Calvin Tenenhouse and Peter White

December 18, 2024

Year in Review and 2025 Market Outlook

Hello Everyone!

We hope you are all keeping well and have carved out some time during this holiday season to focus on the things that matter most to you and your family. Each year, we like to start off this blog post with a gentle reminder that, despite what we often hear in the news (both traditional and otherwise), it isn’t all doom and gloom out there. Beyond it being a pretty superb year for investment returns, here are a few of our favorites developments from the past year, feel free to reply with any of your favorite news stories from 2024.

- The UK closed its last coal-fired power plant in 2024. It was a symbolic moment as the UK was the first country in the world to use coal for public power generation and the fossil fuel was the lifeblood of the industrial revolution.

- Deforestation in the Brazilian Amazon dropped to a nine-year low in 2024, falling by more than 30% in the 12 months to July, according to data released by Brazil's national space research institute

- Global child deaths from pneumonia have been cut in half since 2009.

- In a step to provide equal opportunity for education, families of students at the Massachusetts Institute of Technology (MIT) making under $200,000 will not have to pay housing, dining, or other fees, and they’ll have an allowance for books and other personal expenses.

- A new United States regulation will classify over 23,000 new vendors as licensed firearms dealers. By doing so, the government has closed a loophole that allowed thousands of firearms to be sold at gun shows and on the internet without federal background checks.

Registered Account Updates for 2025

The Registered Retirement Savings Plan (RRSP) dollar limit for 2025 is $32,490, up from $31,560 in 2024. As usual, the amount you can contribute to your RRSP in 2025 is limited to 18 per cent of your 2024 earned income, which includes (self-)employment and rental income, up to the RRSP dollar limit of $32,490, plus any unused RRSP contribution room from 2024, subject to any pension adjustments. The tax-free savings account (TFSA) limit will remain at $7,000 for 2025. The First Home Savings Account limit will remain at $8,000. If you haven’t yet, please reach out to our team to set up a time to review your registered accounts and organize contributions.

A Year in Review

2024 has had no shortage of economic headlines. Conversations surrounding inflation, central bank responses, and global elections have driven market movements. In this post, we will provide a brief summary on where global markets stand, our thoughts on the road ahead and how we are positioning portfolios to capitalize on the current macro environment.

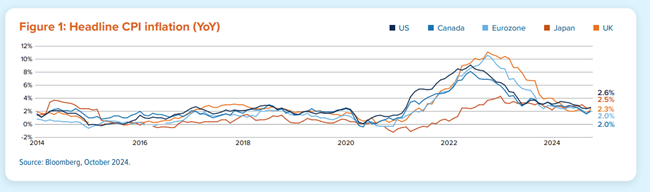

The global economy continued its resiliency in 2024 despite headwinds from higher interest rates. The economic momentum, and deceleration of inflation globally has given central bankers the green light to begin the long-awaited easing cycle. Of the 37 global central banks that are actively tracked by JP Morgan, 27 are currently cutting policy rates, including every major central bank except Japan. As a result, the odds of a global recession have diminished considerably over the last 6 months, amid better than expected economic data, easing inflation, and a stable labor market.

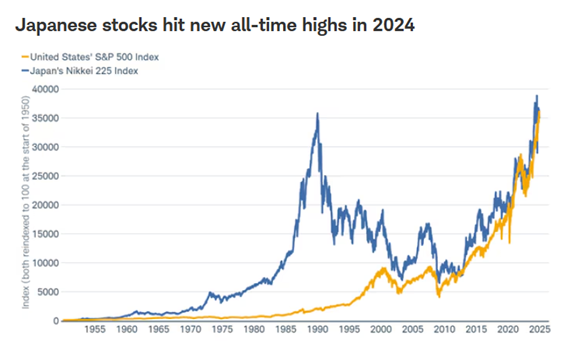

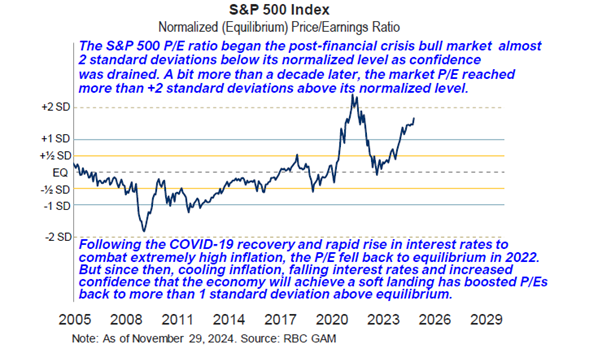

Global Stocks extended their impressive gains through the fall but returns have been highly varied between regions and styles. The S&P 500 has risen over 26% so far this year, and while gains had been concentrated in a small group of mega-cap technology stocks in the first half of the year, the rally broadened out since the summer and other parts of the market have slowly come alive. For example, the S&P 500 Equal Weight Index is up over 18% year to date (which lowers the weight of Apple, and hence its influence on the index’s returns, from 7.5% to 0.20%), the S&P 600 Small Cap Index is up 16%, the S&P 400 Mid Cap Index up 21% and the TSX Composite up 16%, all in U.S. dollars. Gains offshore, however, have been less impressive and Trump’s protectionist inclinations could continue to pose a headwind for international and emerging markets. Still, Emerging Market and EAFE (Europe, Australasia and the Far East) markets generated positive returns through 2024, led by Japanese stocks who are finally exiting a long period of muted returns. As a result, U.S. Large-Cap Stocks are relatively expensive when compared to Global Stocks and Small Caps, suggesting relatively attractive return potential from undervalued areas of the market.

