The JJM Investment Group

May 26, 2020

View from the Street: Where We Go From Here – Some Historical Perspective

We have just experienced the most abrupt of bear market corrections in history. From February 19th to March 23rd the S&P500 dropped 33.9%. This has been followed by a very rapid rebound.

Stating the obvious, this pandemic has triggered an unprecedented shockwave to our society, the economy and to markets. Questions related to the depth and duration of the economic and market contraction, the timing and strength of the eventual recovery, the success in finding a treatment or vaccine, and the effectiveness of various government policies – measured in trillions of dollars! – are admittedly very difficult to answer.

Will the equity market recovery be V, U, L or W-shaped? The best-case scenario would be a V-shaped recovery where the market’s sharp decline is followed by a quick and somewhat permanent reversal. While we can’t know for certain where markets will head in the short term, we can look at past market declines and recoveries for some helpful insights. It goes without saying that no two situations are identical and, as Howard Marks of Oaktree capital recently said in one of his more notable memos : “…if you’ve never experienced something before, you can’t say you know how it’s going to turn out.”

Starting with earnings, and looking at the S&P500, analysts are projecting record results for 2021. We can say fairly confidently that the lasting adverse impacts from COVID-19 will result in a lower growth rate well into 2021, and likely beyond, and that we will not be returning to record earnings next year. Those analyst projections, in our opinion, are far too optimistic. For the time being, we believe we will experience a slow-growth economic environment.

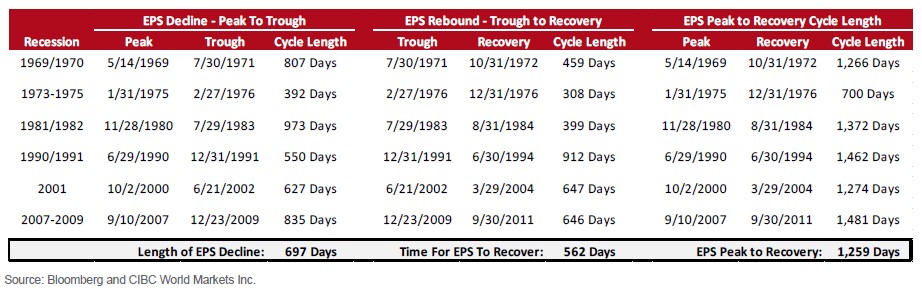

If we take a look at past recessions, we can see that, on average, it has taken 1,259 days for earnings to return to peak levels.

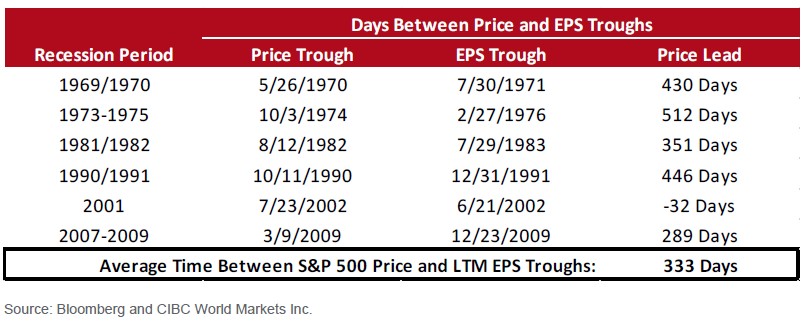

Markets tend to be forward looking and it should be expected that they will bottom before earnings do. As CIBC strategist Ian de Verteuil points out in his March 23rd report, “Two Variables For Considering The Market Bottom,” if it takes two years for earnings to trough (see first chart), then stocks historically would wait one year before resuming a convincing uptrend. This makes us a little suspect of the recent, and very rapid, rally off the March 23rd lows.

We cannot say for certain what is ahead of us or when the recovery will happen. While the media and some prognosticators may have an opinion, it is worth noting what John Kenneth Galbraith once said, “We have two classes of forecasters: Those who don’t know – and those who don’t know they don’t know.”

It’s important that investors maintain a long-term perspective and never revert to a short-term, reactionary approach. Usually, the best course of action is to do nothing. We have structured our clients’ portfolios to withstand shocking and unnerving events. Our job is to ensure that clients can continue to meet current and long-term objectives while we go through this uncertain period.