David Ricciardelli

June 08, 2020

Money Economy In the newsThis market is bananas! B-A-N-A-N-A-S! A bull market thesis

When investing, it is often in an investor’s best interest to get nervous if their view lines up with a consensus. Being nervous is prudent because even if the investor’s view is correct, profiting from the view is unlikely. The consensus view has already been priced into the market. Said slightly differently, if everyone is making the same wager, the payout for the bet becomes smaller for each bettor.

One of the reasons why today’s market is so interesting is that there are two consensus opinions. Professional money managers have been very vocal in saying this market is exceptionally overvalued (see my earlier post for more details). At the same time, retail investors clearly expect the market to continue to ‘climb a wall of worry.’ Which is correct? Without the benefit of hindsight, we are all just guessing. Ideally, we are making well researched and thoughtful guesses that reflect the knowledge and wisdom acquired over a lifetime of investing, but we’re still guessing.

What is the current bull market thesis?

The market participants can already see and price the risks associated with:

- The economic damage caused by responding to COVID-19 and the potential for future waves of infection;

- Social unrest in the United States;

- Increasingly strained relationships between China and the rest of the world, especially the US; and

- Stretched valuations and weak fundamentals in equity markets.

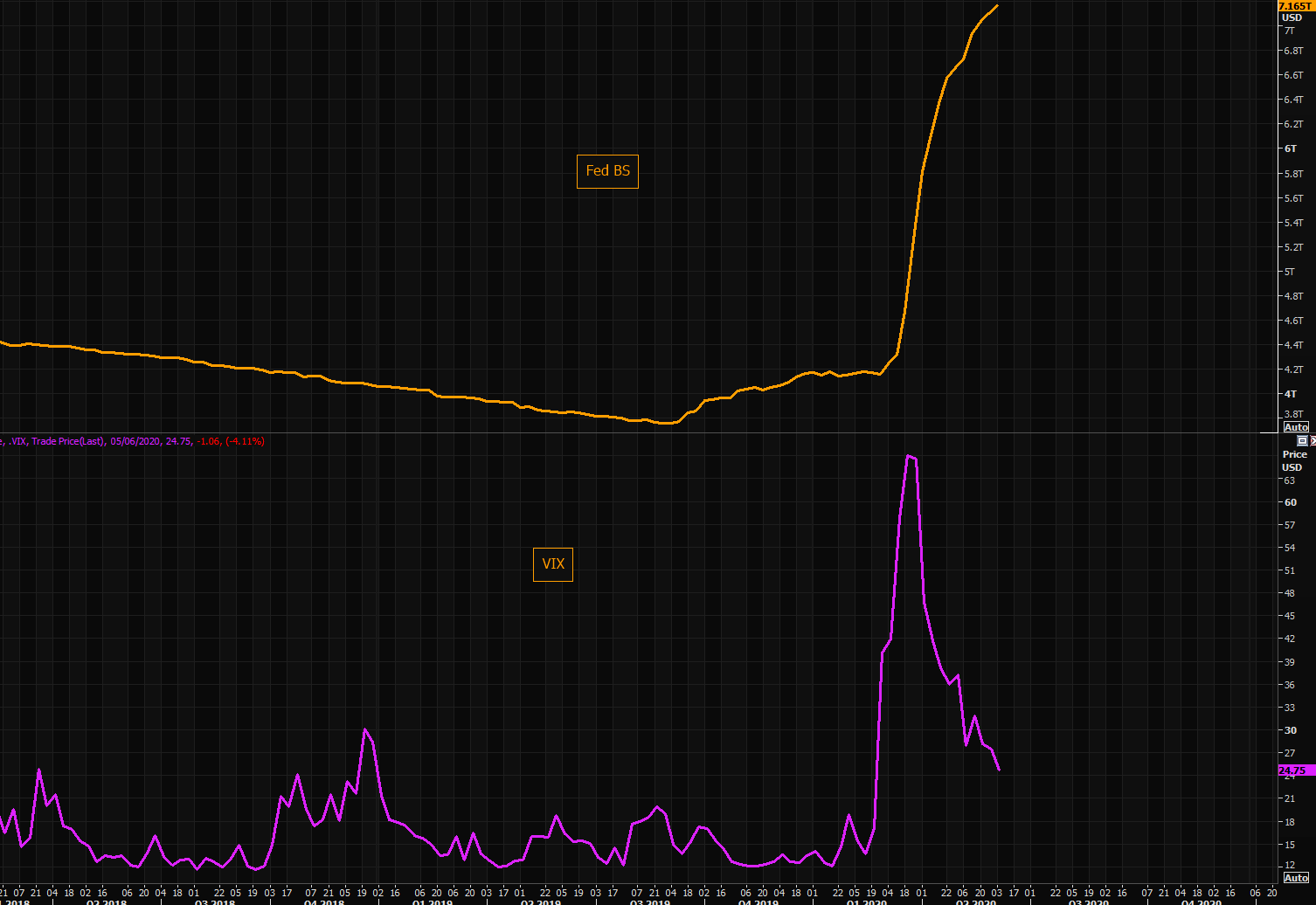

Additionally, the only thing that matters is the unprecedented amount of liquidity that has been provided by central banks.

The US Federal Reserve Balance Sheet vs. the VIX (Volatility Index)

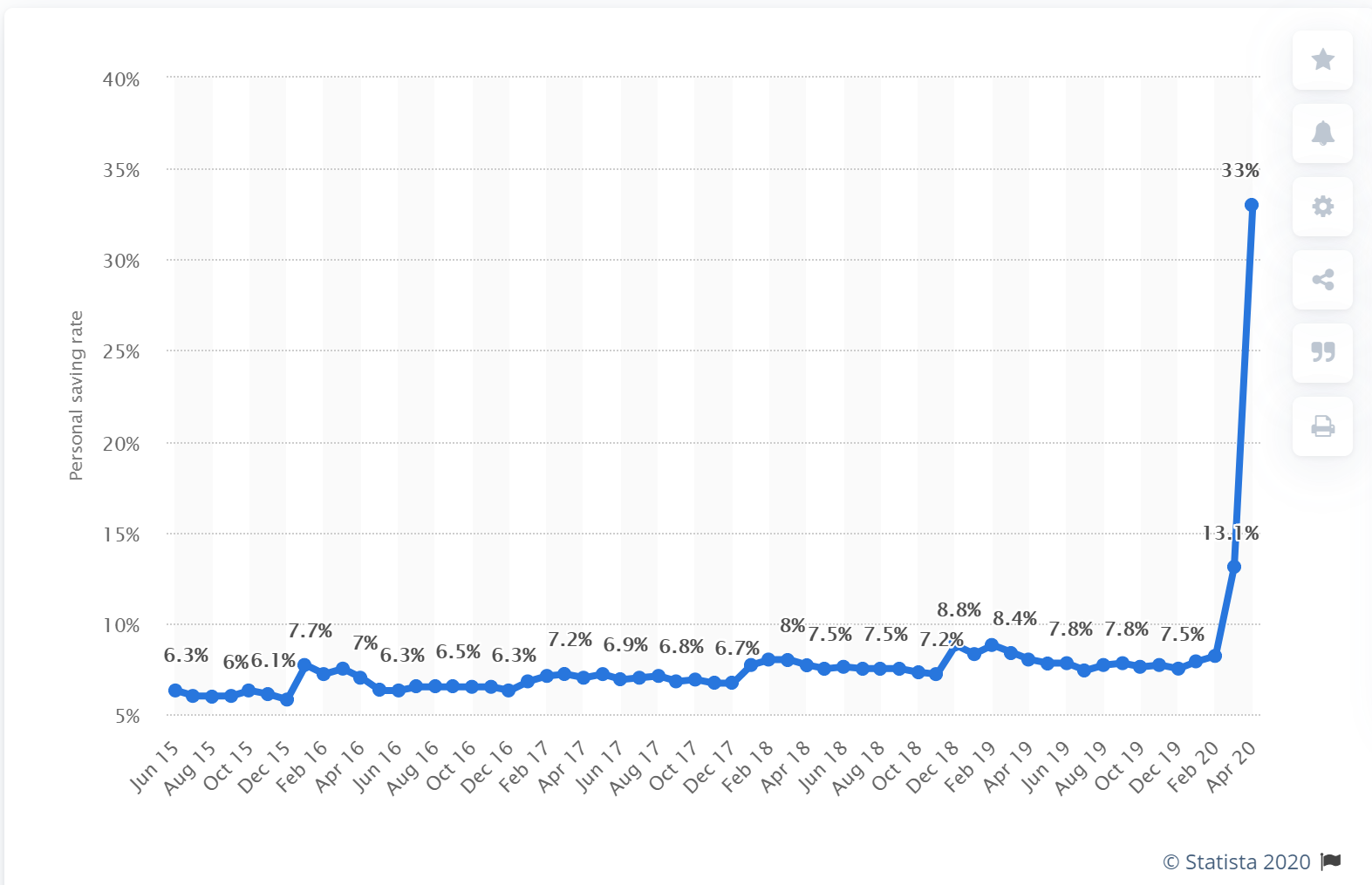

The lockdown has created personal savings rates to surge.

