David Ricciardelli

August 23, 2021

Money Financial literacyCharts for the Lake: Bulls and Bears Slugging it out in August.

At the risk of sounding like a broken record, here is another post about the benefits to taking a balanced approach and continuing to put money to work across the business cycle since we never ‘know’ how events in the world are going to play out nor how those events will be perceived in the market. I recently re-read a comment from Howard Marks that he wrote in 2004 reinforcing this view.

“… you can’t know the future; you don’t’ have to know the future; and the proper goal is to do the best possible job of investing in the absence of that knowledge”.

Howard Marks, Us and Them (May 7, 2024)

In my last post, Inflation, Growth and Value, I argued that the inflation we were seeing was mostly transitory and, that after mature companies were done growing back to their pre-pandemic stature, growth would again be scarce and command a premium valuation. Markets are forward looking and this call played out faster than expected. However, a few more months of data have helped revise our perspective. While the majority of the inflation we’re seeing today is transitory, wage inflation and the related knock-on effects looks structural. As a result, I believe that after the transitory spike, inflation will muddle along in a 2-3% range vs. a 1-2% range we've seen over the last decade. This means that rates and equity risk premiums will be a little higher, so companies will need to deliver more fundamental growth to drive stock appreciation. As the above quote from Marks’ states, we don’t actually know how events will play out so our intent is stay balanced and work diligently to keep portfolios antifragile.

While corrections are necessary to maintain market health, the good news is that there are still a lot of positive data points that support the case that the market can continue to rise even as valuations multiples contract.

A couple of charts to consider:

