David Ricciardelli

December 28, 2022

Money EconomyHere Comes 2023!

A Quick Look at 2022

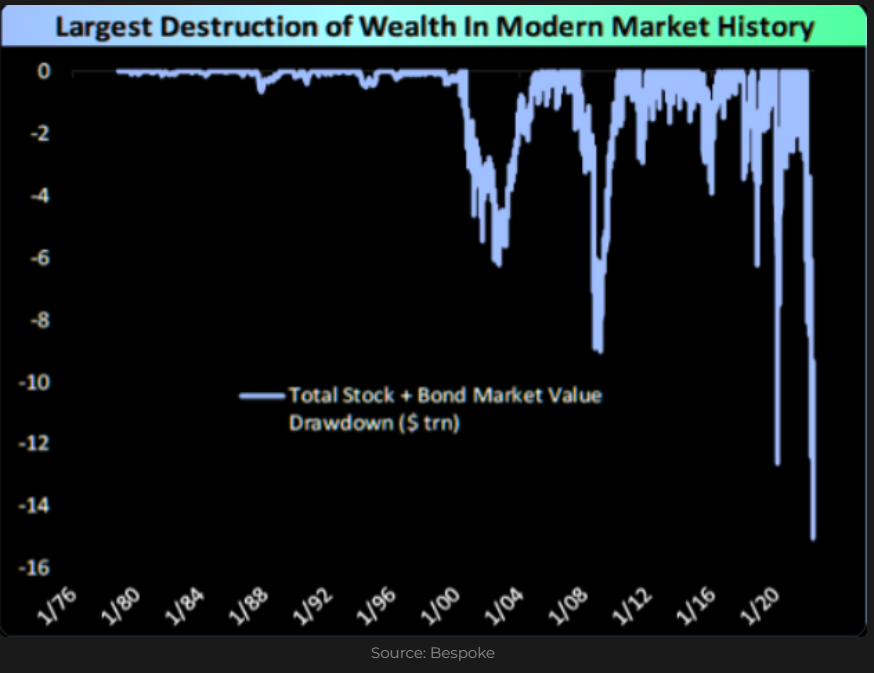

We’re still waiting for the final numbers for 2022, but it will likely be a year that most investors will want to forget. While we’ve seen rougher years for equity markets, it was the bond market which helped 2022 claim the dubious distinction of seeing more wealth destroyed than any other year in modern history.

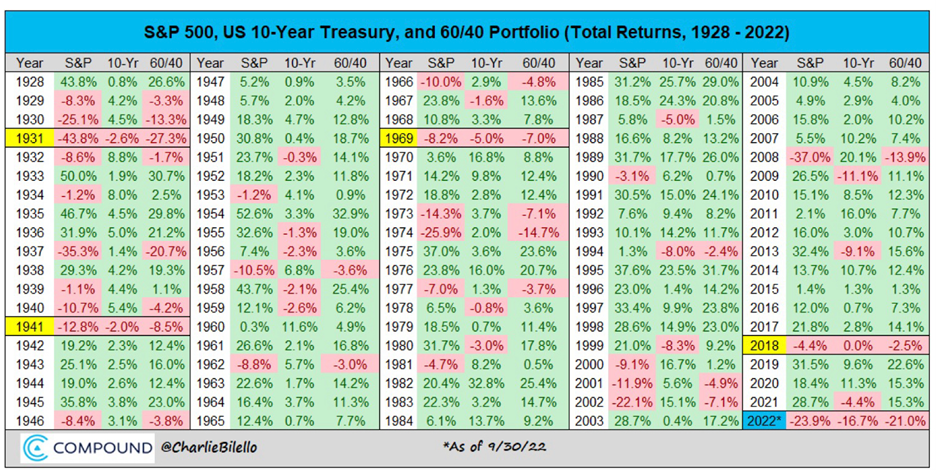

We’ve highlighted that since 1928 there have only been five years where both the stock and bond sides of a 60/40 portfolio made up of the S&P 500 and US 10-Year Bond had negative returns. 2022 has the ominous distinction of being the only year where both sides of this portfolio have been down more than ten percent.

