The JJM Investment Group

November 12, 2021

View from the Street: Of Trains, Dividends and Autos

This blog looks at three disparate themes: The history of over-investing in a new technology (mid-1800s style); the banks and insurers return to their dividend-raising ways; and our opportunistic view of an industry in supply-chain distress

Railways, Overbuilding and Unclipped Coupons in the mid-1800s

The construction of railways in the province of Canada West, as it was known between 1841 and 1867, commenced in earnest by 1849. Taking over from canals as the chief mode of commercial transport, rail was the new technology of the mid-19th century, permitting the centralization of industrial production. Municipalities, banks and individual investors were only too eager to invest through equities and bonds.

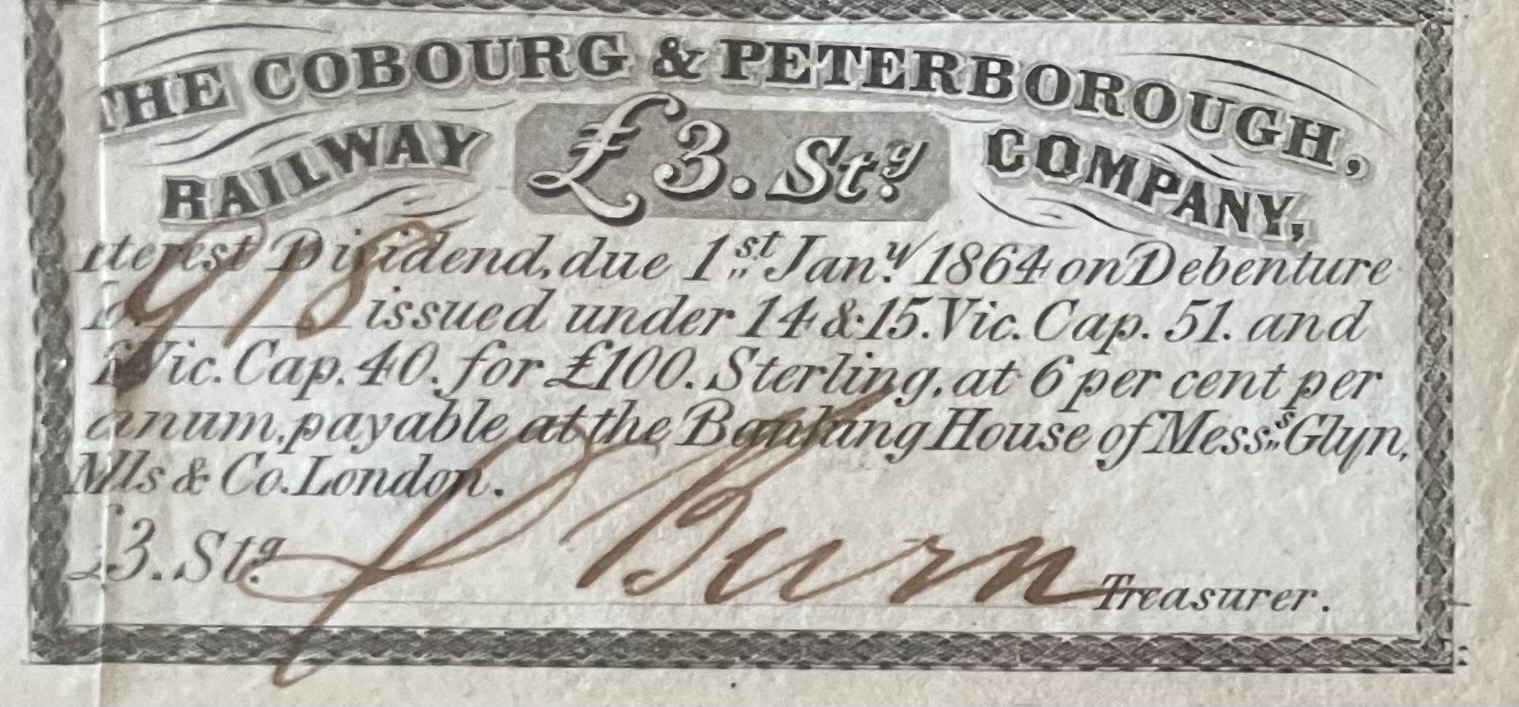

Over investment and excessive building, as evidenced today by the many old rail lines that now serve as bicycle paths, was the result, creating a series of economic and banking crises beginning in the late 1850s. The 6% Cobourg & Peterborough Railway Company debenture, issued in 1854 and pictured below, stopped paying interest by January 1864. Many financially strapped small rail companies failed, resulting in a major consolidation in the industry, much of it carried out by the Grand Trunk Railway of Canada.

Dividend Increases Set to Resume for Banks and Life Insurers

Since the onset of the pandemic in March of 2020, the Office of the Superintendent of Financial Institutions (OSFI) announced total restrictions on the increase in dividends and any share buybacks by banks and life insurance companies. We tuned in to Superintendent Peter Routledge’s address on November 4th, and, as expected, he announced that banks and insurers could indeed begin to raise dividends and resume share repurchases immediately.

We expect that the banks will move quickly on dividend increases when they release their fourth quarter results between November 30 and December 2. TD (current yield 3.2%) and Royal (4.3%), for example, will likely announce dividend increases of 5% to 25% over the course of next year, with some moves taking place within the next month. Great West Lifeco (current yield of 4.6%) will probably move its dividend up by 10% to 15% with its next earnings report, due in early February. Sunlife and Manulife moved quickly to hike dividend payments up by 20% (announced November 8) and 18% (November 5).

We have long incorporated the theme of rising dividend yields as one key criterion of our stock selection process. Finally after over one-and-a-half years, this key sector will contribute to our clients’ growing cash flow experience.

Automobile Manufacturing and Magna

In the view of our analyst, Kevin Chiang, “auto production will benefit from an extended peak period given the demand and inventory environment.” He suggests in a report published on November 5, 2021, that investors are underestimating the earnings/FCF [Free Cash Flow] recovering opportunity in MGA [Magna] as we look past the supply chain disruption issues.”

Not surprisingly, the most recent 3rd quarter report proved underwhelming, with earnings coming in at $.56 (all figures in U. S. funds) per share versus last year’s $1.95. Ultimately, Kevin sees earnings potential of $9.10 per share in 2023 with free cash flow of $7.78, for an impressive free-cash yield of 9.2% based on the current price of the shares at $84.55. While the company is hardly reporting peak earnings as yet, its staying power is evidenced by a strong balance sheet, with cash on the books of $2.7 billion and unused credit of $3.5 billion of its $3.8 billion limit.

Despite the surge over the past 1.5 years in the shares of companies exhibiting negative profits, we believe earnings, cash flows, dividends and balance sheets still matter. We are now starting to see some major cracks in the former category. As Eric Savitz wrote in the November 8th issue of Barron’s, “Investors have abandoned the pandemic trade over the past few trading days […].” We look to buy stocks in great companies and hold them, ideally for long periods of time (overvaluation or manage missteps notwithstanding). For the individual investor, the average time horizon for owning a stock is 5 months and we expect that our clients can benefit by their impatience.