David Ricciardelli

January 04, 2021

Welcome to 2021!

I’ve generally found that predictions are more entertaining than useful, so this post intends to reflect on 2020 and look forward to 2021.

2020 was full of surprises that were not easy to predict. Still, despite the wild flight path we experienced throughout the year, the year-end returns for most assets classes (see the image below) aligns pretty well with the constructive setup that markets had as we entered 2020.

As we highlighted a number of times last year, the NASDAQ 2009 analogy worked incredibly well.

NASDAQ returns in 2020 vs 2009

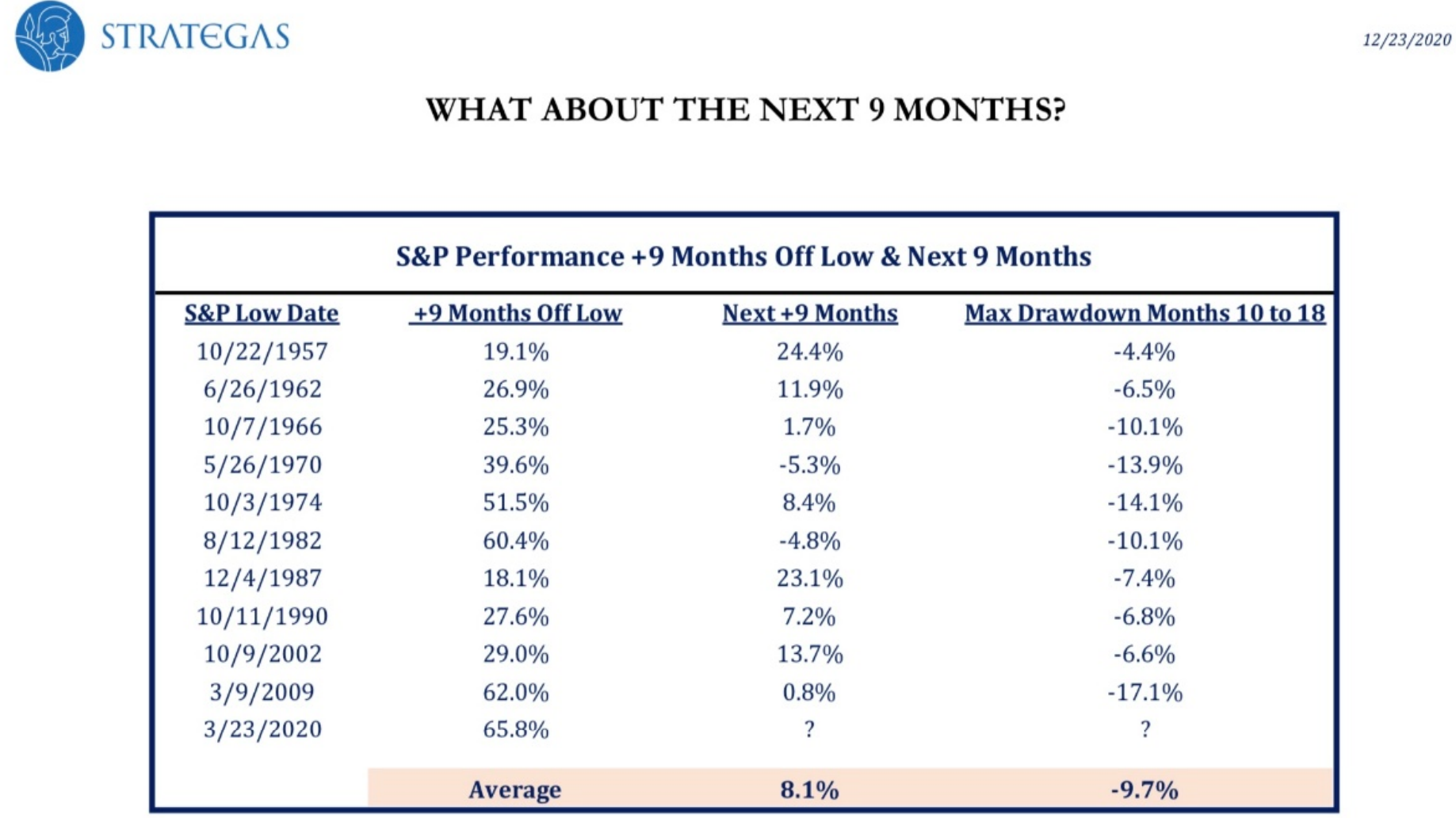

But the million-dollar question is always, “What happens next?” The chart below from Strategas shows that stocks tend to be higher in months 10-18 off a significant low, but the trajectory tends to be more volatile, and a correction of some magnitude during the period wouldn’t be a surprise.

A couple of themes that we will be paying close attention to:

- Telecommuting and telework (or work from home) are likely to become a common labor benefit. Platforms that enable telecommuting should continue to benefit. Land values outside of urban cores will likely benefit at the expense of land value in urban centers. A resurgence of vehicle sales may accompany more rural living.

- Growth had been scarce, and companies that grew revenues commanded large valuation premiums. But the pandemic has rebased revenues and earnings across industries, and as the economy ramps back up, growth will be less scarce for at least the next year.

- Private equity is setting up well for the next decade. Entrepreneurs will exit the pandemic with new ideas for business, products, and services. These entrepreneurs will be helped by managers that have experience operating firms during the most challenging economic environment we’ve experienced in generations. Venture and then Private Equity will finance these businesses before they become public companies.

We will talk about risk another time but in the near term the most significant market risk is tomorrow's (Tuesday, January 5th 2021) Georgia Runoff election. The market will want to see a Republican win that will leave a Republican controlled Senate to balance the newly elected US President and the Hose Democrats. Should the Democrats win both seats in Georgia, the market may correct pretty quickly.

Finally, while it’s easy to focus on the items that made 2020 a challenging year, I thought Wired did an excellent job of highlighting 20 Things That Made the World a Better Place in 2020. As the Wired byline states, “From record-beating scientific discoveries to an elephant baby boom, this year was about much more than just a global pandemic.”

Happy New Year and have an excellent 2021.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimer: This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2020