David Ricciardelli

September 22, 2025

Money Financial literacy EconomyAI Bust or AI Boom

"It's not supposed to be easy. Anyone who finds it easy is stupid."

Charlie Munger

With the market up more than 38% from its April lows, we have experienced a sharp increase in inbound calls from clients. About half of these calls are from clients who think we should be more aggressive with our investments. The other half ask if we should be more conservative. Rather than trying to time markets, our advice to both sets of clients is to stay diversified and balanced.

What Happens Next

If you look at consensus forecasts, you will conclude that the next ten years will look a lot like the last ten years, with inflation of about 2%, low single-digit GDP growth, and high single-digit earnings growth. While consensus may be correct, the unprecedented pace of capital spending in pursuit of AI-related productivity improvements could lead to more extreme outcomes.

Bulls will argue that markets could continue to melt higher if:

- AI becomes a general-purpose technology, like electricity or the computer, that improves the productivity of individuals and corporations, resulting in faster growth in earnings and the economy.

- Looser monetary policy encourages both investment and spending.

- The capital gains taxes, created by a bubble or bubbles, could balance the US budget and allow the US Treasury to term out its debt by issuing longer-duration bonds at low interest rates.

Bears will argue that markets could correct because:

- Capital spending will slow as companies realize that the near-term benefits of AI will be underwhelming relative to current expectations.

- Sovereign debt levels and budget deficits are unsustainable.

- The US will run out of energy to support incremental AI workloads before 2028.

- The market has become complacent, resulting in unprecedented concentration in equity markets, extended valuations, and muted volatility.

Investors must weigh the potential for consensus, bullish, or bearish outcomes. The goal is to participate in the upside while protecting against downside risks.

We will speak more about maintaining a balanced and diversified approach, but first, let's take a quick look at some charts that aim to put today's markets in context.

Today’s Market

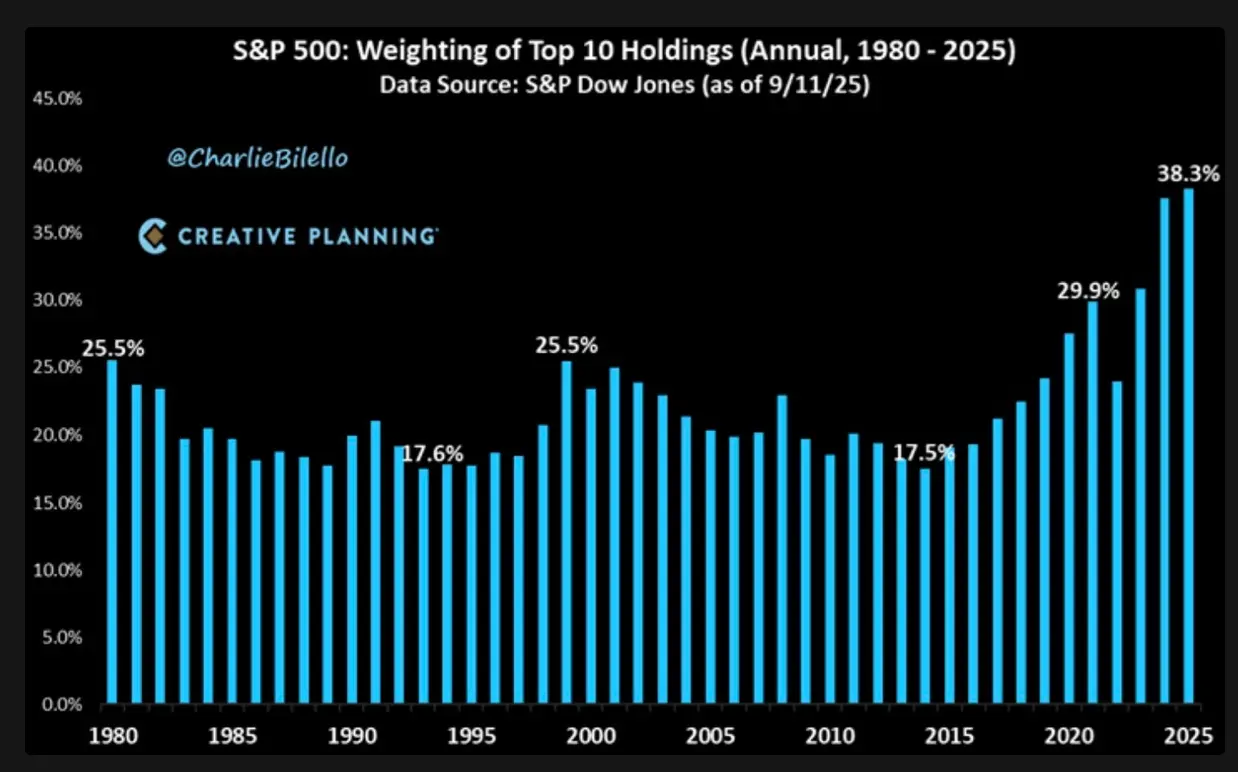

The S&P500 has never been more concentrated. Ten stocks represent more than 38% of the index.

