David Ricciardelli

July 15, 2025

Money Financial literacy EconomyThe President Who Cried Tariff = The Boy Who Cried Wolf?

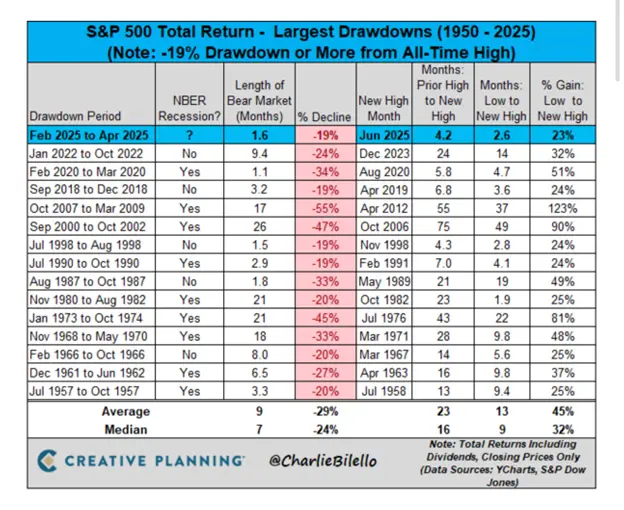

The on-again off-again tariffs and trade commentary from the US Administration has led markets to grow complacent and encouraged a pullback in market earlier this year that has been followed by the fastest market rallies from a 19% pullback to a new all time high in S&P 500 history. As of July 11th, the S&P500 has made five new all-time highs in the last nine trading sessions.

Markets are often ripe with conflicting signals that leave investors to wonder if we will continue to surge higher or if we could share the fate of the villager in the children’s story ‘The Boy Who Cried Wolf.’ The charts below try to put markets and current events in context.

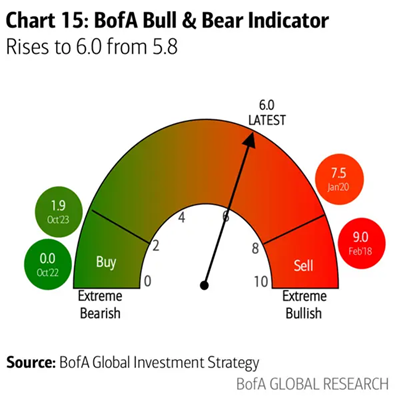

Despite the market rally, investor sentiment remains divided.

Red Meat for the Bears

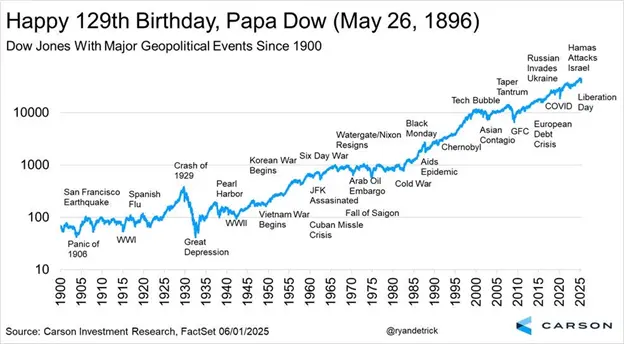

There is always something to be concerned about in markets, but they tend to ‘climb a wall of worry’ over time. While we continue to fret about US political uncertainty, geopolitical turmoil, inflation and energy price volatility, and the impact of AI, it is the risks we do not see that cause problems for equity markets.

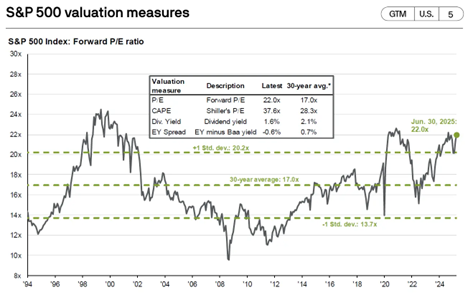

Valuation is once again looking stretched and bears will argue that the impact of tariffs is yet to be felt, the threat of tariffs has pulled forward demand, and this pull forward in demand has created more challenging year-over-year comparisons as we enter 2026.

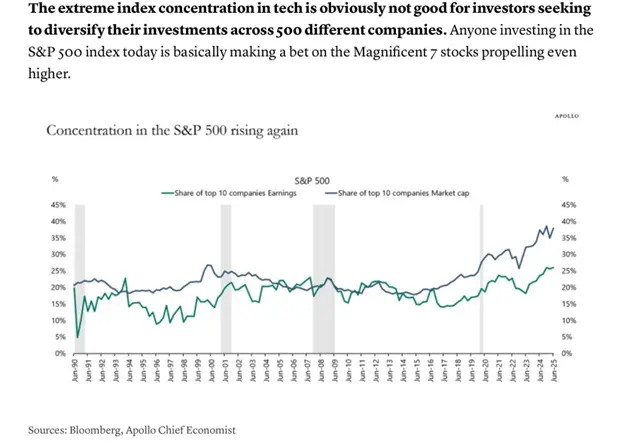

Market has become even more concentrated as multiple expansion among AI beneficiaries driving the rally off the April lows.

