David Ricciardelli

May 19, 2020

Money Financial literacy Economy In the newsFor investors, it often pays more to be late than early

Last month, I wrote that it was difficult to tell if today’s market is at the beginning of a multiyear bullish run, a position in the market cycle called “UNCERTAINTY,” or if we were on the precipice of a pullback, a place in the market cycle call “OVERCONFIDENCE.”

It has been almost a month since I wrote that post and some market heavyweights have weighted-in in the OVERCONFIDENCE camp:

- Gundlach is shorting the market;

- Tepper said this is the most overvalued market in history; and

- Druckenmiller said this is the worst risk/reward in a lifetime.

S&P500 Price Chart

In the UNCERTAINTY camp, implying that we are just getting started with another bull market run is:

- Unprecedented levels of global stimulus spending;

- Fed Chairman Powell telling CBS's 60 Minutes he has lots of ammo to support the economy;

- Globally coordinated efforts to develop a vaccine and drugs to battle the pandemic;

- High cash balance a raft of investors determined not to miss the next pullback; and

- Human ingenuity and historical precedents of post-pandemic rallies.

So how should investors proceed given the high level of path uncertainty presented by the current market? I continue to recomend a barbell strategy. On one end of the barbell is an equity portfolio of high-quality large-capitalization companies and other companies with positive exposer to the changing world. The other end of the barbell are securities that tend to perform well in volatile markets, and cash to opportunistically invest as volatility creates opportunities.

My confidence in this barbell strategy improved after reviewing two charts that found their way on to my screens over the past week.

The first is a simple chart from a former colleague that highlights how well high-quality balance sheets have performed during the pandemic.

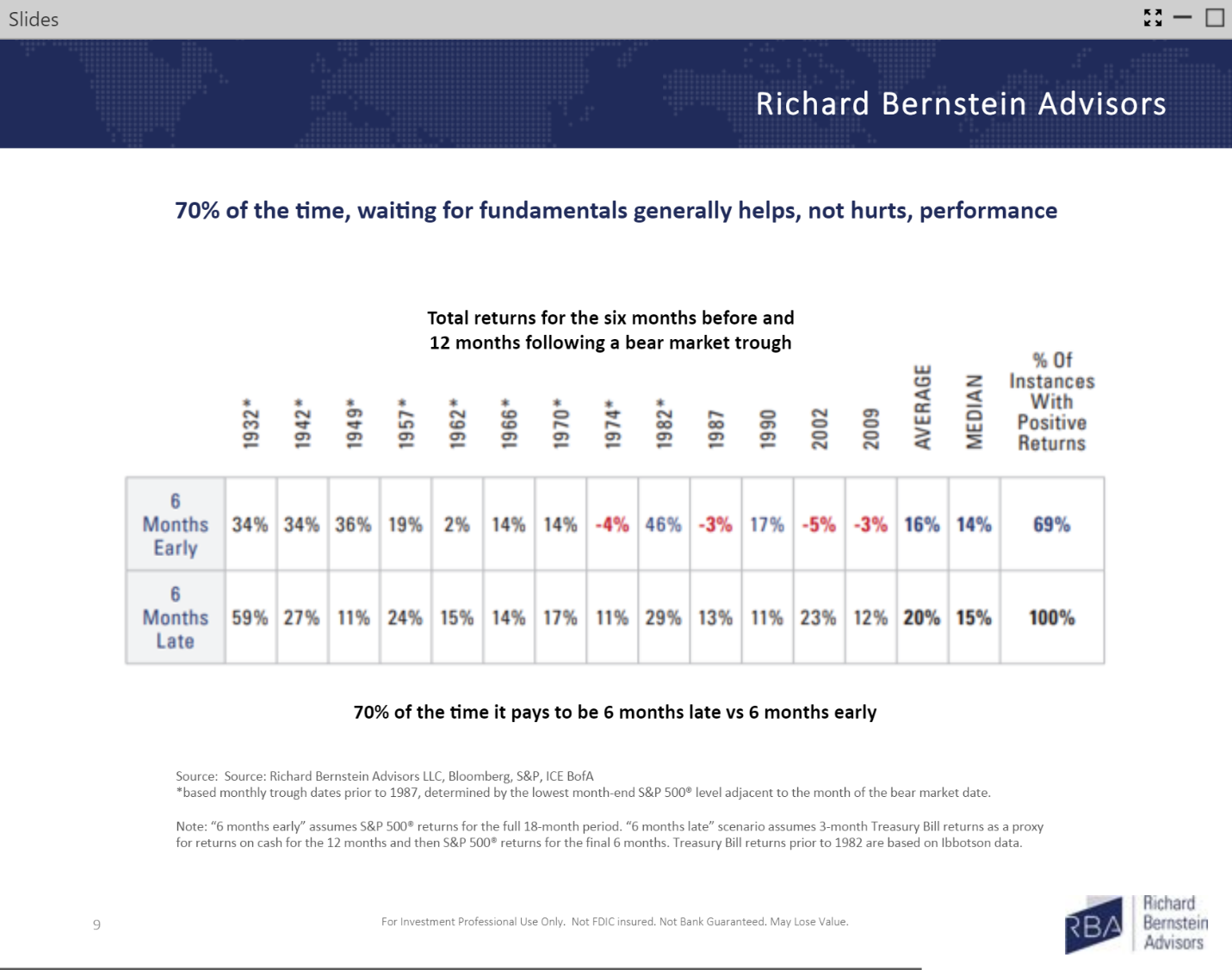

The second is a chart from Richard Bernstein’s market update. Richard and I worked together years ago, and I believe he is one of the best equity strategists I’ve ever met. The chart below highlights how much better off investors perform when they are six-months later vs. six-month early.

Let me know if you’d like to have a more involved discussion.

Delli (delli@cibc.com)

Disclaimer: This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2020.