David Ricciardelli

February 20, 2023

Money Financial literacy Economy CommentaryFrom an Unloved Rally to a Range Bound Market

In Here Comes 2023! our view was that expectations for markets and the economy were so terrible, that if the economy was just bad, markets would perform well in 2023. This view played out uncomfortably fast over the first six weeks of the year as we experienced one of the most un-loved rallies I’ve ever seen.

To put this rally in context, in January a 60/40 stock bond portfolio composed of the S&P500 and US 10-Year Treasuries was up +6.2%, a 96th percentile return month since 1921 for this portfolio. The S&P500 was up 6.2% and the NASDAQ was up 10.7% in January. Now take a moment and try to remember how many positive headlines you saw about the rally. Apart from some headlines about a potential technical breakout in S&P500 or NASDAQ, this rally got very little love from the media.

From Rallies to a Range Bound Market

Following the rally to start the year it feels like we are about to settle into a range bound market. The backdrop for the January rally was inflation is trending down, labour tightness is moderating, and the US Federal Reserve will stop hiking rates at 5.0-5.25%. Markets can perform well when rates are increasing, or inflation is elevated, as long as market participants have planned accordingly.

Over the last two weeks, the narrative has shifted and market participants are again grappling with tighter labour markets, inflation that is slowing at a slower pace, geopolitical uncertainty, and concerns that central banks will make a policy mistake (overtighten) and cause a deeper recession. It will take a while for this tug o’war to play out during which weaker economic data, lower inflation, and less hawkish central bankers will likely be seen as positive for risk assets, like stocks.

