What is tactical asset allocation?

Tactical Asset Allocation offers investors the opportunity to outperform in any market environment. Under the model, the portfolio manager increases a portfolio’s exposure to asset classes that are believed to be more attractive than others while under-weighting assets that appear to have poor risk-reward characteristics. Risk mitigation is one of the main goals in this type of strategy and when successfully implemented, this strategy can result in stock market-like returns, with a fraction of the risk and volatility, giving the investor peace-of-mind.

How does it work?

In an effort to synthesize your wants and needs, the Schiller Investment Group will take time to understand and visualize your ideal. By gaining an understanding of your unique situation and making recommendations based on the wealth plan developed together, you can hand off the day-to-day decisions to a trusted team of professionals. An Investment Policy statement is critical to success, setting targets, and is central to the plan.

Why does it work?

Quite simply: Human psychology. Investor behaviour. There are bubbles. Prices exceed intrinsic value. Bubbles burst. Prices fall below intrinsic value. Momentum is real. Let the Schiller Investment Group help with the details

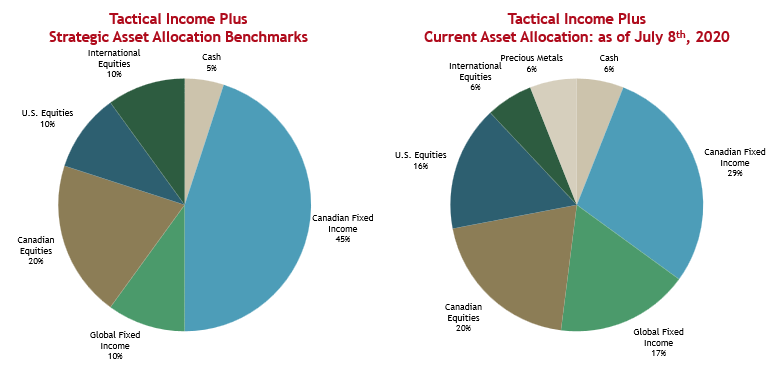

Tactical Income Plus

Theme-Driven Security Selection

Theme Rationale

Many investment professionals would agree that the four most dangerous words that can be used in this business are:

“This time it’s different”

And while we are sensitive to Bob Farrell’s Rule# 3 – ‘There are no new eras – excesses are never permanent’, we believe the Covid-19 global pandemic has shifted society to “high-gear” in the technological revolution.

Companies' plans for 2030 are happening now. Working remotely is likely here to stay to a certain extent. Digital content delivered efficiently across the globe is more important than ever.

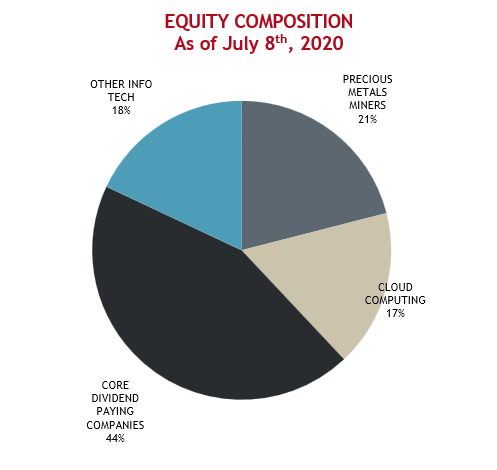

At the same time we believe we need to own hard assets that cannot be printed out of thin air, such as precious metals.

These are the current themes that complement our core principles of owning good businesses that have steady earnings and a strong dividend policy.

Jay Schiller

Portfolio Manager