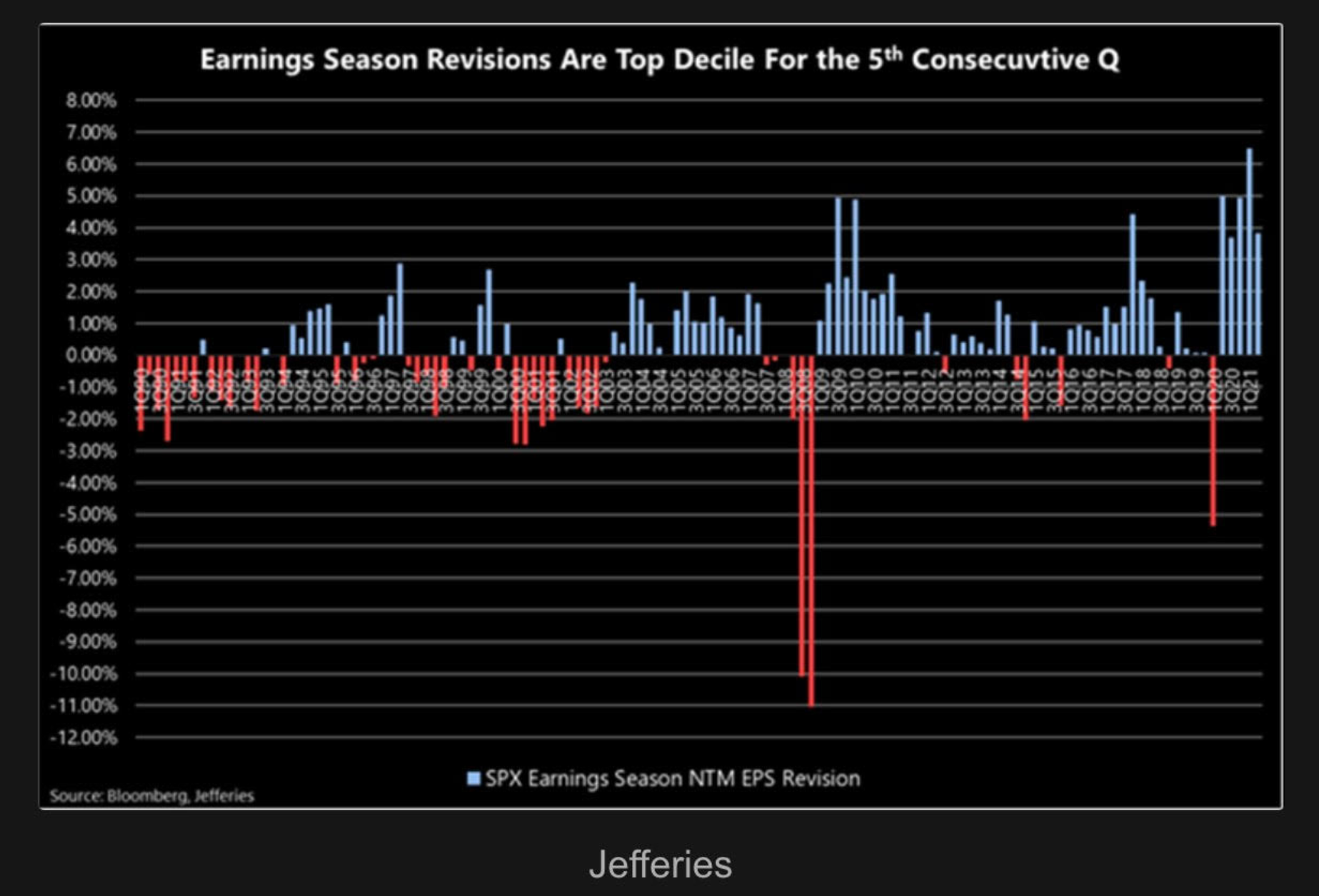

Earnings remain exceptional in terms of breadth and magnitude. For the last five quarters, earning revisions were better than in 90% of the preceding quarters.

