David Ricciardelli

March 28, 2022

Money EconomyCharts to put 2022 in Context

2022 has been an unsettling year. Between the lingering pandemic, the first war in Europe in decades, surging inflation, Fed rate hikes, a shrinking Fed balance sheet, and incredible bond market volatility there is a lot to digest. As a result, we’ve collected some charts to try to help put today’s markets in context.

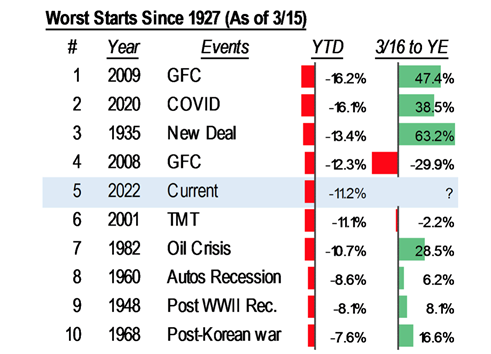

Through March 15th, the S&P500 was off to its fifth worst start since 1927.

I find that investor sentiment is more influence by the length of time that markets are making new lows rather than the size of the drawdown. From this perspective, the market action in 2022 had been ‘harder’ on investor psychology than the onset of the pandemic in early 2020.

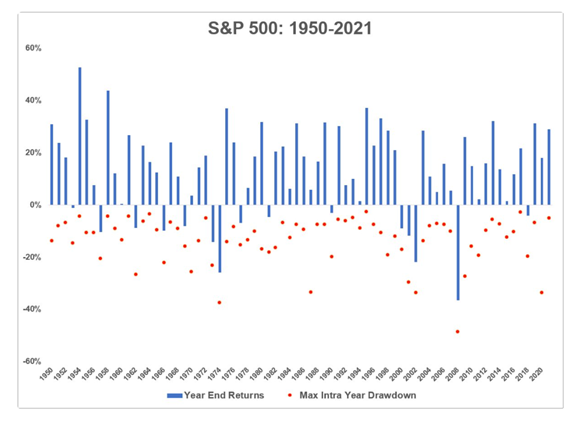

The drawdown that we’ve seen in the S&P500 in 2022 is about average.

Going back to 1950, the average peak-to-trough drawdown each year is -13.6%. On average, the S&P500 has experienced:

- A correction (-10%+) once every 2 years;

- A bear market (-20%+) once every 7 years; and

- A crash (-30%+) once every 12 years.

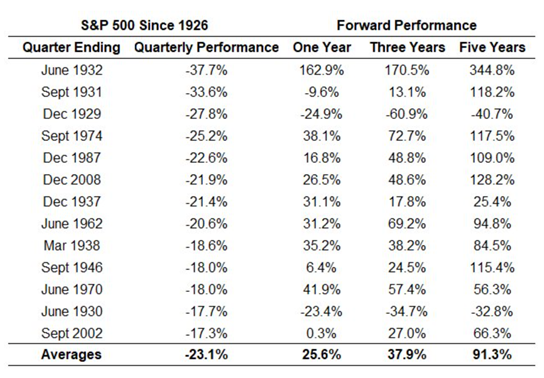

What happens after stocks have a bad quarter?

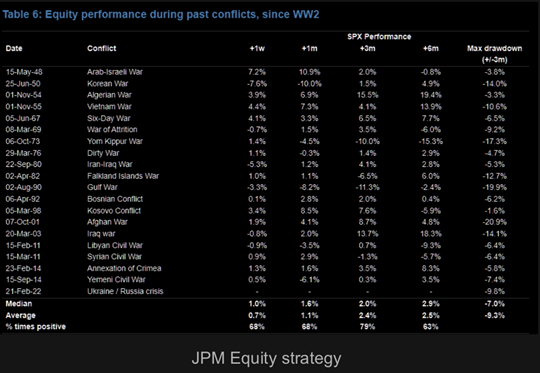

What happens to markets after military conflicts?

What happens when the Fed starts hiking rates?

S&P500 Performance Before and After the First Fed Rate Hike

Why is market timing so hard?

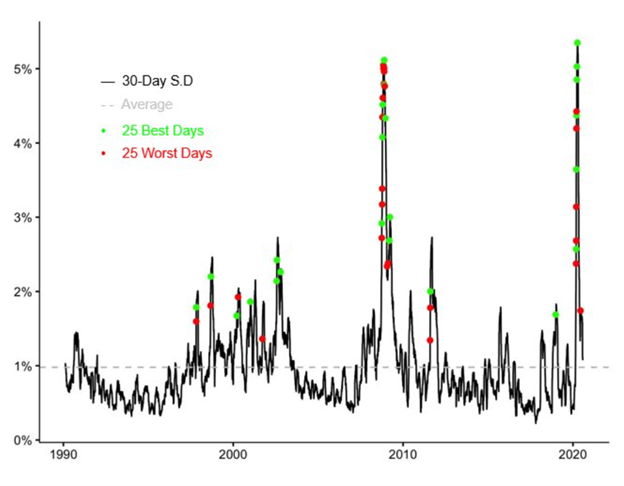

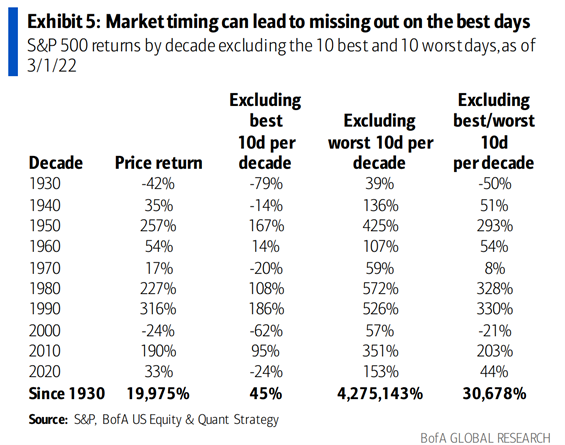

S&P500 Best and Worst Days

Look how clustered the best and worst days in the market are. To put this in context, since 1930 if an investor sat out the 10 best days for the S&P500 each decade their return would be just 45% vs ~20,000% is they remained fully invested.

In the probably useless but interesting category, I’d highlight that S&P500 had six 1% advances in eight trading sessions for only the third time in history during March. This occurred in 2020 and 1974, and markets rallied 35% and 31% over the next year. In both cases interest rates were rising over the next 12 months.

What’s an investor to do?

Every market is different and unsettling events can lead to volatile markets that make it difficult to stay invested. The challenge for investors is remain focused on their long-term objectives. Geopolitical shocks don’t happen on a set schedule but just as day follows night, historically markets have recovered over time.

Let me know if you’d like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2022.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.