The JJM Investment Group

June 10, 2022

View from the Street: Inflation & Interest Rates—We have lift off

The fine line facing the Federal Reserve and the Bank of Canada in their efforts to quell inflation and manage the expectations message.

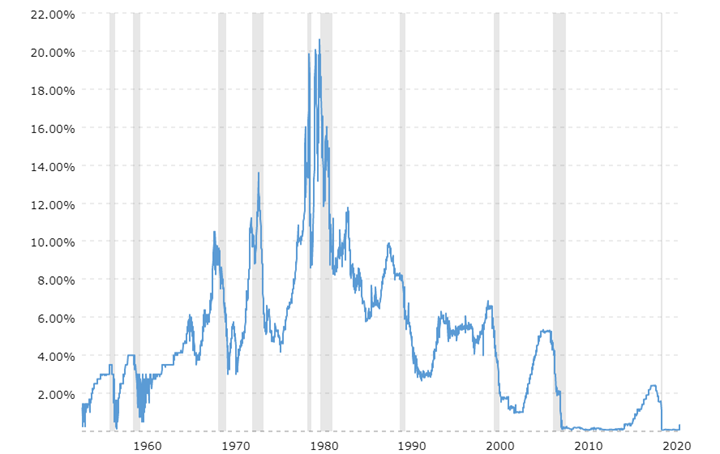

While it could be argued that central banks have been spoiling us over the last thirty years with interest rates that had dropped to record lows of late, the race is now on to reverse that trend. The 62-year chart, below, shows just how low the Fed Funds rate plunged following the financial crisis of 2008-09 and more recently at the onset of the pandemic in 2020.

Chart courtest of MacroTrends LLC: "Federal Funds Rate - 62 Year Historical Chart" date as of June 8, 2022

With decades-high inflation, the Bank of Canada and the Federal Reserve have sent out clear warnings that interest rates will be on the rise. This represents a tough monetary measure that, along with the intention of bringing down pricing in the economy, can also have the effect of “weakening demand and thereby raising unemployment” (Charbonneau and Shenfeld). The authors of the accompanying report state that central bankers, with their strong messaging on interest rates, are just as keen to quell the expectations that people may have about inflation and its future prospects as much as they are to deliver the medicine of tighter monetary policy.

Moving interest rates up carries risks as the authors indicate: “They could tighten too much and too fast, and their desired slowdown turns instead into an outright recession.” Conversely, by moving too slowly they could find inflation a problem that becomes very difficult to contain. As for the hard messaging, is the person in the street listening? It may be that BoC Governor Macklem and Fed Chair Powell have to carry their tough talk beyond the pages of The Globe and Mail Report on Business and The Wall Street Journal to Twitter and TikTok.