Is there a Bull Case for this Market

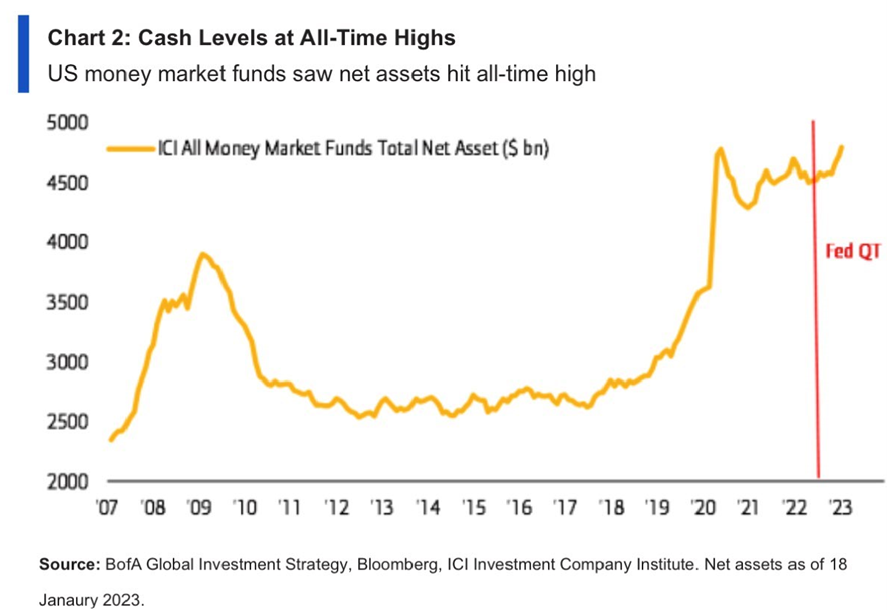

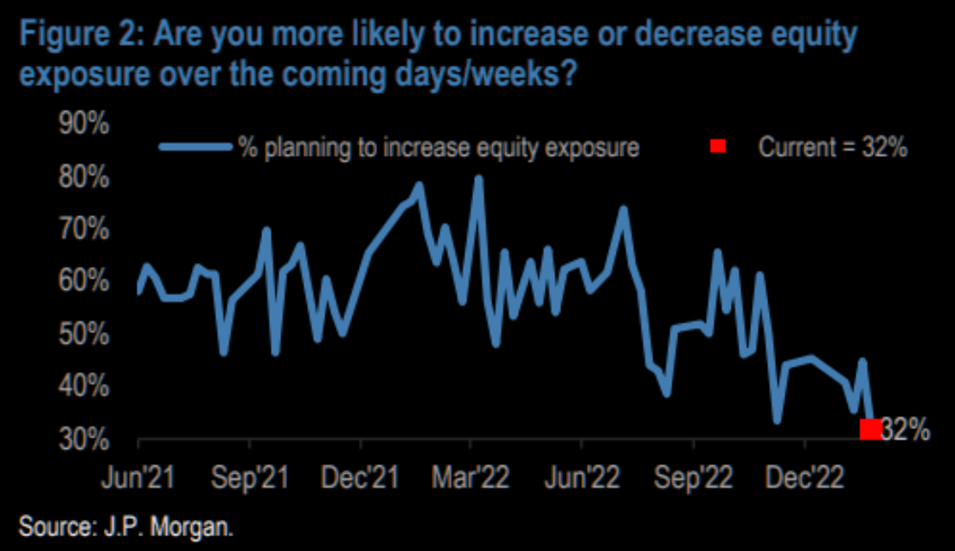

Perversely, I’m often encouraged by the onslaught of negative headlines and investors clamouring for money market funds and GICs (Guaranteed Investment Certificates) because it often means the markets can outperform by beating muted expectations. The charts below provide a reprieve from the negative headlines that find their way to you everyday.

