David Ricciardelli

May 23, 2023

Money Economy Monthly commentaryTrading Ranges, The Debt Ceiling, and Recessions

The Trading Range

Back in February we wrote From an Unloved Rally to a Range Bound Market which argued that markets would remain range bound as investors grappled with changes in inflation, the labor market, and central bank hiking cycles. Since February, the S&P500 has been in a relatively tight range with a small breakout last week when it looked like US lawmakers were finally starting to make progress on the debt ceiling discussions.

S&P 500 Trading Range

The Debt Ceiling and the Trading Range

In the article What Happens if the US Defaults on its Debt?, Nick Maggiulli does an excellent job of running through the mechanics and potential implications of a US debt default. This an area where my view is uncomfortably consensus. I believe we’ll get a last-minute deal to raise or suspend the debt ceiling. However, it feels like the implications of lawmakers not coming to an agreement are underappreciated. As Warren Buffet commented during the Berkshire Hathaway shareholder meeting earlier this month:

It’s very hard to see how you recover once…people lose faith in the currency…All kinds of things can happen then. And I can’t predict them and nobody else can predict them, but I do know they aren’t good.

The Recession that Hasn’t Been

Once the debt ceiling debate is resolved, or more likely kicked down the road until after the US election in 2024, discussion will likely pivot back to the recession that we’ve been told is one-month away for the last eighteen months. We will get another recession. When we will experience a recession remains up for debate (it might have already happened in 2022 when economists were telling us that negative GDP prints weren’t the right measure), but we need to remember that markets are forward looking. It feels like this market has already priced a recession and is now looking through a recession at the recovery that will follow.

Historically after a peak in US inflation, like we saw in June of 2022, the S&P500 would be flat over the next twelve-months if the US economy falls into a recession (the orange line below) and has had significant upside if the US can avoid a recession (the gray line below).

S&P500 Performance Following a Peak in US Inflation (Goldman Sachs)

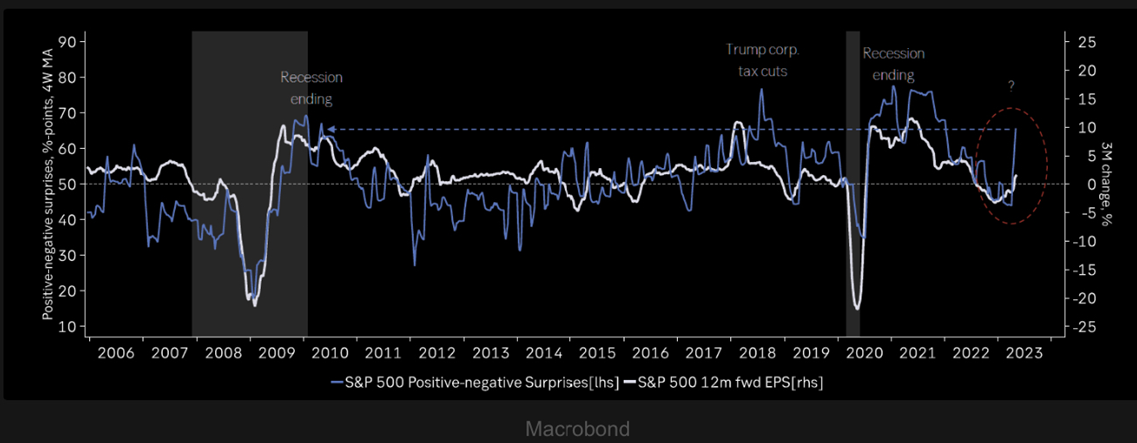

It’s worth noting that the US doesn’t typically fall into recession when S&P500 companies are delivering positive earning surprises of this magnitude; the current level of positive earning revisions looks more like an economy that is recovering from a recession.

