David Ricciardelli

January 17, 2022

Money Financial literacy EconomyIn the Short Term, Markets are Rarely your Friend

When Mike Tyson was asked by a reporter whether he was worried about Evander Holyfield and his fight plan, he answered, “Everyone has a plan until they get punched in the mouth.” Investing can be similar. While we plan to be long-term focused, short-term volatility can punch us in the mouth and knock us off our plan.

We’ll walk through some challenges and opportunities that we see in this market, but before we do, I’d invite you to read What if you only invested at market peaks; (spoiler alert) the bottom line is even if you were the worst possible market timer, time can skate you back onside and make your returns reasonable. Again, sticking to the plan is the hard part.

Challenges this market needs to navigate

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Peter Lynch

- A potential monetary policy mistake. We often cite a possible central bank policy error as a risk for markets. Still, the potential feels elevated as the US Federal Reserve responds to inflation by shrinking its balance sheet and raising rates. We’ve only seen the Fed do both in 2018, and the result was not pretty with the S&P500 falling more than 16% from September to December. The stakes feel higher in 2022, since the Fed will be shrinking it balance sheet and raising rates, while governments continue to withdraw COVID support payments for individuals and their employers. Higher interest rates are unlikely to help unfurl supply chains, and monetary policy might be the wrong tool to address today’s inflationary challenges.

- COVID-19 and our response. Thankfully the omicron variant appears to have caused less severe illness than earlier variants, and Western vaccines appear effective at reducing the risk of hospitalization and death. Risks for markets include:

- another variant,

- incremental supply chain disruptions, especially from short-sighted policies or from countries with less effective vaccines and low levels of natural immunity, and

- policies that do not evolve as quickly as our understanding of the virus.

Three opportunities in this market

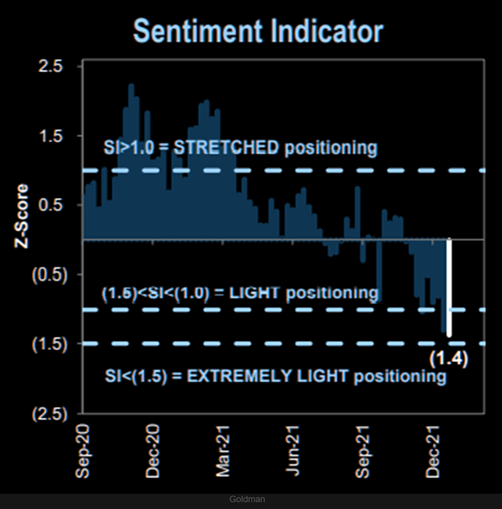

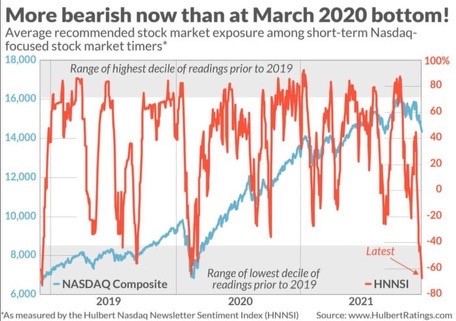

- Sentiment may not improve in the near term, but it can’t get much worse.

… some measures are already more bearish than the March 2020 COVID induced trough.

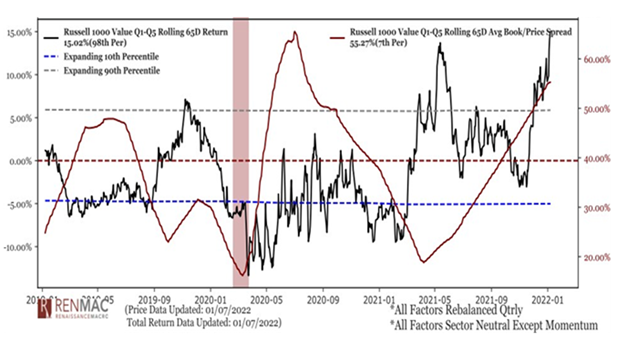

- More attractive valuations for growing companies that are changing the world. The underperformance of growth stocks from mid-November to mid-January, now exceeded every period of relative growth stock underperformance in the past 20 years. Valuation multiples are now at or below pre-pandemic levels, while the stocks now discount much higher interest rates than the market (10-year yield was 2.5-3.0% in 2017-2018 versus today's 1.8%) and sales and earnings growth rates that are higher than many of these companies had pre-pandemic.

Value has Outperformed Growth since November 2020

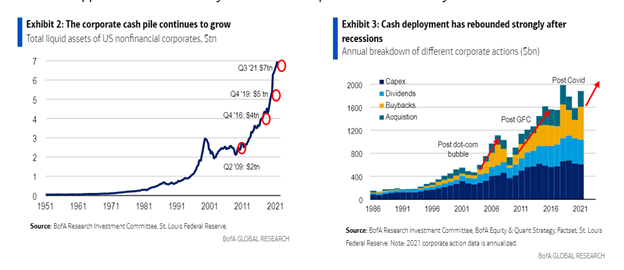

- Cash that can be deployed. There is more than $7 trillion (trillion is not a typo) on the balance sheets of US corporations. As companies become more confident in their prospects, this cash will be reinvested in their business (capex or capital expenditures), used to fund acquisitions, or returned to investors via dividends and buybacks. Markets may react poorly to higher capital expenditures in the near term; companies should benefit from these investments over time.

What’s an investor to do?

At the risk of sounding like a broken record, I continue to recommend investors to remain long-term focused and to pursue a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets, while cash and alternative investments are used to reduce volatility and provide ballast for portfolios.

Over the longer term, investors can reduce the need for market timing and ‘hero market calls’ by saving and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Let me know if you’d like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2022.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.