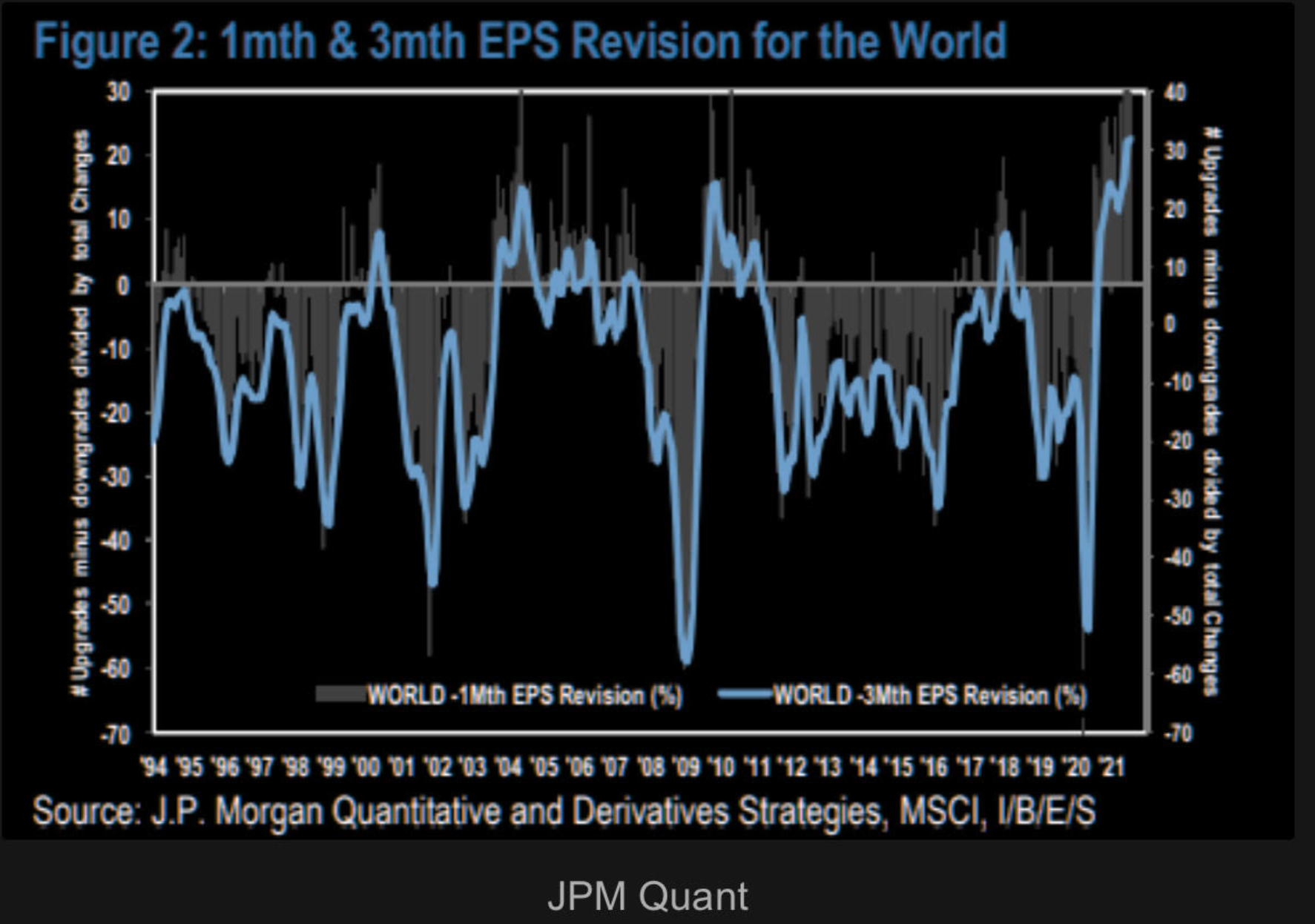

Globally earnings revision also look robust.