S&P500 Positive Earnings Surprises

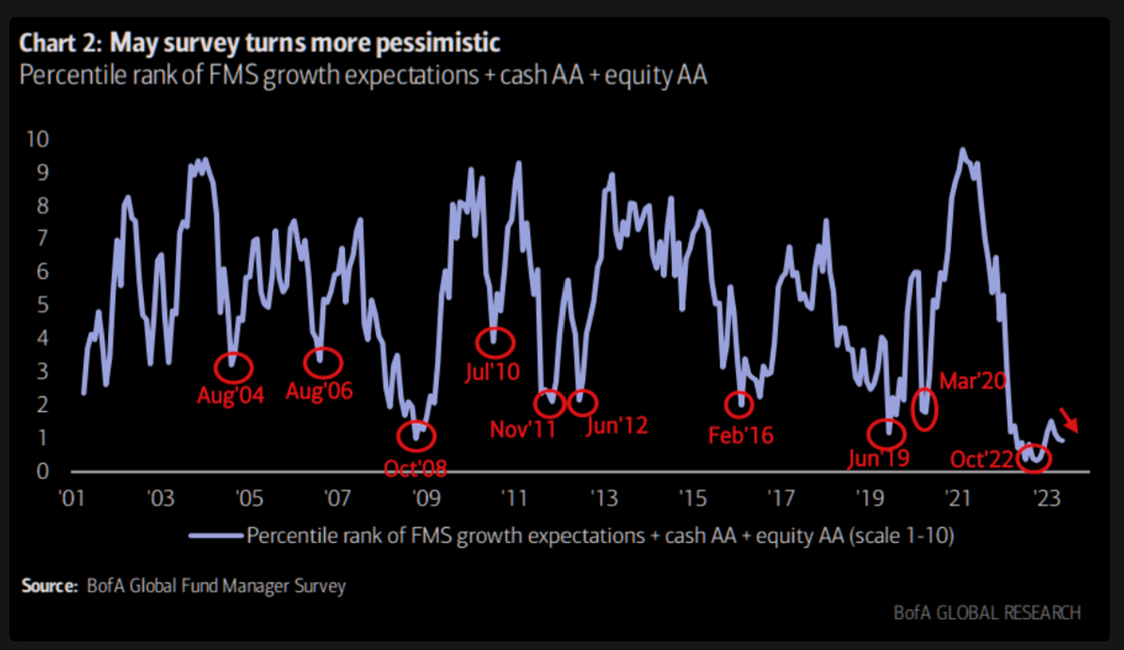

Sentiment isn’t as bad as it was at the October low, but it’s still terrible.

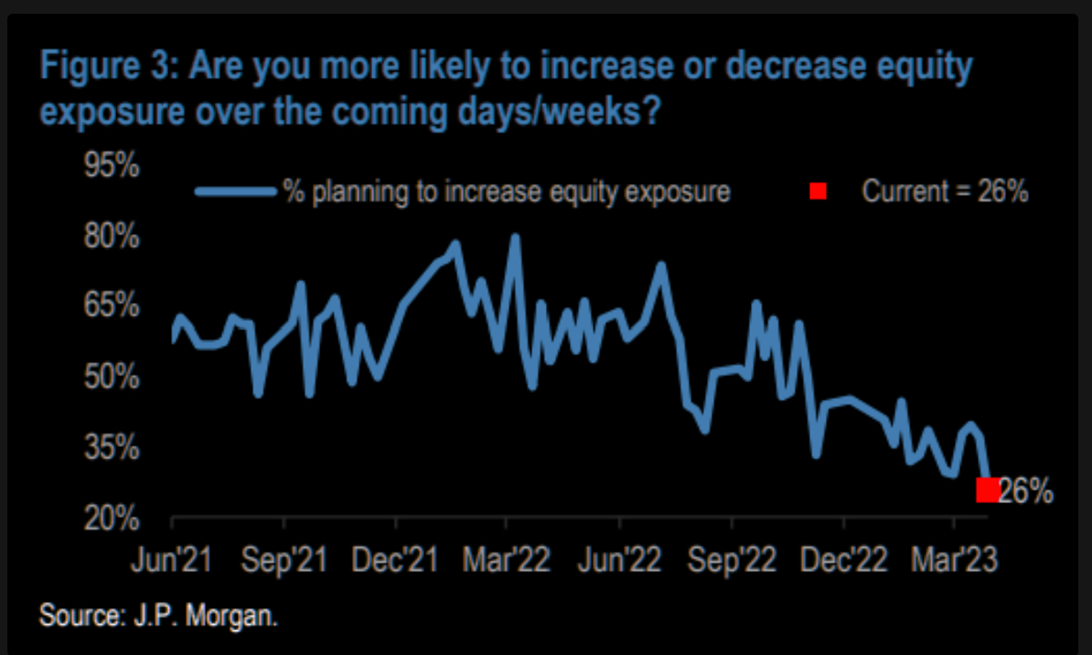

No one is looking to add equity exposure.

