David Ricciardelli

January 07, 2021

Money Financial literacy EconomyWhat if you only invested at market peaks

A common theme in my blog posts is that investors need to focus on their time horizon and not just on returns. So it won’t surprise you that a post by Ben Carlson’s blog A Wealth of Common Sense title “What if you only invested in market peaks?” caught my attention.

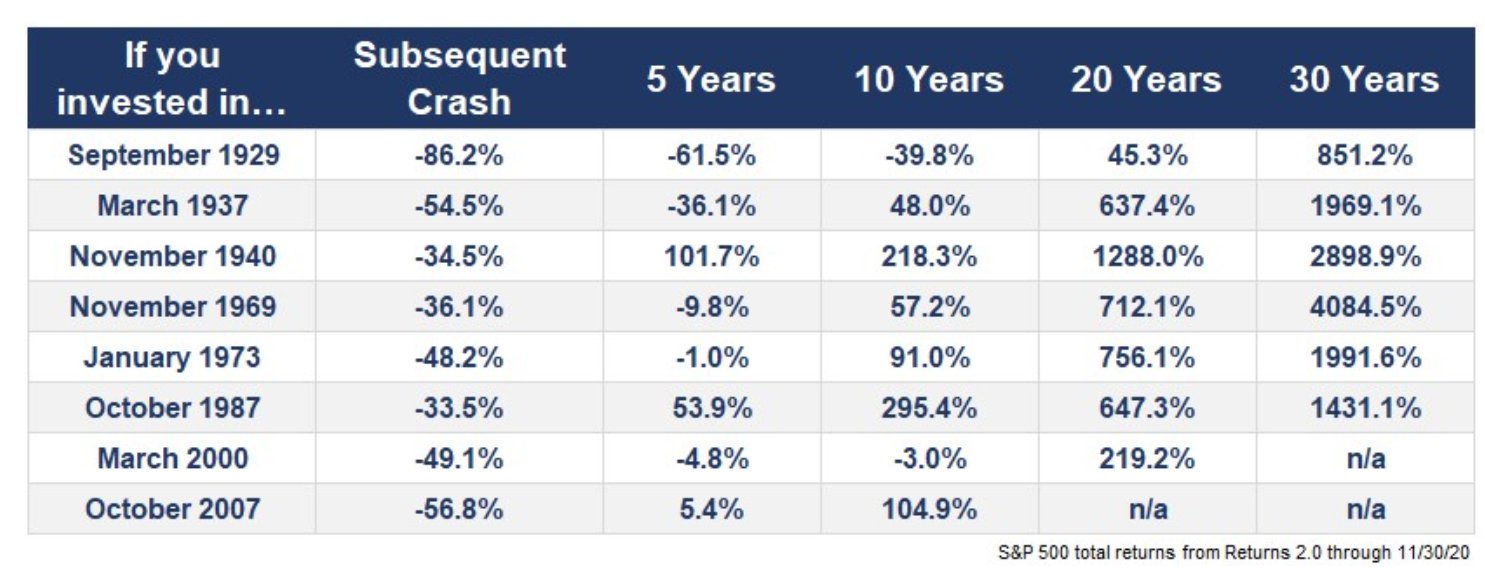

Ben first wrote the post in 2014, and he updated it in late 2020. The post has a cute 5-minute video that tells the story of a hypothetical investor Bob who consistently saved, never sold his investments, but had the bad fortune of only making investments at market peaks, right before significant market crashes. The table below shows how long holding periods can save investors from poor market timing.

Market Returns After a Crash

So how should an investor approach an aging bull market?

Tactically, I have recommended a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. At the same time, fixed income, cash, and alternative investments reduce volatility and provide ballast for portfolios.

Over the longer term, a more practical approach for investors that reduces the need for market timing and ‘hero market calls’ would be to save and invest using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimer: This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2020.