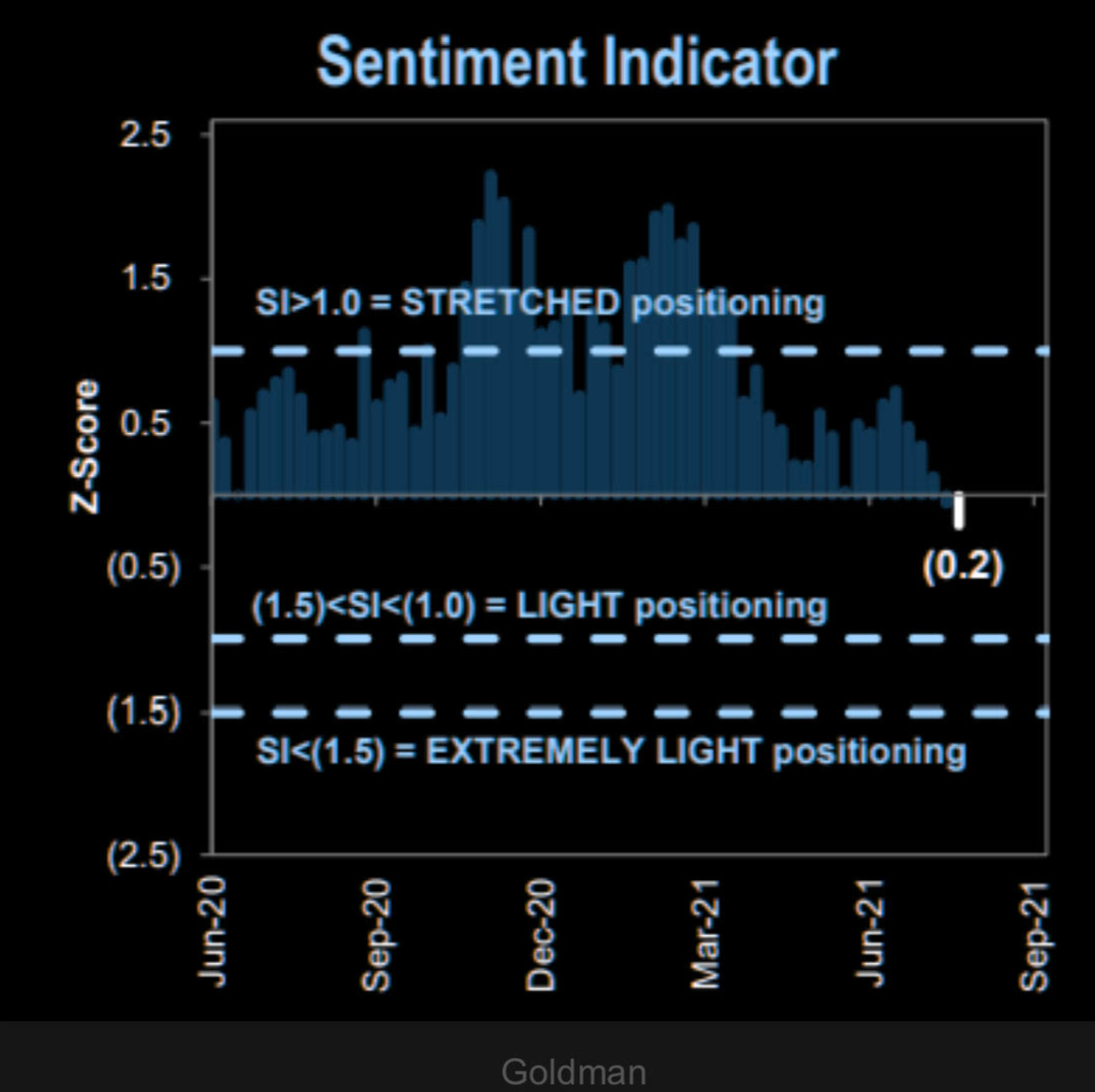

For the first time, in a long time, investor sentiment has capacity to improve.

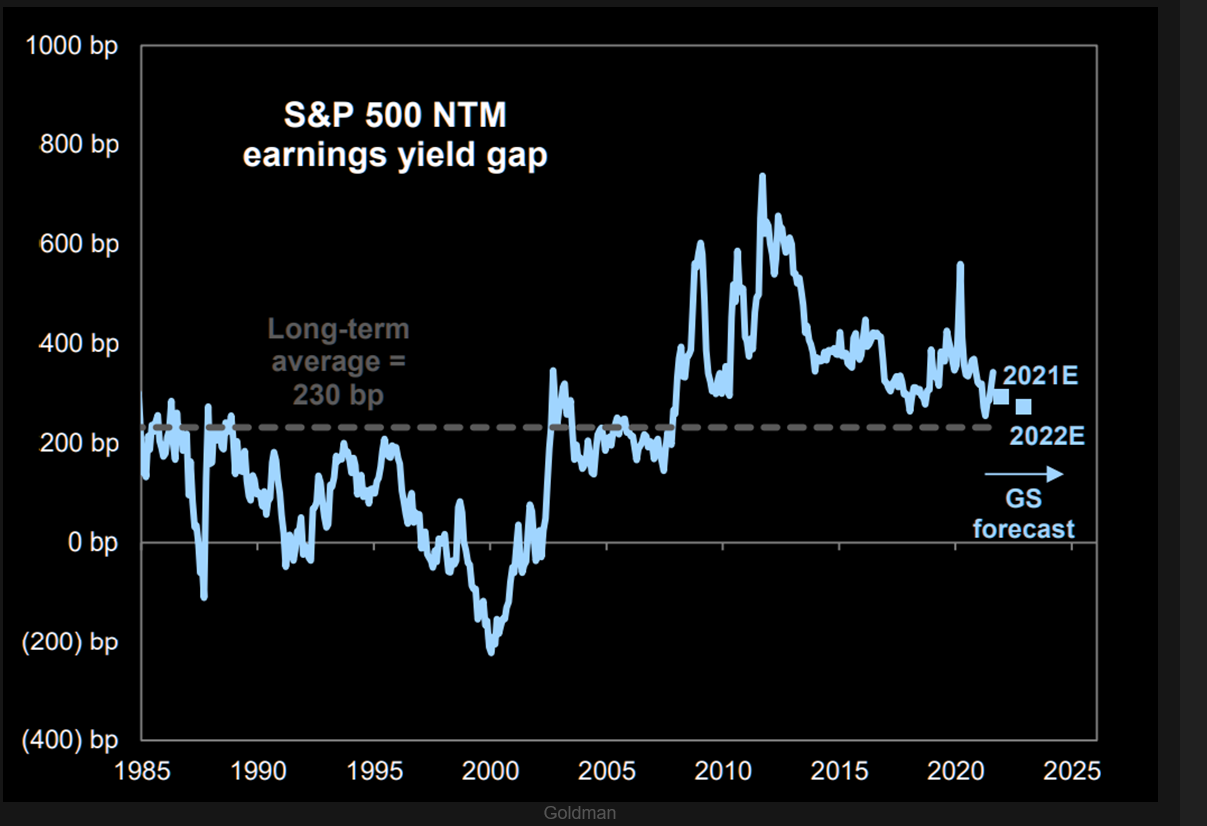

The relative valuation for equities vs 10-year treasuries is improving.