Note: As of November 30th, the total return of the portfolio above was -15.2% with the S&P 500 down 15.5% and the US 10-Year Treasury down 14.7%.

2023 Year Ahead Reports

It’s an annual tradition for the Research Departments of Wall Street and Bay Street Brokerages to fill our inboxes with their year ahead prognostications and sector outlooks. The onslaught of these year ahead reports start at US Thanksgiving and runs through the first week of January. While we agree with Howard Marks (see his memo, What Really Matters) that investors shouldn’t put much weight in forecasts (theirs or those of others), we’ve been struck by how consistent these reports have been this year. These reports are written by professionals who don’t want to be ‘consensus’ but this year it feels like only names of the authors and brokerages change from report to report. Most reports look something like this:

- A punchy title.

- A blurb trying to put 2022 in context – like the one I’ve written above.

- A paragraph that talks about the recession we will see in 2023. A recession in 2023 is a foregone conclusion and the most consensus call I’ve ever seen in my career. The difference from one report to the next is the severity of the recession they expect to see in 2023.

- A paragraph explaining that earning estimates for North American companies need to be revised lower to reflect the oncoming recession; some reports mention that estimates for the S&P 500 are down more than 8% since they peaked in April.

- A paragraph that talks about the risk that inflation will come in waves, similar to the 1970s, and that central banks may loosen monetary policy too soon and be forced to tighten again.

- A paragraph talking about the headwind to global growth posed by China’s Zero COVID policy (for reports published around US Thanksgiving) or the repeal of China’s Zero COVID policy (for reports published closer to the end of the year).

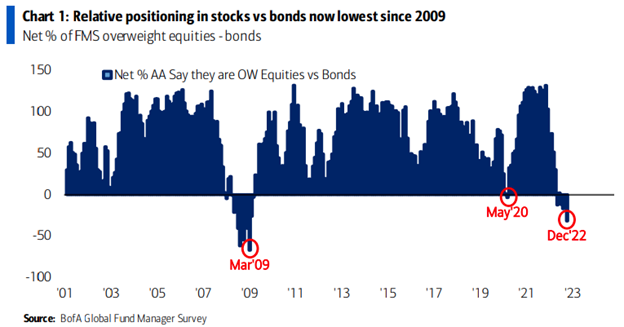

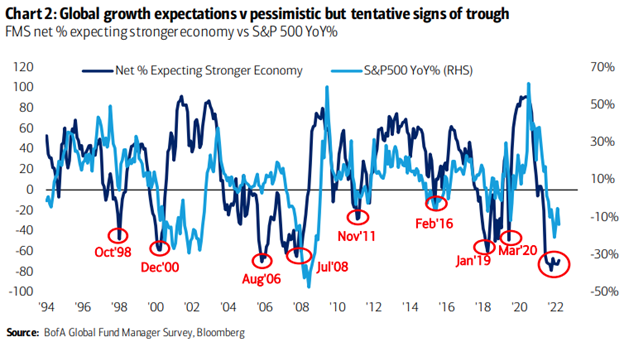

Counter intuitively, we’re comfortable with the setup for 2023 since sentiment is quite weak, cash balances are large, equity weights in portfolios have been significantly reduced (see the charts below), and it’s almost impossible for rates to increase another 800%+. Markets typically don’t get hurt by events that are expected, it’s the events we don’t expect like COVID in 2020, or the pace of the Fed’s rate hikes in 2022, or the shooting war in Eastern Europe, that cause investors heartache.