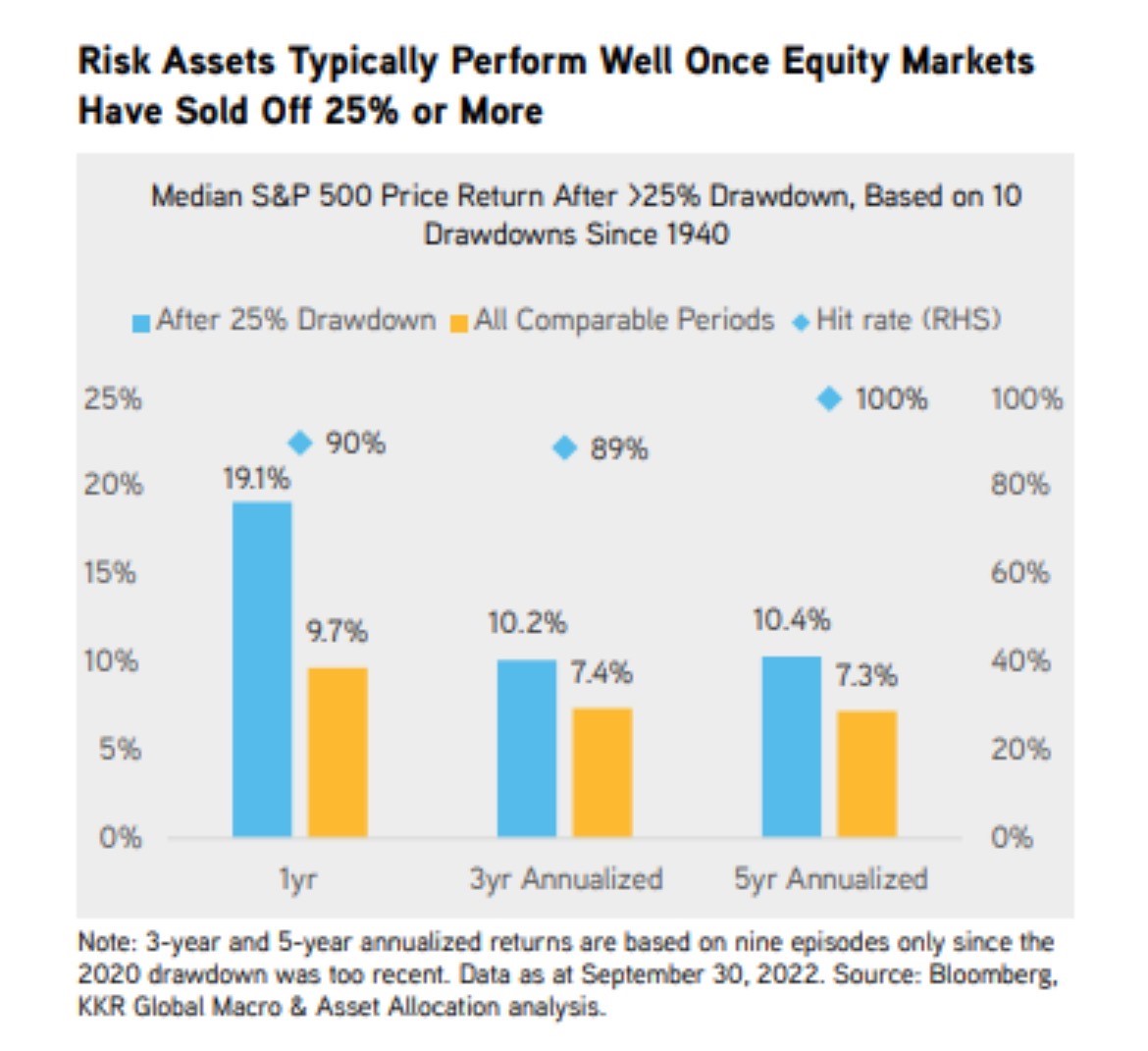

The S&P500 generally performs better than average for the next one, three and five years after a 25% drawdown, like we had in 2022.

Market seasonality improves significantly in March.

