David Ricciardelli

May 13, 2021

Money Financial literacy EconomyInflation, Growth and Value

Inflation: Transitory or Structural

Inflation will likely be one of the most significant inputs to investment returns over the next year. Investors need to form a view on whether inflation is transitory or structural. If inflation is transitory, it will persist for a short period and then regress back to the levels we have lived with over the last decade. If inflation is structural, then elevated inflation levels will be the new normal for years. Uncomfortably, this is one of the uncommon circumstances where I agree with central bankers that inflation looks more transitory, while disagreeing with the market that seems to be pricing in persistent higher inflation levels. As always, we reserve the right to let the data further inform our opinion.

Inflation is popping everywhere

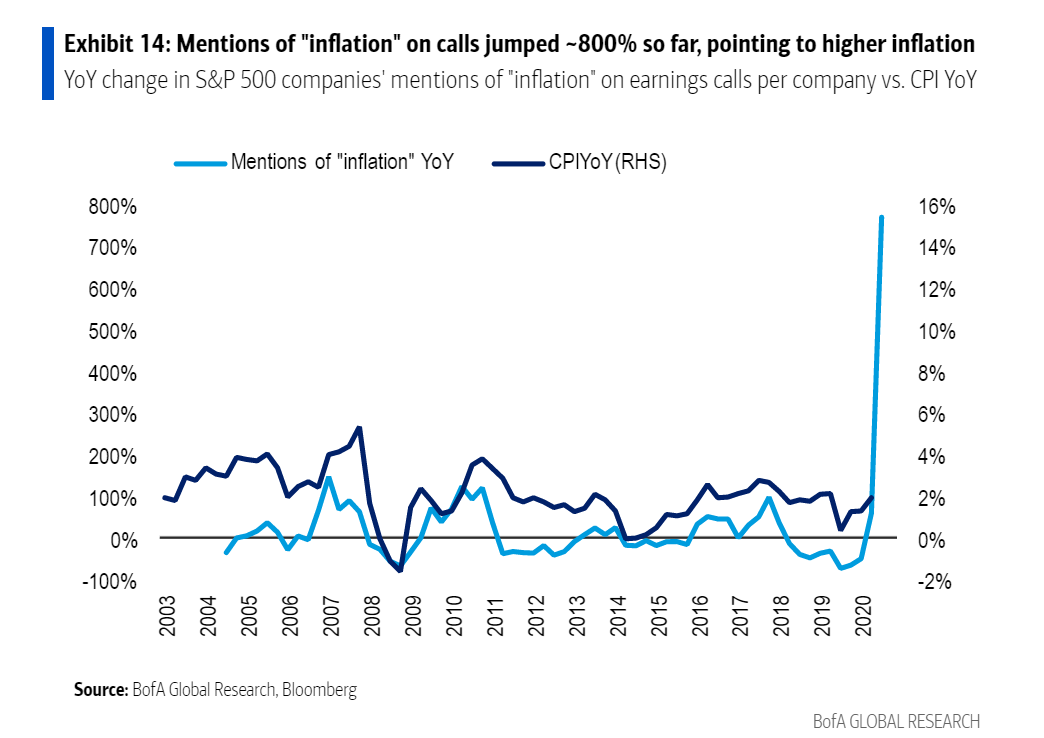

There is a cyclical component to inflation. As economies restart faster than expected, pent-up demand, supply chain issues, and commodity squeezes result. The price of all sorts of inputs from oil to lumber to metals to labor to semiconductors are being squeezed higher. A recent report from Bank America highlights that through four weeks of S&P500 earnings, "inflation" mentions have jumped nearly 800% YoY.

A key to keep in mind is that these price changes don't last forever. The investing adage that "the cure for high prices is high prices" is apt. Corporations had to halt production lines temporarily. The keyword here is temporarily. Those production lines will restart and higher prices will cause supply to increase and lower prices.

The question is how long this transitory period will last? We don't actually know if and when inflation will fade so we try to formulate an informed guess on both. It is important to remember that markets are forward looking and by this time next year the comparisons go from being easy to being challenging, and supply chains will have had a year to respond. The risk likely flips from tight supply chains to supply chains overreacting and a period of oversupply for many inputs.

While it’s easy to get laser focused on the present, investor may be well served to remember that run up in commodity prices that we witnessed in 2010/11 did not translate in a persistent increase in inflation.

The structural inflationary forces

More worryingly are structural factors that could drive long term increases in inflation. These include:

- Onshoring or nearshoring after decades of globalization and using lower-cost offshore labor to drive down the cost of goods and services, the trend is reversing. There is clearly a desire to produce more domestically, and the uncertainty around political policy encourages companies to invest in production in the countries where their products will be consumed.