The S&P 500 has become increasingly concentrated, with just ten stocks accounting for over 38% of the index. Year-to-date, the index is up 13.3% in USD, but gains are lower in CAD (9.0%) and EUR (1.1%). Notably, 68% of these gains have been driven by ten stocks.

While the S&P 500 is up 13.3% year to date, earnings growth has kept the index’s forward price to earning ratio consistent (21.8x on January 1st vs 22.0x on September 19th).

S&P 500 Forward Price to Earnings Ratio

(Source: Bloomberg)

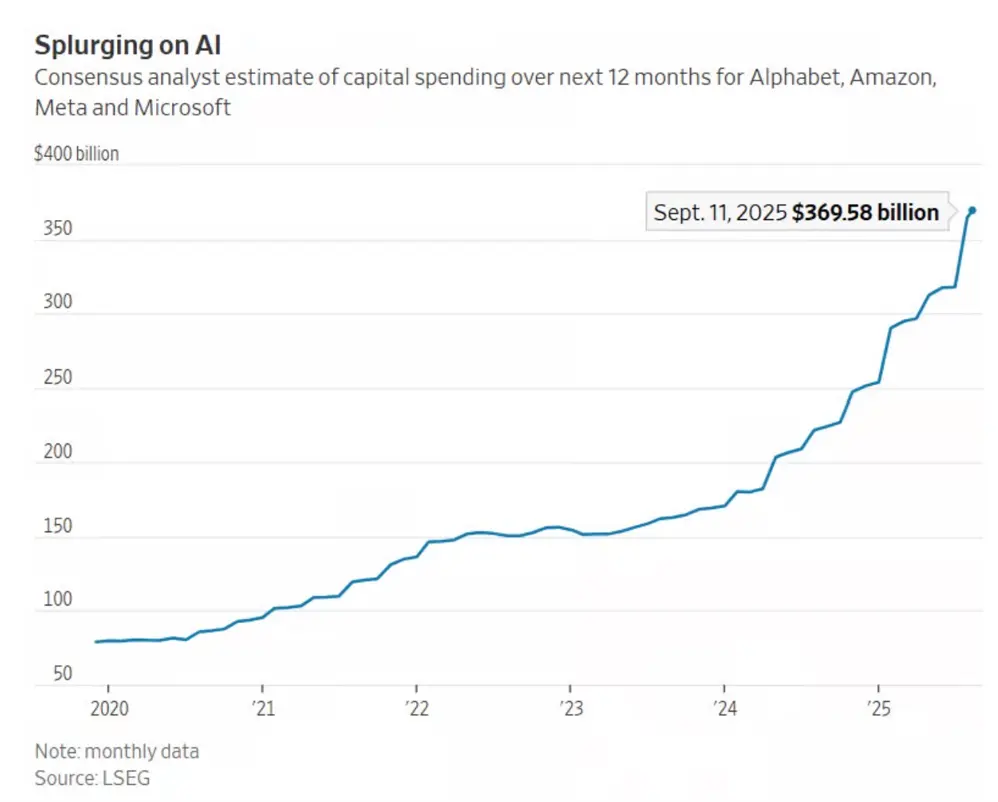

Amazon, Alphabet, Meta, and Microsoft have announced $369bn in capital spending over the next twelve months.