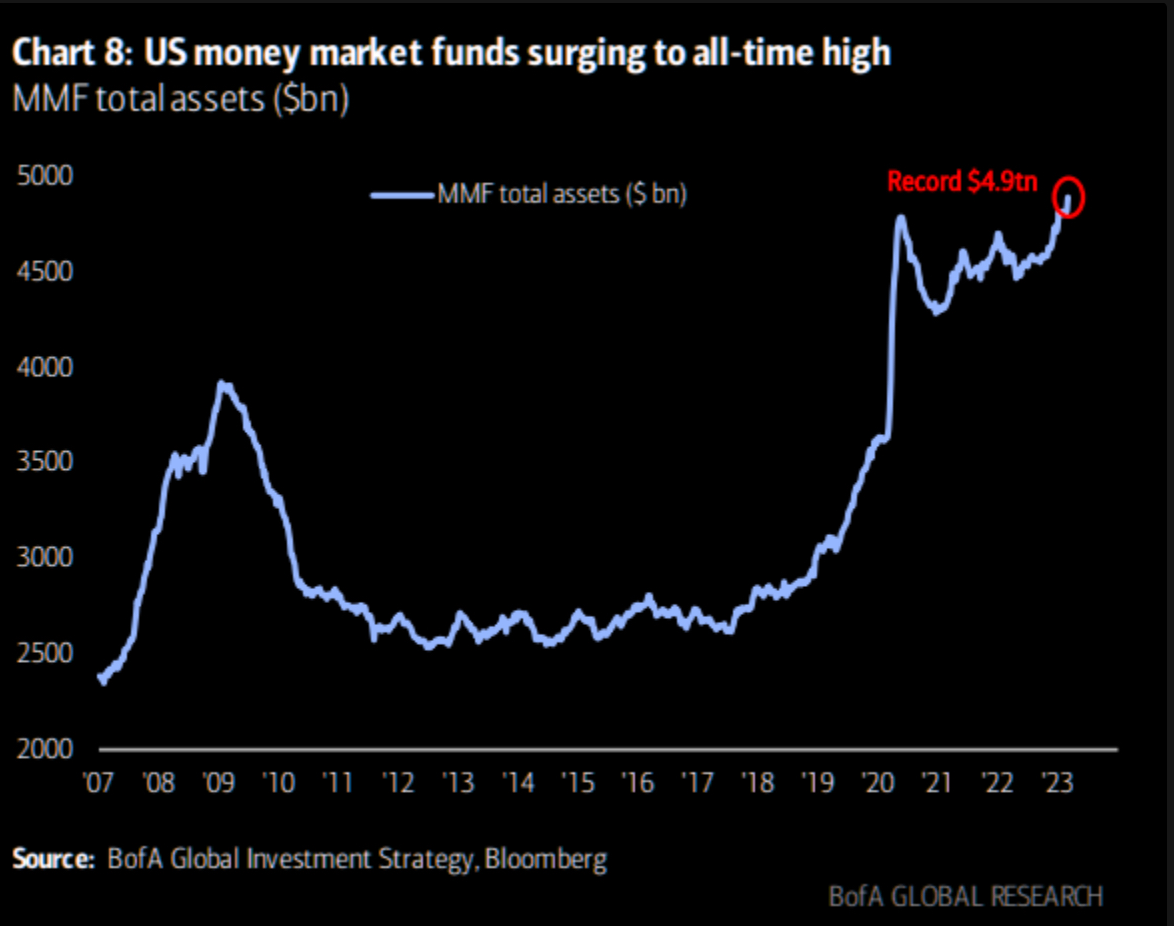

There is lots of cash on the sidelines that can be invested.