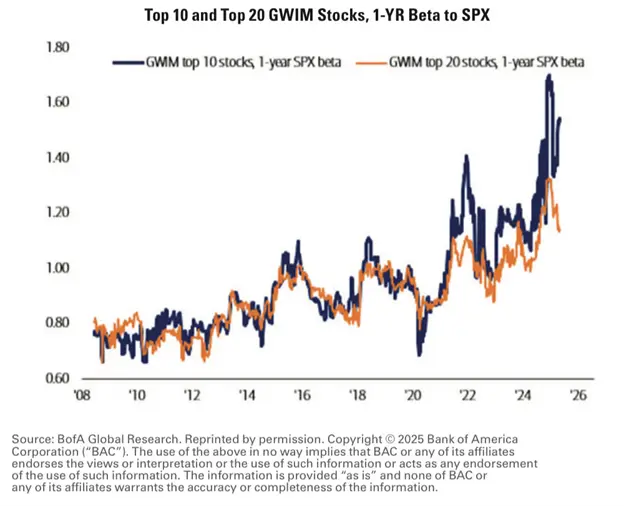

The beta in retail portfolio in the Bank of America Merrill Lynch network continues to increase.

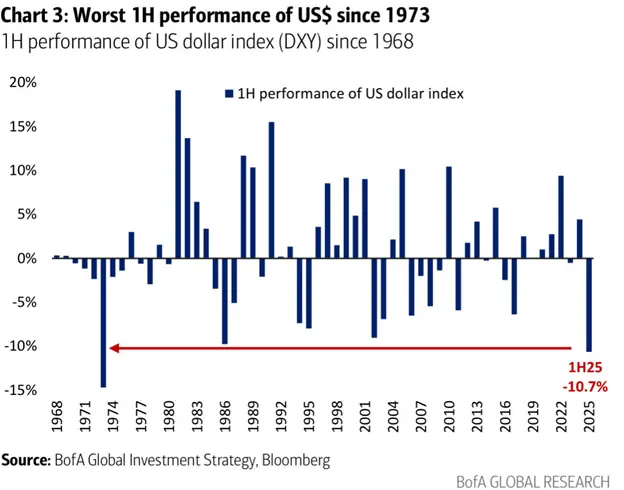

The USD has had the roughest first-half since 1973. While a weaker USD is positive for S&P 500 earnings it also signals that markets are becoming increasingly concerned about US fiscal and monetary policy.

This concern has resulted in the largest underweight in USD from institutional investors in twenty years.

Red Meat for the Bulls

The equal weighted S&P 500 valuations looks reasonable and inline with its historical average.

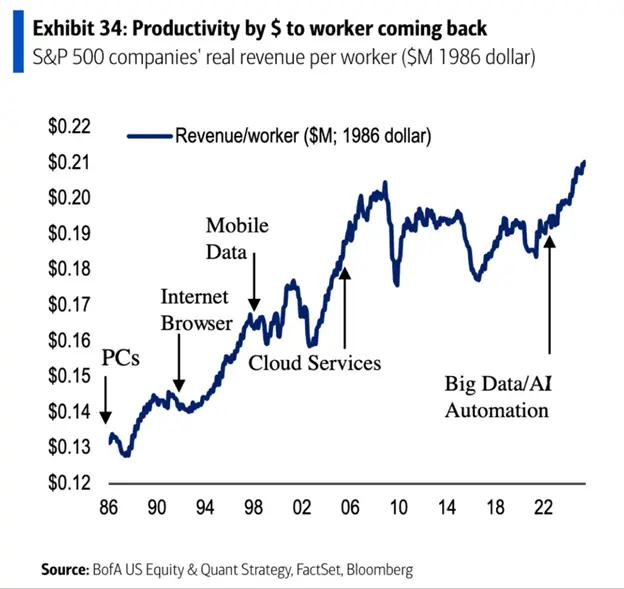

US labour productivity is making new highs for the first time in more than a decade.

Margins are expected to increase, creating an environment where modest revenue growth will translate into robust earning growth for the S&P 500.

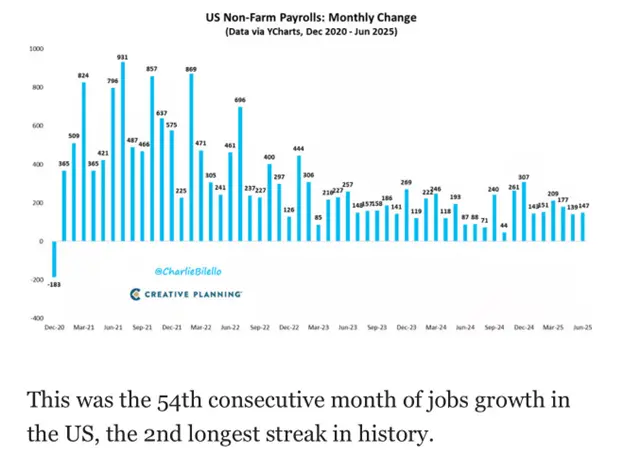

US job growth is slowing but remains robust, and the unemployment rate in the US at 4.1% remains near a 50-year low.

From a historical perspective this bull market may just be getting started.

There has never been more cash on the sidelines that could be invested in markets.

Thoughts I have Been Reflecting On

“We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.”

Bill Gates, 1996

“Basic corporate profits have grown about 8% per year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years… The next 500 points, the next 600 points – I don’t know which way they’ll go. “

Peter Lynch, 1994

What's an Investor to Do?

While action helps alleviate anxiety, timing markets is extremely difficult. We continue to recommend that investors save and invest consistently across market cycles. This process will allow an investor to buy more securities when the market is inexpensive and fewer securities when the market is expensive. Consistently investing across market cycles also provides investors with fresh capital to exploit emerging structural changes.

To smooth out the market cycle and reduce volatility, we recommend a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. The other side of the barbell is cash, actively managed fixed income and alternative investments that reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus expands to optimize the tax efficiency of distributions.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2025.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.