David Ricciardelli

May 24, 2022

Money EconomyFlirting with a Bear

A bear market is defined as a market that has experienced a 20% decline from its peak. The S&P500 briefly crossed into bear market territory on Friday before Fed Governor Bullard’s comments sparked a rally into the close. While the S&P500 isn’t officially in a bear market, you’ll likely notice a pivot in the financial press as the dialog shifts from corrections, which are relatively common, to bear markets, which occur about once every four years for the S&P500.

Anatomy of a Bear Market

While we’re going to talk a lot about sentiment, here are the numbers on bear markets.

Since WWII, there have been about 17 equity bear markets. Among them, eight stopped around the -20% mark and nine were greater than 25% pullbacks. Among the nine bear markets that were greater than 25%, the average peak-to-trough decline is -38%. Excluding the three bear markets of > 40%, the average peak-to-trough decline is less severe, but a still uncomfortable -31%.

In most bear bear markets, stocks tend to stabilize at the -20% mark, with the two-month forward return for the S&P500 averaging 6.4% and 1.6%, respectively.

From a timing perspective, eight of 17 bear markets would be at their trough now, of the 6 of 17 where markets pulled back more than 25% but less than 40%, the trough was 71 trading days after they were down 20%, which would imply a trough in September of 2022. If you’re thinking this is a grizzly bear market, the 3 of 17 bear markets that were down more than 40%, the trough is 258 trading days after the market is down 20%, which implies we trough in late 2Q of 2023.

Bears Roar

Equity markets generally appreciate over time, but it is easy to be bearish in a bear market. The current bear arguments will focus on:

- That bear markets can get worse – the numbers we ran through in the section above;

- The Fed is behind the curve and will relentlessly hike interest rates and shrink their balance sheet as they try to fix supply side problems, that are causing inflation, by crippling demand;

- The geopolitical risks caused by the war in Eastern Europe, a potential nuclear event, China’s COVID lockdowns, COVID/Monkey Pox, a potential Chinese encroachment in Taiwan, and the unwinding of the benefit of decades of globalization;

- Energy prices will further exacerbate inflation as China re-opens following the latest COVID-related lockdowns; and

- We have not seen any panic. The adage goes “Markets stop panicking when policies makers start to panic” but this has been the calmest most orderly pullback I’ve observed in more than two decades of studying markets closely.

Of the items above, the lack of panic is the item that gives me the most indigestion.

If you could find a Bull, what would they say?

While it’s tough to find a bull in a market that is trending down. Here are some bullish arguments:

- 8 of 17 bear market would have troughed at these levels;

- The Fed’s commentary and actions will become more accommodative once the Fed Funds rate is back to their Neutral Rate of 2% - this implies 50bps rate hikes on June 15th and July 27th;

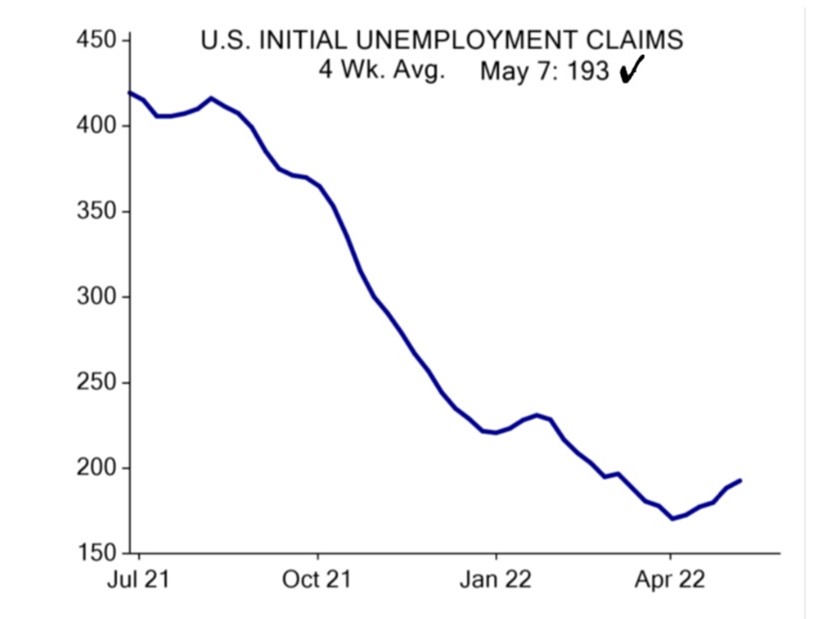

- Inflation has already peaked with the charts for many key economic indicators (like Core CPI, Core PPI, Freight Rates, …) and commodities (like corn, wheat, …) starting to role over; let me know if you’d like to see the charts. You’ll also hear more about basis effects in the future, which means that it’s tougher to show large year-over-year increases if you’re lapping a large increase from the previous year. Most importantly, the US labor market is also starting to show signs of cooling which will make it easier for the Fed to appear more accommodative.