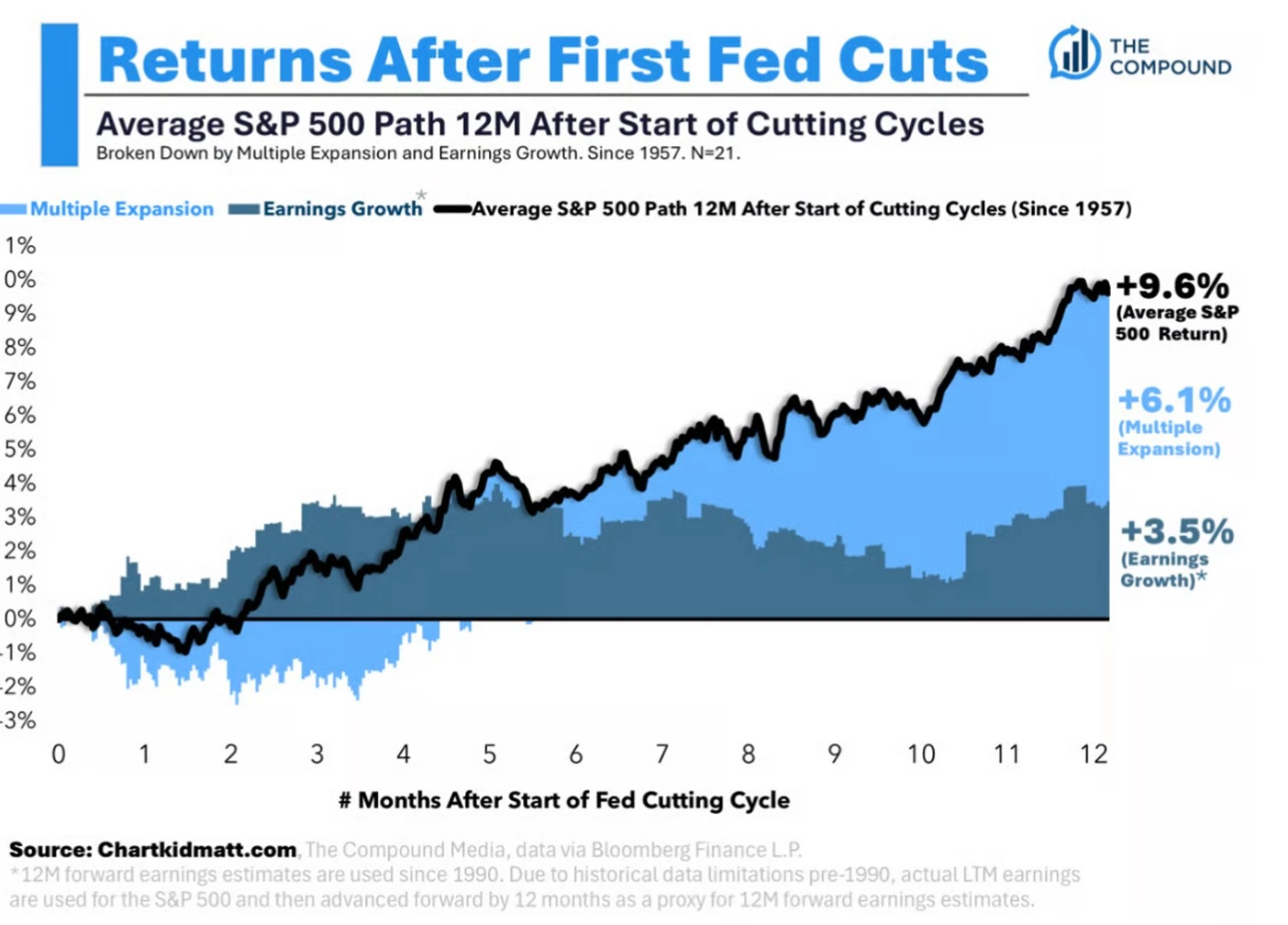

The S&P 500 usually trades lower for a pair of months when the Fed begins to cut rates.

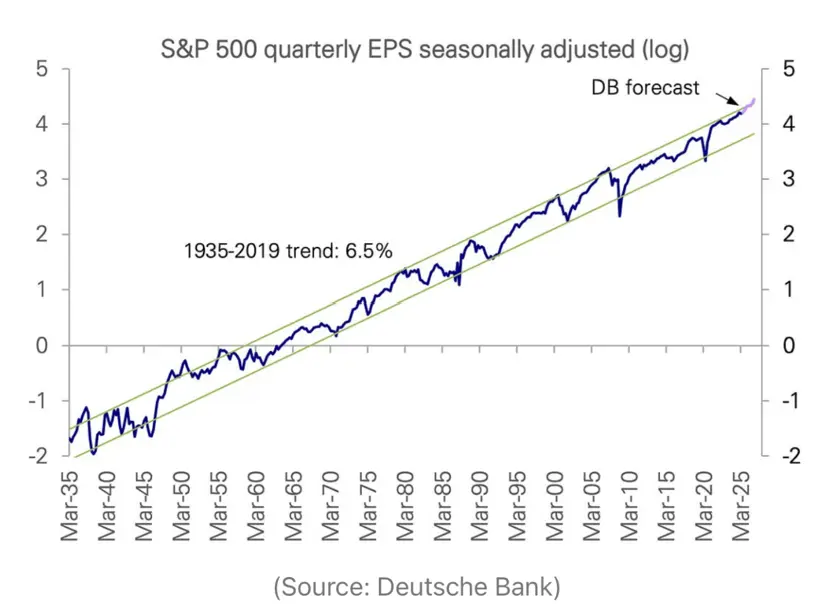

While expectations will cause valuations to expand and contract, the most important driver of equity markets over the long term is earnings growth.

