The S&P 500 has averaged positive returns under every partisan combination (Source: Fidelity). Interestingly enough, a divided government has historically resulted in outsized returns! (Figures 2 and 3). This is likely a result of government gridlock. The absence of unified control creates less radical policy shifts, leading to greater stability and more certainty for investors.

Figure 2 provided by Fidelity

Figure 3 provided by CIBC Asset Management

What typically happens in the markets during election years?

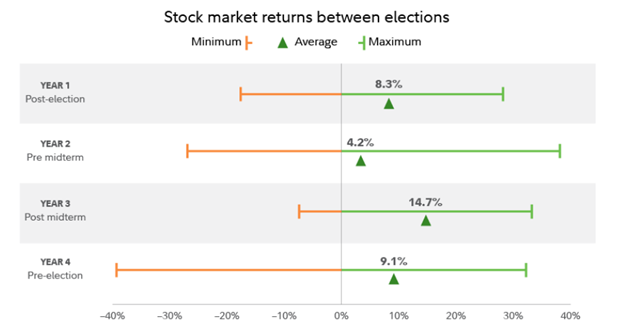

Since 1950, US stocks have averaged returns of 9.1% during election years (Figure 4). Unsurprisingly, the 365 days leading up to an election have the highest market volatility of the four-year cycle. Investors dislike uncertainty, and often react to the political news cycle with emotional buying and selling. However, the average return during this period does not substantially deviate from the mean. A politician’s impact on the economy is far greater in emerging markets that have less established institutions and smaller, domestic-focused companies. In contrast, many American firms have become global institutions. For example, Apple’s Market Cap of 3.38 trillion is larger than the GDP of all but six countries (USA, China, Japan, Germany, India, and the UK.)

Figure 4 provided by Fidelity

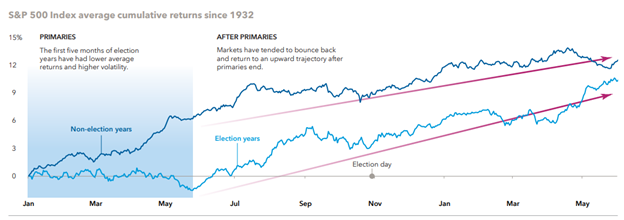

As illustrated below, markets tend to rally after primaries end all the way into the following calendar year. (Figure 5).

Figure 5 by Capital Group

How should we be positioning the portfolio? Where should I invest right now?

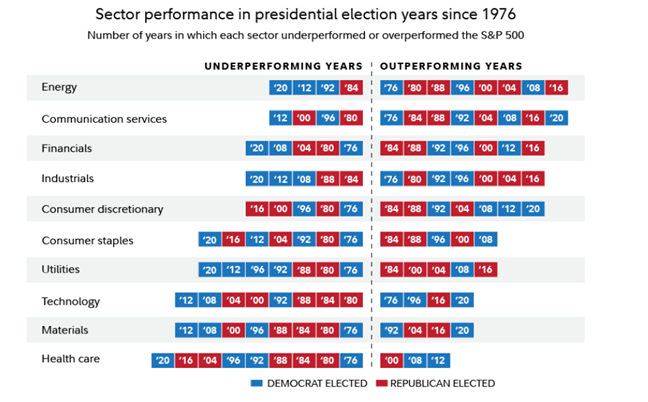

As stated previously, the investment process for buying quality, cash-flowing business should not deviate based on the expected winner and their policies. There are significant differences between the promises given on a campaign trail and the eventual policies implemented in Washington. Even if we had a crystal ball to tell us who is going to win the election, the information would not be significant enough to correctly predict an investment sector to generate outperformance. I encourage the reader to try to identify any patterns in the chart below, which shows sector performance in each presidential election since 1976. (Figure 6). Let me know if you find something!

Figure 6

Turning to geo-political risks, the US government is expected to continue its efforts in slowing the growth of China's technological capabilities and will seek to reduce US economic exposure to the region, regardless of who wins the election. In fact, the Biden administration has increased the China tariff policies that were introduced by the Trump government. In the short term, equity investors would benefit from Trump's polices of government deregulation and further corporate tax reduction. However, more fiscal easing, in addition to a potential increase in trade conflicts would be a concern for all market participants Meanwhile, neither candidate has shown any roadmap to retiring the current $35 trillion in gross federal debt.

Final Thoughts

Markets naturally move in cycles. Political developments can impact short-term market performance and volatility, and in turn, the performance of your investment portfolio. US voters will have their voices heard in November, but by sticking to your long-term plan, investors can position themselves for success regardless of the outcome. As we work together, it is important to stay focused on your long-term goals, remain invested, and avoid making emotional decisions during short-term volatility.