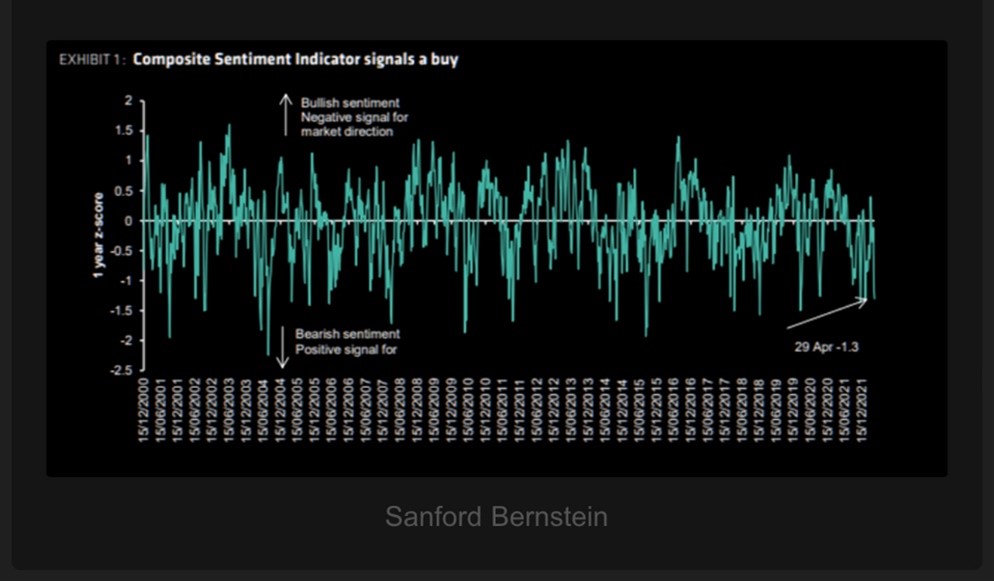

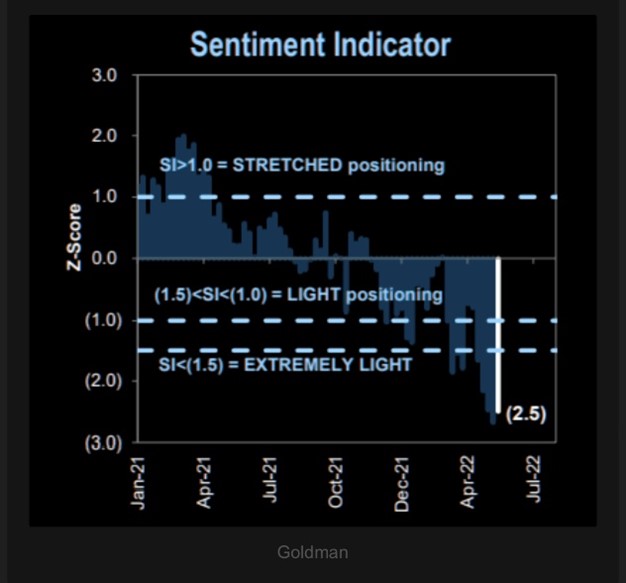

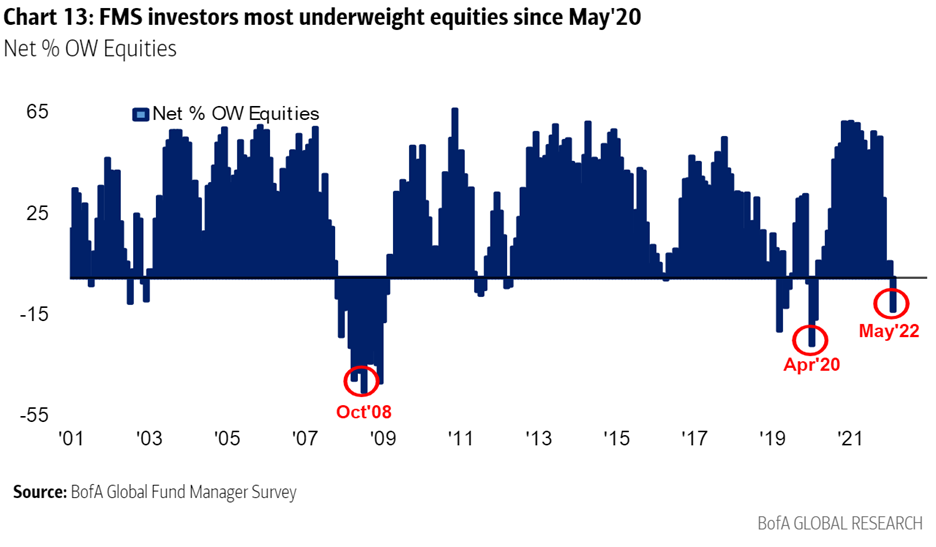

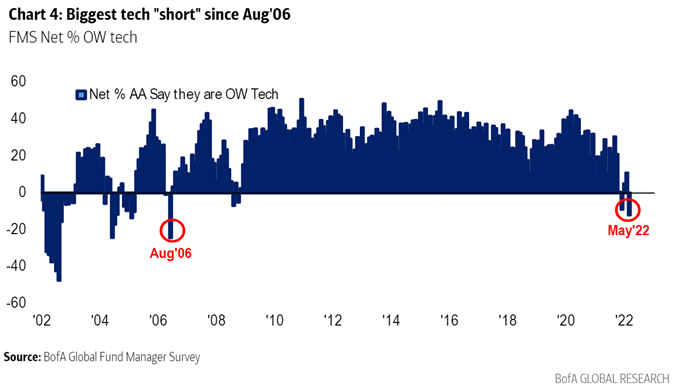

- Investor sentiment is already at an extreme and a contrarian buy signal.

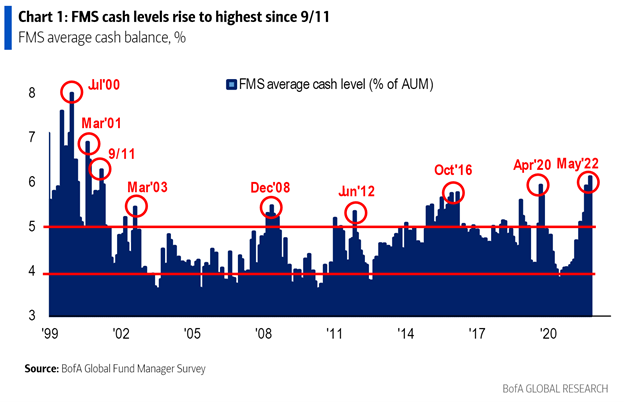

- Institutional cash balances are at levels that are a compelling contrarian buy signal.

- The underweight in equities is already significant.

- The biggest bulls are starting to throw-in the towel. From a sentiment perspective, I’d point to two important developments. First, while they don’t ring a bell at the top, or the bottom, you do see capitulation and the tweet below about Cathie Wood selling Tesla (TSLA US) to buy General Motors (GM US) has that type of feel. Further, from a sentiment perspective you could argue that while the market peak was in November 2021 but the peak in enthusiasm was around the meme stock rally in early 2021. If you believe the NASDAQ (off 31% from peak) has been the leadership for this market, and the meme rally was the peak, the trough may already be in unless you’re expecting a grizzly bear market.

- Many investors are targeting a 30% decline in the S&P500 making it unlikely that we see a 30% decline; these investors will step in and make purchase before the S&P500 is down 30% and support the market above this level. Did I mention that Warren Buffet put $51.1bn of money to work in 1Q, 2022? Warren also mentioned that he and Charlie Munger “haven’t the faintest idea what the stock market is gonna do when it opens on Monday”.