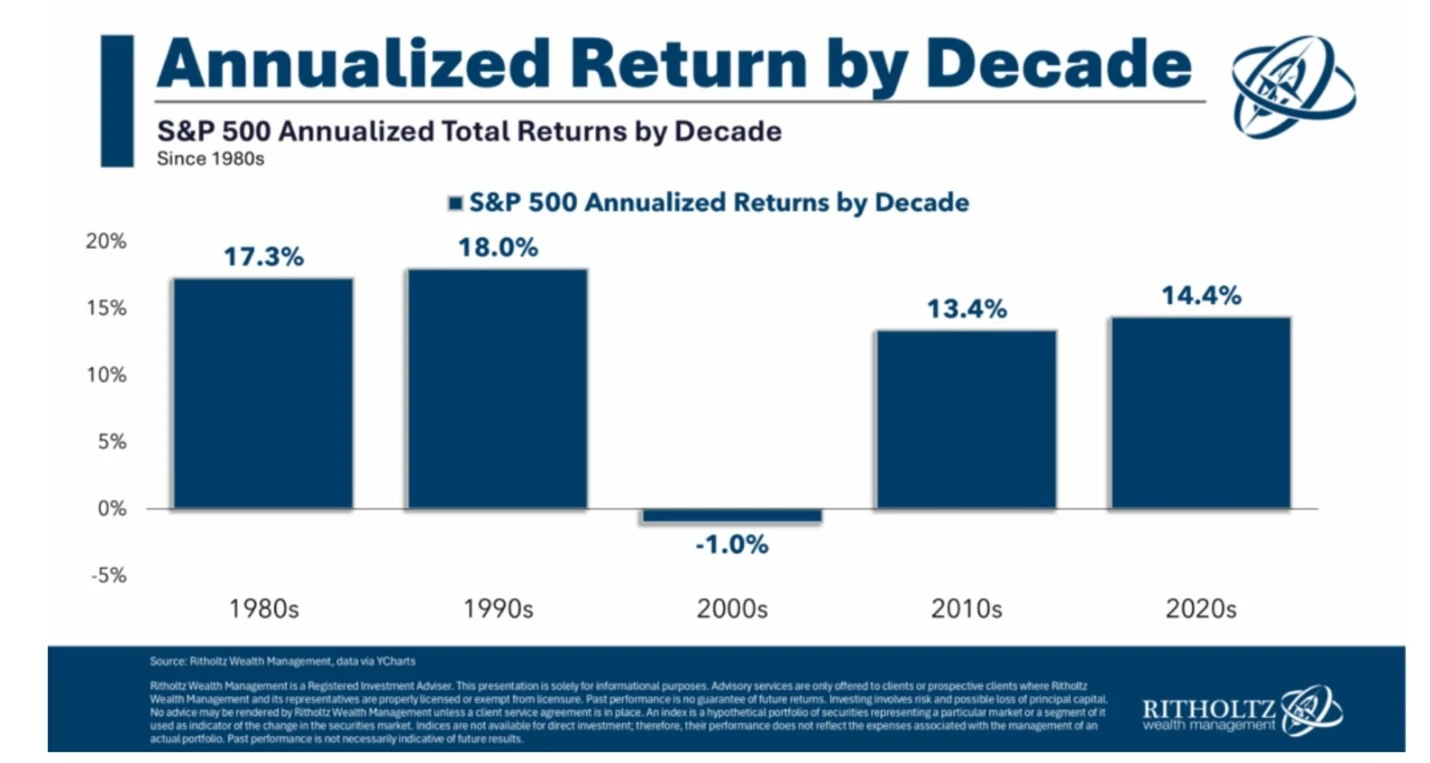

The benefits of a diversified and balanced approach became apparent in the 2000s, when the S&P 500 delivered muted returns.

What Should Investors Do

While action helps alleviate anxiety, timing markets is extremely difficult. Thus investors may benefit from saving and investing consistently across market cycles. This process allows investors to buy more securities when the market is inexpensive and fewer securities when the market is expensive. Consistently investing across market cycles also provides investors with fresh capital to exploit emerging structural changes.

Some investors may find value in using a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. The other side of the barbell is cash, actively managed fixed income and alternative investments that may reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus expands to optimize the tax efficiency of distributions.

Don't hesitate to get in touch with me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2025.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.