Personal Savings Rate in the United States

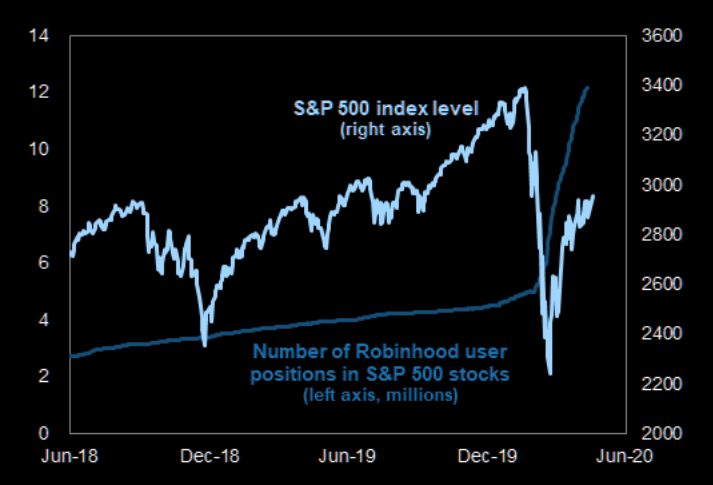

Some of the increase in savings is finding its way into equity markets.

Robinhood User Positions in S&P500 stocks vs. the S&P500

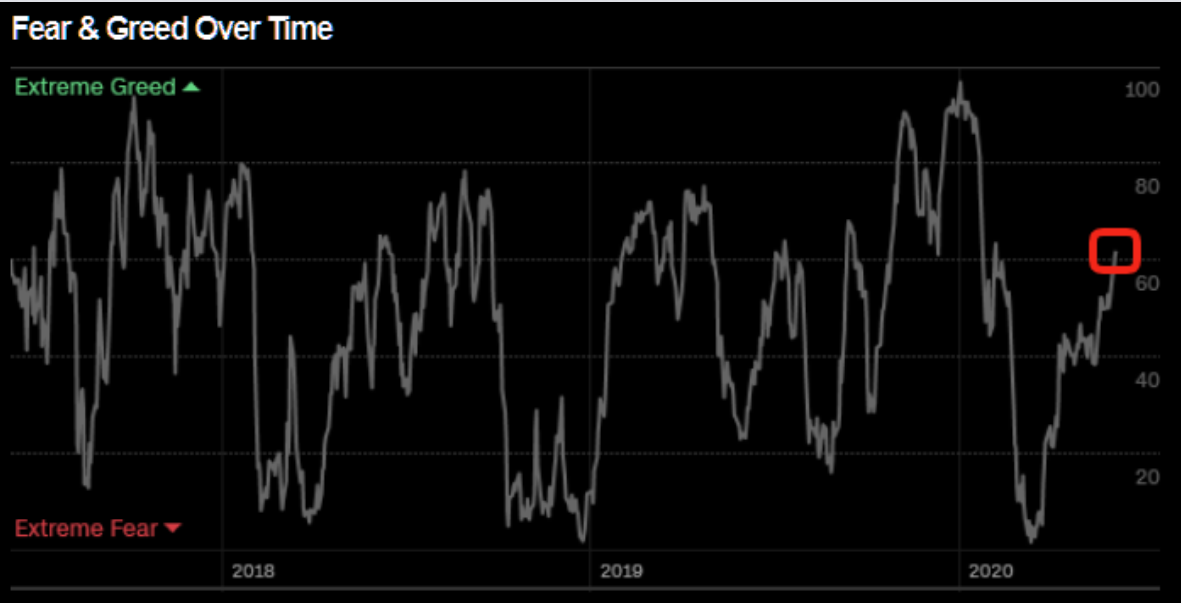

While investor sentiment has improved, there is still significant headroom for further improvement.