(Note: For those looking at Shiller CAPE Ratio valuation for the S&P500, please let me know if you’ve ever made money using the valuation metric to inform investment decisions.)

There are piles of cash in corporations that could be used for M&A and buybacks.

For the bears out there, I’d flag that the S&P500 tends to take a breather after it runs up 100% off a trough. So I’d encourage you stay diligent in investing across the market cycle and put money to work when we do get a pullback.

S&P500 Performance

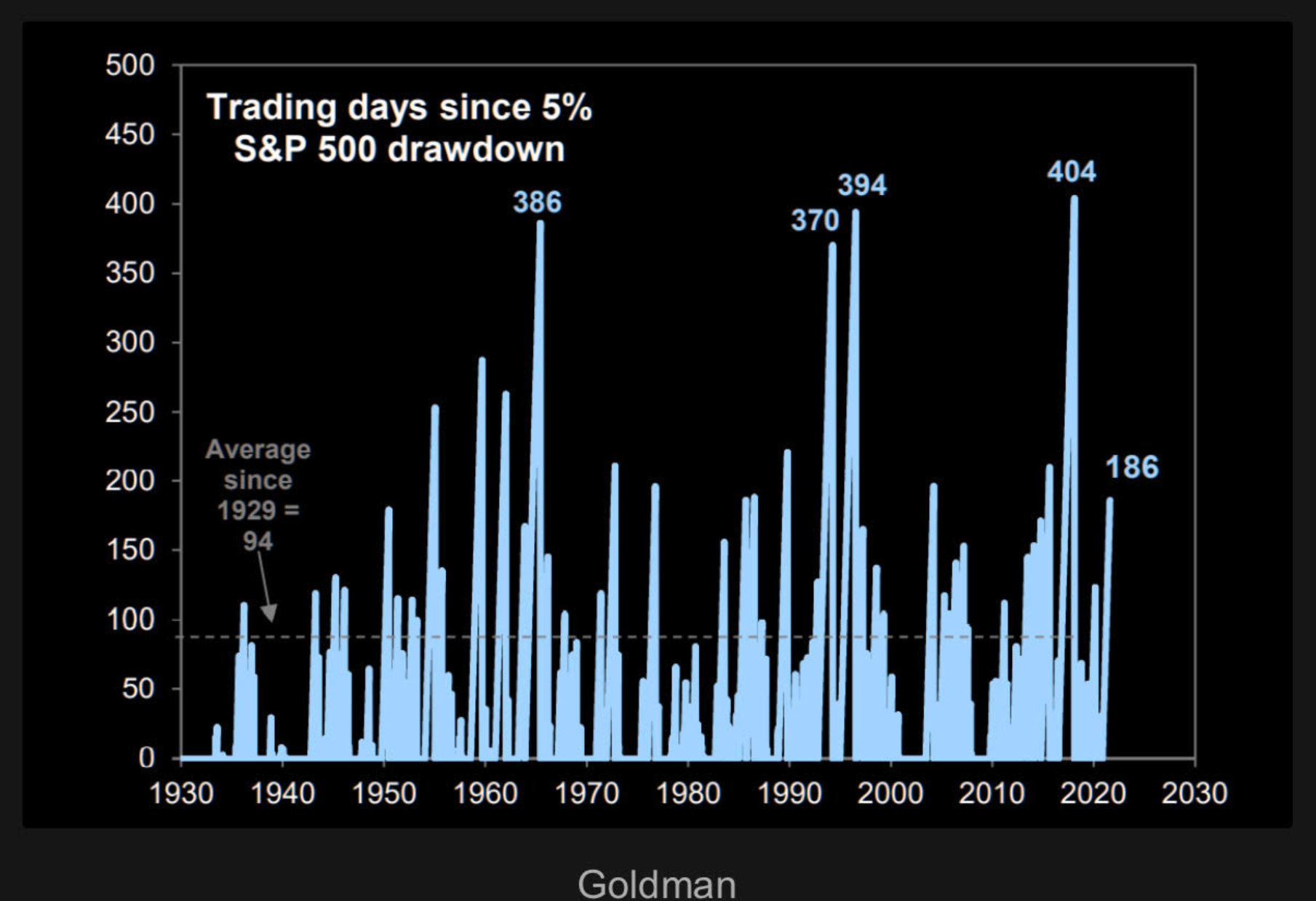

And we’re likely due for a pullback at some point in the next 200-ish days. After all it’s been 190+ days since the S&P500 last pulled back 5% or more.