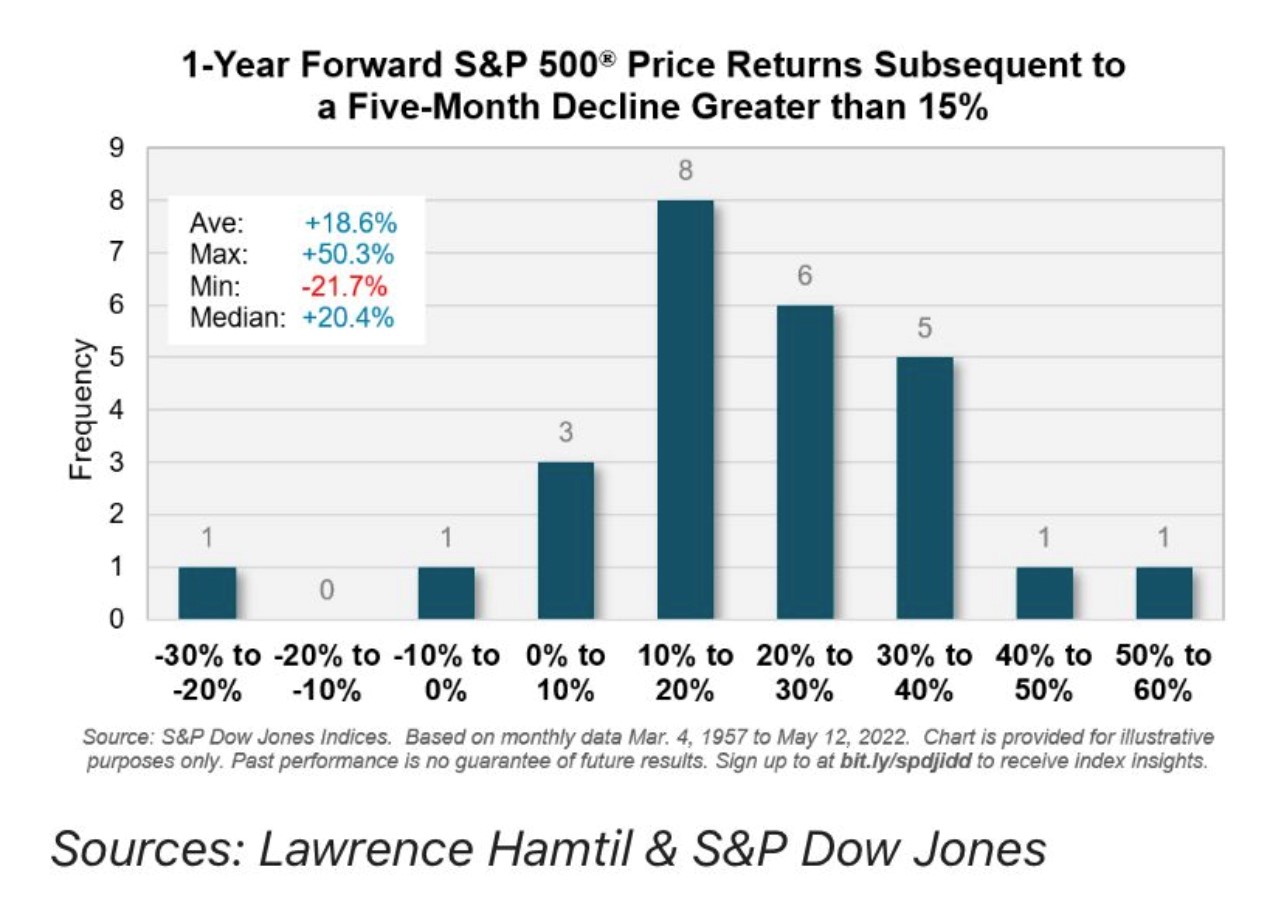

- If we look at how the S&P500 has performed after a 15%+ draw down over a five-month period since 1957, a year later the market is higher 92% of the time.

- 2022 is off to a rough start but historically the market has performed well after opening the year with a rough 9-trading days.

If the dates in the table above look familiar it’s likely because they are historically significant: The Great Depression (1932), World War II (1940), and Vietnam War/US Recession (1970).

The challenge for investors

It is easy to talk yourself out of investing in a bear market, to anchor on a price, and miss years of stock market appreciation that have followed bear markets. It is very difficult to remain focused on the long term and think about the opportunity that these markets offer, particularly if you can look out more than one year. There is an adage in North America that says, “if you are wrong and invested, it’s temporary but if you are wrong and uninvested, it’s permanent”. For investors that kept putting money to work in 2001, or you were able to pick away any of the FAANMG stocks in 2008 (and not sell them) the results have been incredible. (Note: Before anyone in compliance gets too excited, I’m not recommending purchasing any individual stock in this post. I’m trying to highlight that both 2001 and 2008 market troughs were excellent buying opportunities.)

While focusing on risk and honing our fight or flight response has generally served homo sapiens well, the more significant risk in investing is not being pragmatic and realizing the world is likely going to be better than your worst-case scenario. We are an incredibly resilient species and capitalism enables a very efficient allocation of resources over time. Investing isn’t intuitive, and it wasn’t even something humans had to worry about until about two generations ago. An emotional approach is problematic. A pragmatic approach has traditionally been an important asset.

What’s an investor to do?

Every market is different and unsettling events can lead to volatile markets that make it difficult to stay invested. The challenge for investors is remain focused on their long-term objectives. If investors can remain focused on their long-term objectives, they can reduce the need for market timing and ‘hero calls’ by saving and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

At the risk of sounding like a broken record, I continue to recommend investors to stay focused on the long-term and to pursue a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets, while cash and alternative investments are used to reduce volatility and provide ballast for portfolios.

Let me know if you’d like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2022.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.