David Ricciardelli

March 28, 2022

Financial literacy EconomyInflation: Cyclical or Secular?

The article below examines some of the economic implications of the war in Eastern Europe. Before jumping into the economics, I wanted to stress that from a humanitarian perspective this war is terrible, it doesn’t appear necessary, and our heart goes out to those that have been directly or indirectly impacted. Although it looks unlikely, we hope for a sensible resolution in the near term.

Inflation over the Long Term

I continue to believe that over the long-term inflation will be modest because of human ingenuity, our ability to drive productivity improvements, and our drive to invent new products and services. That doesn’t mean that products and services will cost less year-over-year, but it does mean the value provided by these things will continue to improve more than the associated price increases.

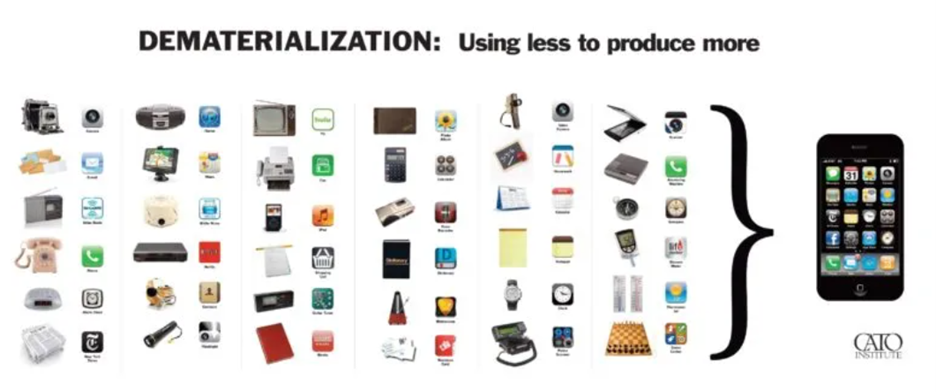

The iPhone is a helpful example, the price of an iPhone tends to increase when a new a new model is introduced each fall. This looks inflationary. However, when you look at all the apps on that iPhone, you can do the math on the number of devices it has replaced, and the new services it has enabled. It gets a lot harder to argue that the value provided by a new iPhone hasn’t increased as well. This innovation happens throughout our economy and is the enduring secular trend we’ve enjoyed as consumers.

Inflation in the Short Term

The challenge is that occasionally this secular inflation trend can be disturbed by cyclical shocks. These cyclical shocks usually create price increases for goods and commodities; we can’t argue that a $120 barrel of oil creates more value than a $60 barrel of oil. For example, when the pandemic caused havoc with global supply chains the price of goods increased. These price increases should be temporary, and the price increases should be competed away as supply chains return to their normal operation. Unfortunately, sometimes we get multiple cyclical shocks that occur at the same time and exacerbate both the price increases and the duration of those price increases.

It feels like the world is now dealing with several cyclical shocks that have been layered upon one another.

War in Eastern Europe

Since early in 2021, our view was that inflation was largely transitory except for higher wages, larger working capital (mainly inventories and raw materials), and greater operational redundancy, as companies moved production closer to their customers. We had expected inflation to peak in the first half of this year before gliding down to the 3-4% range over the next twelve months. Higher than the 1-2% inflation we enjoyed before the pandemic but still at a level that companies can adapt to, and markets could digest relatively easily.

Our view changed with the start of the war in Eastern Europe. Russia and Ukraine are significant producers of energy (oil, natural gas, and coal), and agricultural goods (wheat, corn and sunflower oil). Coupled with the economic sanction levied against Russia, our previous expectations that that inflation peaks in the first half of this year and normalizes in the next twelve months is no longer valid. Higher inflation is going to persist longer than our previous expectation. It is going to take a us longer to unfurl supply chains, create substitutes for items that were previously imported from Russia and Ukraine, and there will be even more capital invested to bring more production closer to consumers and reduce Europes relaiance on Russian hydrocarbons.

What does the war mean for markets?

Markets started the year wrestling with the implications of higher inflation, higher interest rates, and higher discount rates. These recalibrations caused valuations to compress and volatility. These recalibrations were exacerbated as the war in Eastern Europe caused the market to digest the potential for higher-for-longer inflation, lower margins, and higher capital spending while companies and countries evolve their supply chains to reflect our new reality.

What does it mean for investors?

It’s going to take some time for companies to work through another round of supply chain disruptions, digest commodity price increases, and adjust their production footprints. The net result is that we’re likely going so see lower returns caused by lower margins and slower earnings while we digest these cyclical inflation shocks. The key for investors in this environment is to remain long-term focused and maintain a well diversified portfolio.

World events and the market reaction can be unsettling but if investors can remain focused on their long-term objectives, they can reduce the need for market timing and ‘hero calls’ by saving and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Let me know if you'd like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2022.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.