- Demographics that drove down the bargaining power of labor, the Baby Boomers entering the workforce and China's working age population exploding as it joined the WTO, have hit an inflection point. Labour again has its voice and the entitlements put in place during the pandemic create incremental upward pressure on wages and inflation.

- ESG (Environmental, Sustainability, and Governance) is an inflationary force in the short term. Sustainable sourcing, fair labor practices, reducing emissions, and all these pledges are inflationary. Longer-term benefits and total cost may favor more sustainable practices, but there are near-term costs associated with achieving long-term benefits.

The structural deflationary forces

Balancing the structural inflationary forces are deflationary forces. Human ingenuity drives innovation and productivity improvements that offset structural inflation. When production is brought back onshore to its domestic market, it rarely looks the same as it did abroad. Corporations need to maintain margins, or stock prices and compensation suffer. As a result, onshore production will rely more heavily on automation and standardization to increase the utilization of assets and keep costs down despite higher labor costs and a need to operate in a more stakeholder-friendly manner. Companies that can't make this transition become targets for disruption from (new) competitors.

Another interesting feature of this cycle is the type of infrastructure spending proposed by the US government. Infrastructure spending typically focuses on physical infrastructure like roads, bridges, and utilities. This type of spending is inflationary. However, in the proposed infrastructure spend bill less than a quarter of spending is on traditional infrastructure. A significant portion of the bill focuses on human capital, intellectual property, and technology /telecommunications infrastructure. This type of investment can lead to innovation and productivity improvements which tend to be deflationary over the long term.

Even if you think the US Federal Reserve will not or cannot respond to higher inflation it is worth noting that the latest rounds of US stimulus cheques hit bank accounts and mailboxes at the end of March. As a result, the US is likely experiencing its peak fiscal impulse right now. While I suspect we will see additional stimulus in the fall – it’s difficult for policy makers to walk back from handing out money – the size of the stimulus will likely be smaller turning an inflationary tailwind into a headwind.

Finally, a bet on inflation in the long term is a bet against human ingenuity. As I’ve repeatedly commented in these posts, you generally want to bet on human ingenuity. As a race, we have a solid track record of consistently overcoming the obstacles we face.

Growth vs Value

While all of the momentum is in value's favor right now, it is hard for value sectors to consistently compound outsized returns for multiple years. Machinery, banks, energy, or materials are cyclical sectors are subject to the whims of the economic cycle. These sectors should continue to do well while inflation rages but become less interesting when inflation normalizes.

Growth had been scarce and growing companies were able to command large premiums. At least, until this year. Growth is now everywhere as companies that generally grow slowly, grow back towards their pre-pandemic stature.

Fundamentals for many growth companies look stunning, but they are competing against a backdrop of surging fundamentals across the market. In this earnings season we are seeing the highest percentage (68% of the S&P500) of companies beat street-wide earnings estimates by more than one standard deviation in the 20+ years that we have tracked this data. This isn't surprising since forecasts usually lag following an inflection, but what is interesting is seeing that these big beats are NOT being rewarded and the few misses we have seen are being severely punished.

Source: Goldman Saks

This leads us to a few conclusions:

- Growth is no longer scarce;

- The premium afforded to growth companies will likely continue to compress until growth is again scarce; and

- After years we may be re-entering a market where valuation matters.

Positively, if growth companies are growing and their stock price is not appreciating, they tend to compress their valuations quit quickly. This compression makes them again look more attractive from an investment perspective.

So what's an investor to do?

Admittedly, investing through the mid-cycle and watching commodity prices run is my least favorite part of the economic cycle. Thankfully the mid-cycle typically lasts 12 months and we’re already 5 months into this cycle. While cyclicals and value are having their day in the sun, we'd continue to urge investors to continue to utilize a barbell strategy with the intent of building a diversified antifragile portfolio. While this portfolio is likely to lag in periods where we have an intense sector rotation, like 1Q 2021, the intent is to consistently compound wealth across market cycles.

Tactically, I continue to recommend a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. At the same time, fixed income, cash, and alternative investments reduce volatility and provide ballast for portfolios.

Over the longer term, investors can reduces the need for market timing and ‘hero market calls’ by saving and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

For investors looking for a practical signpost that we’re exiting this part of the economic cycle, I’d suggest it’ll likely occur around the time when it’s becomes relatively easy to buy a bicycle for less than $1,000.

Let me know if you’d like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2020.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.