The ‘New’ Investment Environment

In Howard Marks’ Sea Change, he discusses how the investment environment has changed from the stimulative environment we experienced from 2009-2021. If you’ve read the blogs (here’s a link) we’ve written over the last two years you’ll see a lot of similarities in our writing and the themes in Howard’s latest memo. I’d encourage you to read his latest memo (linked above and here again) but here is a summary table from page seven:

Investing Environment

|

| 2009 to 2021 | Today |

| Fed behaviour | Highly stimulative | Tightening |

| Inflation | Dormant | 40-year high |

| Economic outlook | Positive | Recession likely |

| Likelihood of distress | Minimal | Rising |

| Mood | Optimistic | Guarded |

| Buyers | Eager | Hesitant |

| Holders | Complacent | Uncertain |

| Key worry | FOMO (fear of missing out) | Investment losses |

| Risk Aversion | Absent | Rising |

| Credit window | Wide open | Constricted |

| Financing | Plentiful | Scarce |

| Interest rates | Lowest ever | More normal |

| Yield spreads | Modest | Normal |

| Prospective returns | Lowest ever | More than ample |

I’ve highlighted the last row in the table for emphasis since it too is counterintuitive unless you’ve studied markets across multiple cycles. Everything looks ‘worse’ today than it did in the 2009 to 2021 window but prospective returns are higher.

It’s not what happens, it’s what happens relative to expectations

As an example, US Treasuries with a 7-10 year duration lost 15% of their value from December 2021 through June 14th, 2022. The US Fed hiked rates 75bps over this period. From June 14th through December 23rd the Fed hiked rates another 350bps. How did US Treasuries with a 7-10 year duration fair over this second period? They were essentially unchanged.

When a market, or a company, or interest rates do exactly what everyone expects we get the market return. Returns are significantly better or worse than the market return when the market or a company surprise us and things playout better (2009-2014, 2016-2017, and 2019-2021) or worse (2015, 2018, and 2022!) than expected.

Expectations aren’t very challenging as we enter 2023.

We have smallest relative weighting in equities vs bonds since March of 2009:

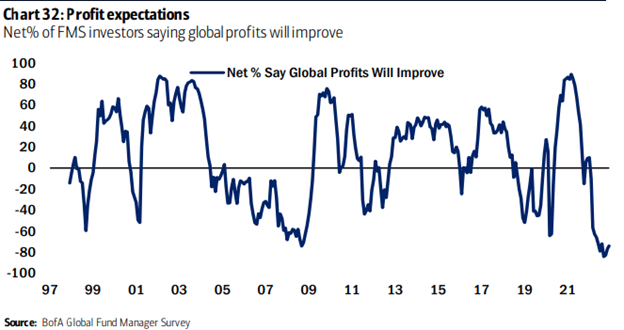

Growth expectations are terrible:

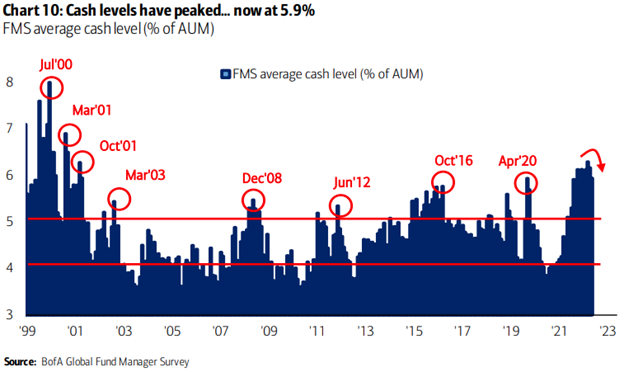

Cash levels are elevated:

And almost everyone expects earnings to be under pressure:

What’s an Investor to do?

We continue to recommend a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. And the other side of the barbell is: cash, actively managed fixed income, and alternative investments that are used to reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus is expanded to optimize the tax efficiency of distributions.

Market timing ‘hero calls’ are very difficult. We recommend investors save and invest at a regular cadence, like putting a portion of your earnings aside every week, or every month, or every year. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Please contact me for a more detailed discussion.

Have Happy New Year and a fantastic 2023!

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2022.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.