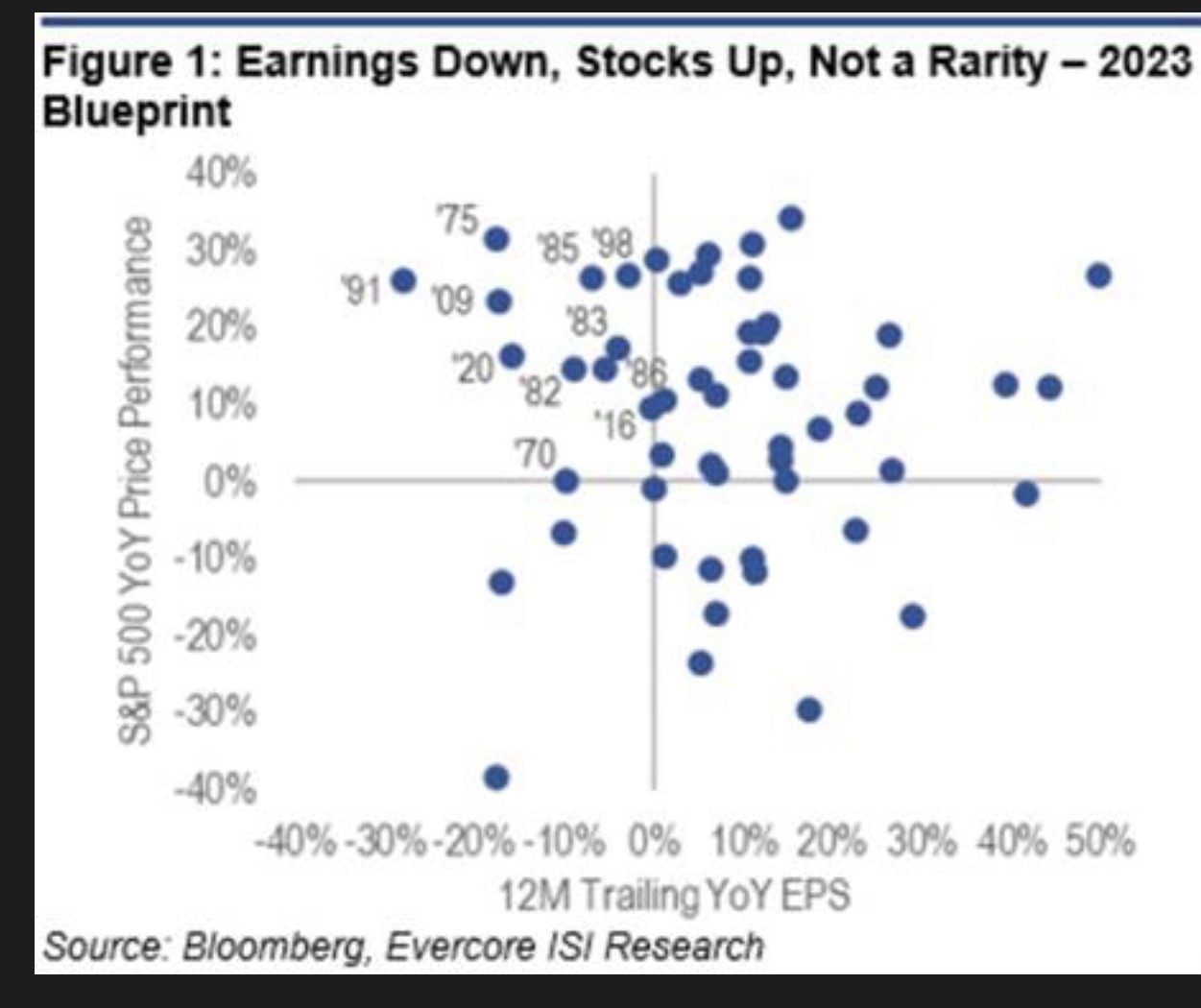

It’s common for stocks to rally while earnings are being revised lower. Markets are forward looking.

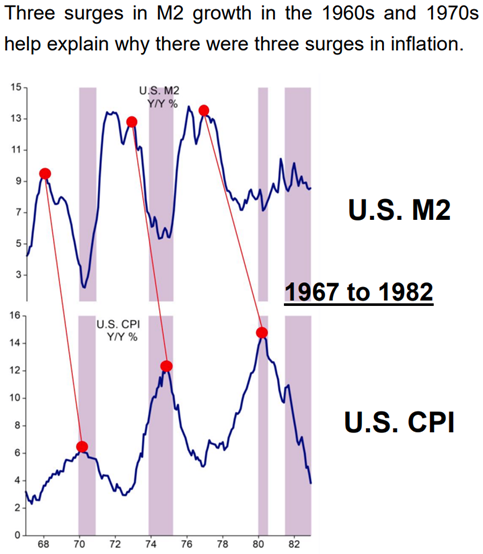

We usually see the M2 money supply surge into the high-single or low-double digits before inflation surges.

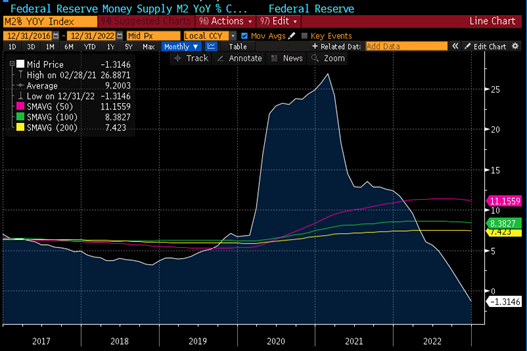

But M2 is not surging. M2 growth was last near zero in the 90s and currently negative for the first time since the data set began in the 60s.

Cash levels are at an all-time high.

And no one wants to add equities to their portfolio.

What’s an Investor to do?

Market timing ‘hero calls’ are very difficult. We recommend investors save and invest at a regular cadence, like putting a portion of your earnings aside every week, or every month, or every year. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

We continue to recommend a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. The other side of the barbell is: cash, actively managed fixed income, and alternative investments that are used to reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus is expanded to optimize the tax efficiency of distributions.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2023.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.