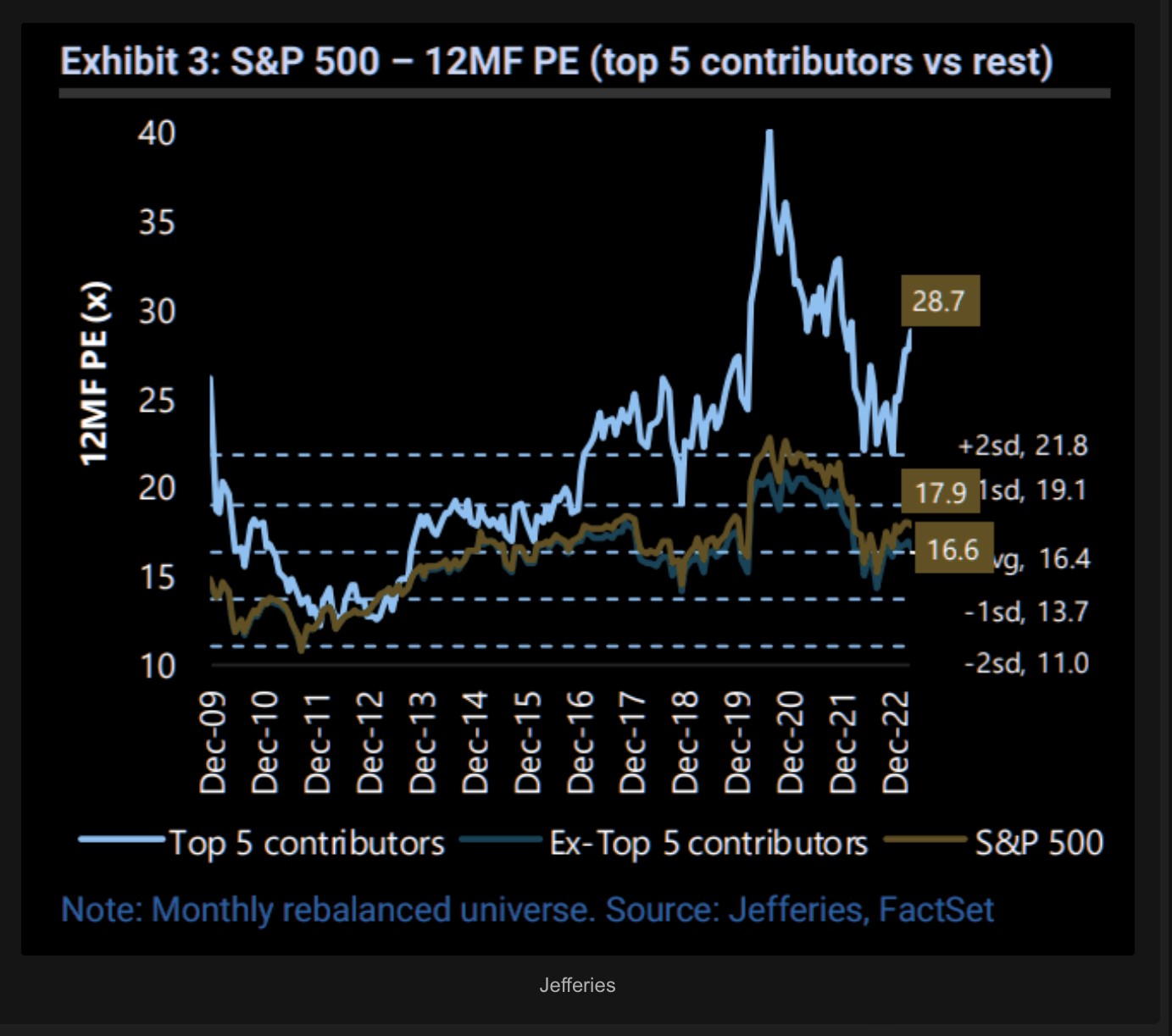

The valuation of the S&P500 looks quite reasonable if we back out the five largest companies in the index.

Finally, in the data mining category, we’d highlight the NASDAQ made a new 52-week high for the first time in eighteen months on Thursday, May 18th. The NASDAQ is 14-for14 with an average twelve-month return of 16.8% after making a new 52-week high for the first time in more than six-months.

What’s an Investor to do?

Market timing ‘hero calls’ are very difficult. We recommend investors save and invest at a regular cadence, like putting a portion of your earnings aside every week, or every month, or every year. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

We continue to recommend a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. The other side of the barbell is: cash, actively managed fixed income, and alternative investments that are used to reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus is expanded to optimize the tax efficiency of distributions.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2023.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.