Calvin Tenenhouse

October 28, 2024

How will your portfolio act in a falling rate environment?

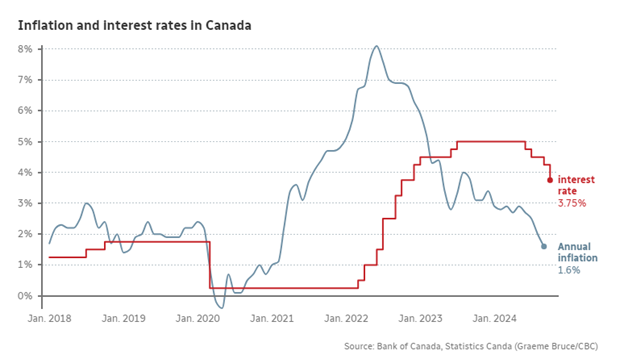

The Bank of Canada has lowered its key interest rate to 3.75 per cent, making a 50-basis-point cut for the first time since the COVID-19 pandemic. As borrowers, the first things that rate cuts bring to mind is the impact to our mortgages and lines of credit. But as savers, changes to Canada’s policy interest rate can have a material effect on the rate of return in our investment portfolio. In this blog post I will cover how falling rates will impact both debt and equity markets and what we can do as portfolio managers to capitalize in this environment.

A background on the boom-bust interest rate cycle

Modern-day monetary policy is grounded in its efforts to balance low and stable inflation with steady employment. Across the globe, central banks have adopted a target of 2% year-on-year rise in the consumer price index, which tracks the prices of a diverse basket of goods and services. This 2% inflation number has been deemed by many economists as the most appropriate to achieve solid economic growth and maintain employment levels without completely eroding our purchasing power. Central banks have sought to offset periods of high inflation by increasing borrowing costs, therefore lowering consumer demand, and subsequently cutting borrowing costs as inflation returns to target. When central banks change the key policy interest rate it impacts both the economy and the stock market. This is because borrowing becomes either more or less expensive for both individuals and businesses alike, which impacts corporate performance. It also impacts the valuation of a whole host of asset classes that are priced relative to risk free borrowing rates – if one can receive an attractive return in risk free bonds then they are less inclined to pursue riskier strategies in the hope of higher returns. The stock market is forward looking, so hikes or cuts have historically materialized in stock market performance immediately. For the rest of the economy, it normally takes between 9-18 months to see any widespread impact from interest rate policy decisions as it takes time for consumers and business to adjust their spending habits to the new macro environment.

Changes to Fixed Income Markets

Interest rate cuts are generally good news for existing bond investors. New bonds pay lower rates, which makes existing bonds with higher yields more valuable in the market. This adjustment doesn’t have to happen on the day of a policy rate decision. All it takes is the central bank to signal that base rates have peaked, and markets quickly pivot to price in expectations of interest rate cuts. We’ve already seen this with the current CAD-USD exchange rate as the widening in US-Canada policy rates has, in-part, caused further declines in the Canadian dollar as investors opt to buy US denominated bonds. Over the last few years, many investors took advantage of higher yields by opting for guaranteed investment certificates (GICs) and money market funds with dollars they would have normally directed to bonds. As rates fall and we move closer to our “new normal”, lower yields on money market prove less enticing and more importantly, less suited to meet long-term goals.

Stock Investment Considerations

The relationship between interest rate policy and the stock markets is much more nuanced. The reduced cost of borrowing encourages consumer spending and investment, resulting in tailwinds for business. Furthermore, firms enjoy the ability to more easily finance operations, acquisitions, and can expand at a cheaper cost, thereby increasing their future earnings potential. In reality, rate adjustments impact different companies and industries in different ways.

Certain sectors like real estate, utilities, consumer discretionary and information technology have historically benefited from rate cuts more than others. Companies that operate in industries like real estate, telecoms and utilities require large capital investments in property and equipment, and tend to use a lot of debt to finance that spending. These highly levered entities tend to benefit most as financing their operations becomes cheaper. Likewise, companies who are valued based on the future growth of their businesses (such as high growth tech stocks who have limited current earnings to value them on) are very sensitive to risk free borrowing rates, as these future earnings are discounted back at those rates. Within the tech space, the biggest beneficiaries of rate cuts have historically been mid-cap tech stocks, and specifically those stocks with high debt balances. The largest tech companies and those with conservative balance sheets, like Apple and Microsoft, will see a smaller direct benefit. Interest rates are just one variable of many that impact the world economy and the companies we choose to invest in. Factors such as inflation expectations, economic growth projections, and geopolitical events will also influence market returns. Most importantly, a company’s own growth prospects or ‘internal returns’ are always going to be the best predictor of its value ‘external returns’. This is why we always own cash-flowing businesses that we understand and can commit to for the long term.