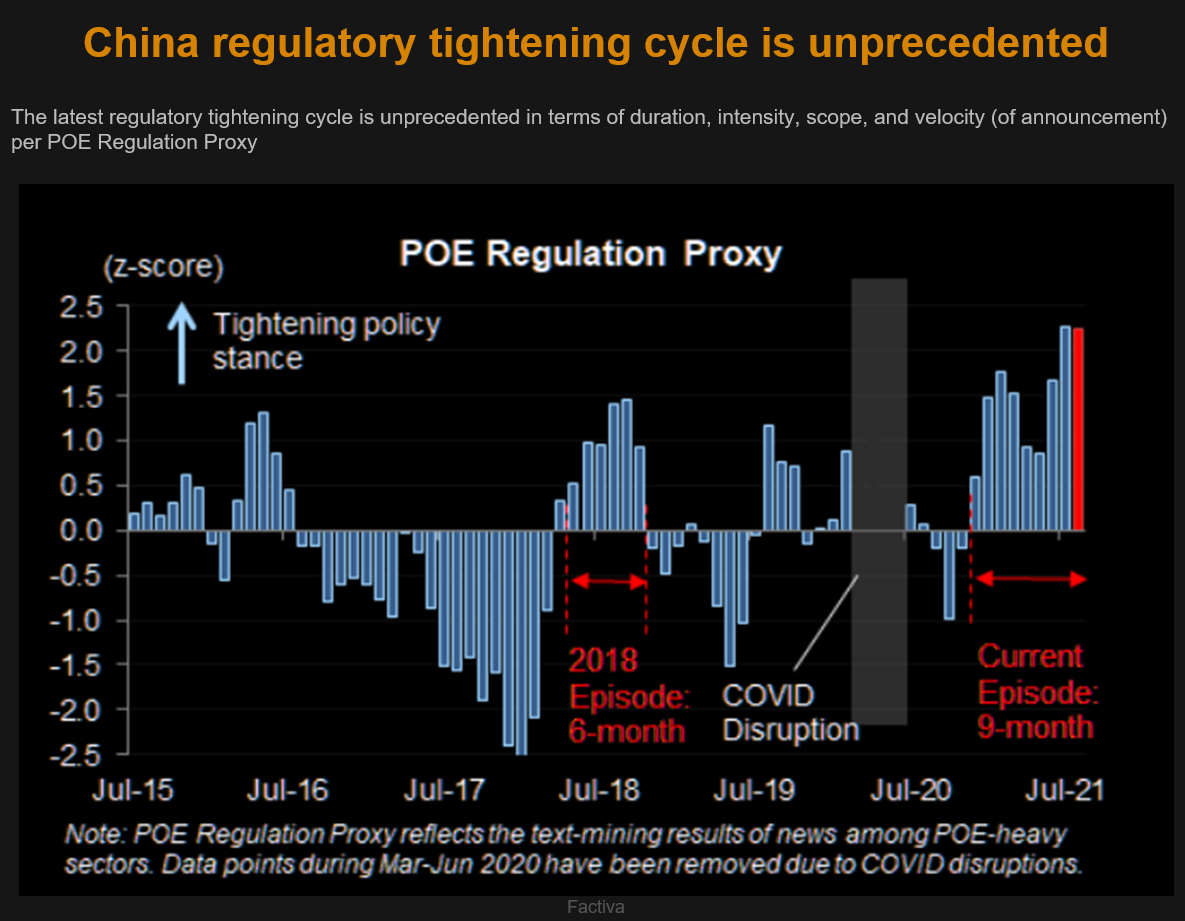

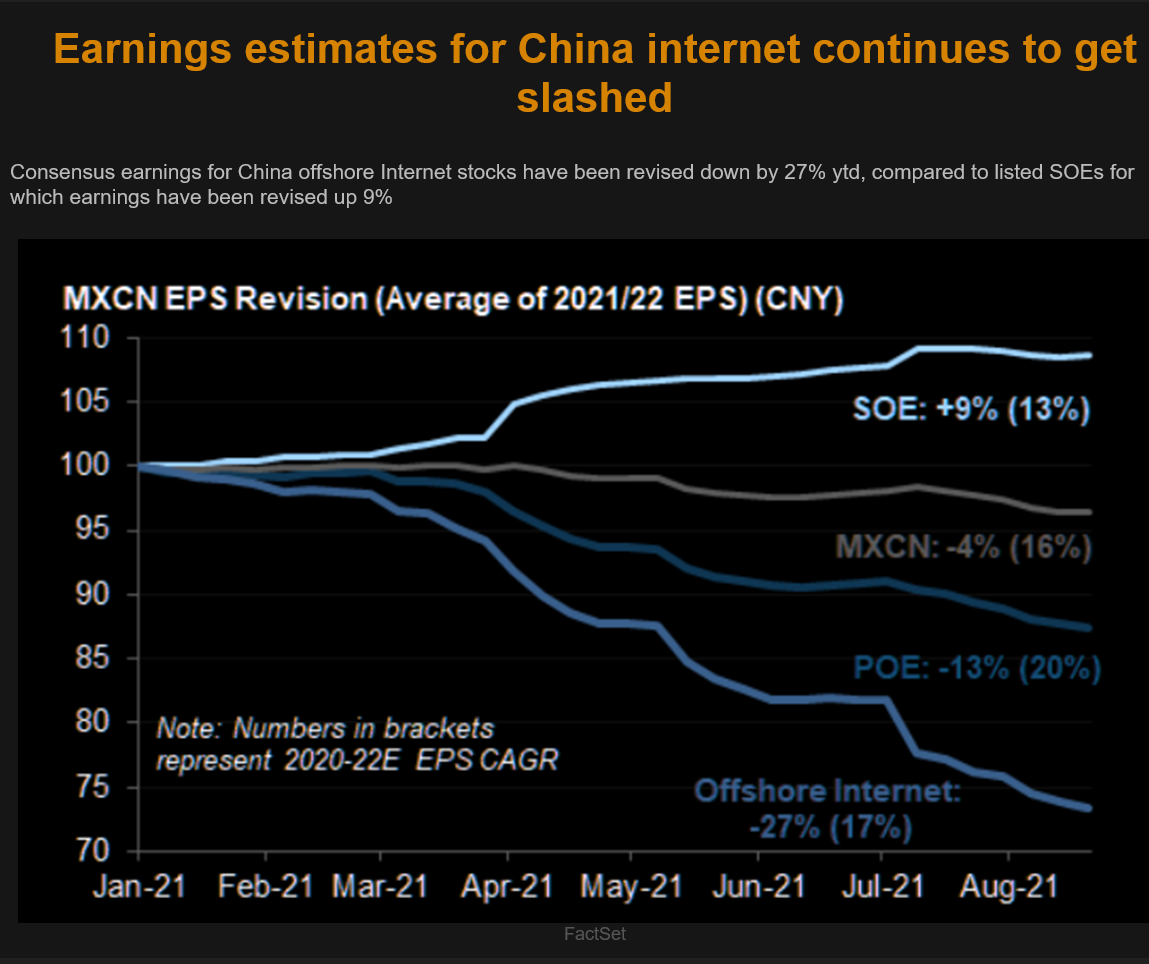

Finally, while I continue to believe that a policy mistake is the largest risk to this market, for context, I’d highlight the impact China has had on their tech, online learning and fintech sector with their recent policy decisions. I don’t see this as a policy ‘mistake’ but rather the product of competing agendas. If you’d like to dig deeper, I’d suggest the recent opinion piece Xi’s Dictatorship Threatens the Chinese State by George Soros that was published in the WSJ.

What's an investor to do?

At the risk of sounding like a broken record, I continue to recommend investors pursue a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets, while cash and alternative investments are used to reduce volatility and provide ballast for portfolios.

Over the longer term, investors can reduce the need for market timing and ‘hero market calls’ by saving and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Let me know if you’d like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2021.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.