CNN Fear and Greed Index

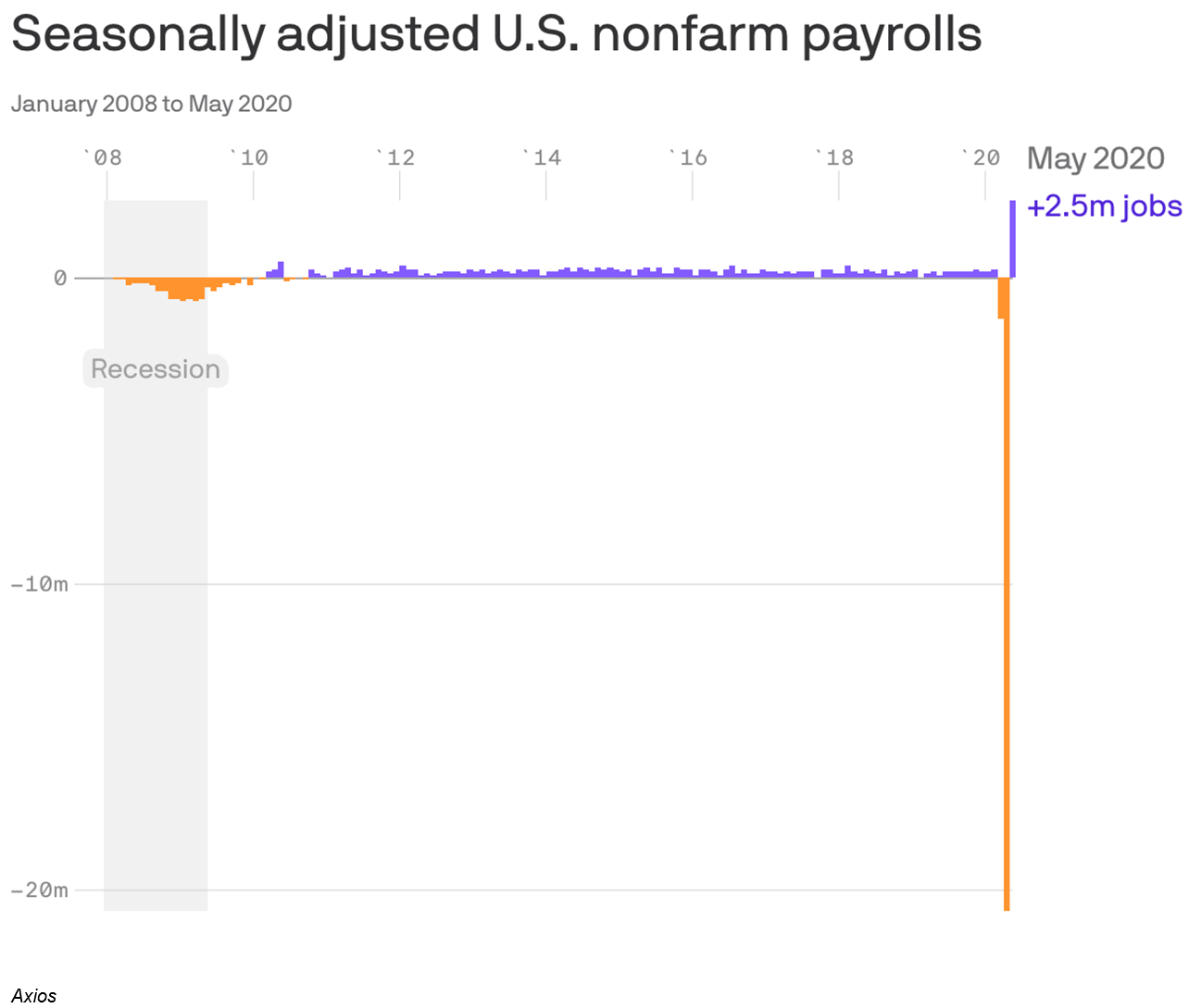

Fundamental data is starting to improve as restrictions are lifted.

And, this market is starting to look a lot like the rally off the bottom during the Global Financial Crisis, which resulted in the longest bull market in the history of the S&P500.

S&P500 in 2009 vs. 2020

What is an investor to do?

While I’ve have made a bullish argument above, I could just as easily find some charts and make an equally compelling argument that markets are poised to selloff.

So how should an investor approach this market?

Tactically, I have recommended a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets, while fixed income, cash, and alternative investments are used to reduce volatility and provide ballast for portfolios.

Over the longer term, a more practical approach for investors that reduces the need for market timing and ‘hero market calls’ would be to save and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and buying fewer securities when the market is expensive.

Please contact me for a more involved discussion.

Delli (delli@cibc.com)

Disclaimer: This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2020