Bonds also enjoyed strong returns in 2024, as inflation fell from its 2023 highs and central banks were given some latitude to lower rates and support growth. In the U.S., the Effective Fed Funds Rate fell from a high of 5.33% last summer to 4.33% in December 2024, and the market is currently pricing in an additional 0.50% of cuts in 2025. In Canada, the Bank of Canada’s Policy Rate fell from a high of 5.00% last summer to 3.25%, and the market is again pricing in an additional 0.50% of rate cuts in 2025. They were not alone, as you can see from the chart below – central banks around the world have been cutting borrowing rates through 2024. Despite the most aggressive increase in borrowing rates in 40 years, defaults remained subdued and economic results were relatively resilient, which was reflected in stable levels of compensation for loans to corporations and commercial mortgages. As a result, core bonds and commercial mortgage backed securities generated 4-6% returns in 2024, investment grade bonds generated 7% returns, non-investment grade (or “High Yield”) bonds returned 9-10%.

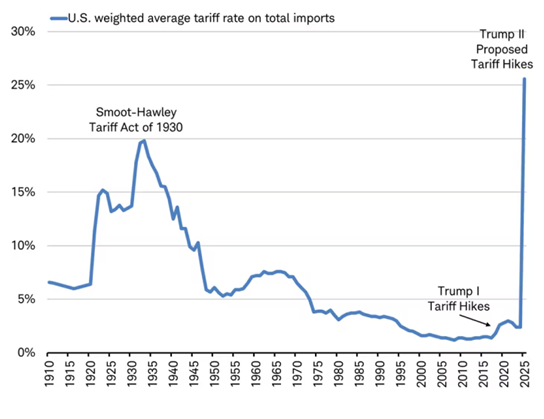

Down south, Trump’s agenda remains highly uncertain at this point, but it is clear that the President-Elect is going to favor America-first policies which will center around growth, less taxation and deregulation. This combination has already ignited confidence in the market, as all major US indices rallied upon his victory. In November, Trump warned of a 25% tariff on all imports from Canada and Mexico as soon as he takes office. Under Trump 2.0, we expect tariffs to be more widely used as weapon of coercive diplomacy. While it remains unclear whether this is a negotiation tactic or a concrete plan, the prospect and implication of higher tariffs warrants careful consideration and will undoubtedly result in short term inflation. Approximately 75% of Canadian exports are destined for U.S. markets, supporting significant employment across multiple industries, including automotive manufacturing, energy, and agriculture. Although it's too early to forecast with a high level of conviction the likely tariff shock Canada will be facing, a 25% general tariff would certainly weaken the Canadian growth recovery we expect. Less growth would have knock-on negative implications for employment, business investment, Bank of Canada interest rate policy (more cuts) and the Canadian dollar, which has already weakened in response to the news and is trading at its weakest levels since the Covid pandemic. Given the political and economic interdependence between Canada and the US, we expect negotiations to lead to much lower tariffs. Both the Canadian government and industry leaders are already working to address the situation and advocate for fair trade practices.

What’s on the Horizon

Let’s start on home soil. Although we are not in a recession by definition of the word, the Canadian economy has grown by a shockingly low 1% per year over the past two years (BMO capital markets). And just this morning, finance minister Chrystia Freeland has resigned from Trudeau’s Cabinet, hours before she was expected to give Canada’s economic outlook. Message received. The glaring difference between Canada and the U.S. is our sensitivity to interest rates. Canada is one of the most interest rate-sensitive economies in the world due to our relatively high levels of household debt. The Bank of Canada has been one of the most aggressive rate cutters in the world, and as a result a significant weight will be lifted off Canadian consumers. Whether this results in the Canadian economy avoiding a recession in 2025 remains to be seen.

As we transition into the new year, we will continue to be hyper-focused on policy changes surrounding trade, immigration, and corporate regulations. We expect to see moderate, but continued, global growth with the notable exception being a slowdown in the Chinese economy, reflecting what we expect to be a revival of the US-China trade war. Stocks, both domestic and international, continue to offer superior return potential to fixed income, but we recognize that elevated valuations in U.S. large-cap equities could limit upside in the short-term. Nevertheless, as valuations and earnings expectations are elevated, stocks could be vulnerable if profits were to underwhelm. As a result, a core weight in bonds, which still yield 3-4%, and corporate credit and mortgage backed securities, which yield 5-6%, should remain core components of a well-diversified portfolio, providing income, portfolio stabilization attributes and a source of cash if exogenous events spook the markets in the months ahead. As always, we continue to stress the importance of a robust, flexible long-term plan. A planning based approach to finances, coupled with our steady hand on the wheel, will provide you with the confidence to make sound decisions regardless of what the markets (and beyond) present for all of us in the years ahead.

Happy holidays from the entire Greenwood White Group!