The JJM Investment Group

November 13, 2020

View from the Street: Canadian Banks, PCLs and the Kitchen Sink

The Canadian banks have faced a difficult year in 2020. That might prove to be good news for 2021

Since the banks represent such a big part of the S&P/TSX index, our clients often ask us our opinion on this group. The Canadian banks will report their fourth quarter results in early December and it may be that all six report another big quarter of Provisions for Credit Losses (PCLs). But, before we discuss that issue in more detail, there are of course other factors that affect a bank’s performance and profitability and one in particular we will discuss.

The net interest margin, or NIM, represents a measure of interest income generated by a bank’s loan portfolio versus the interest expense paid on money held on deposit. In his September 1st report, our bank analyst, Paul Holden, characterized the net interest margin experience for the banks’ third quarter as “worse than expected”[i]. An increasing deposit base added to interest expense, while net interest income actually dropped by 2% year-over-year, representing “the first negative quarter since the end of 2009” [ii]. After all, everyone knows how cheap it is to borrow these days!

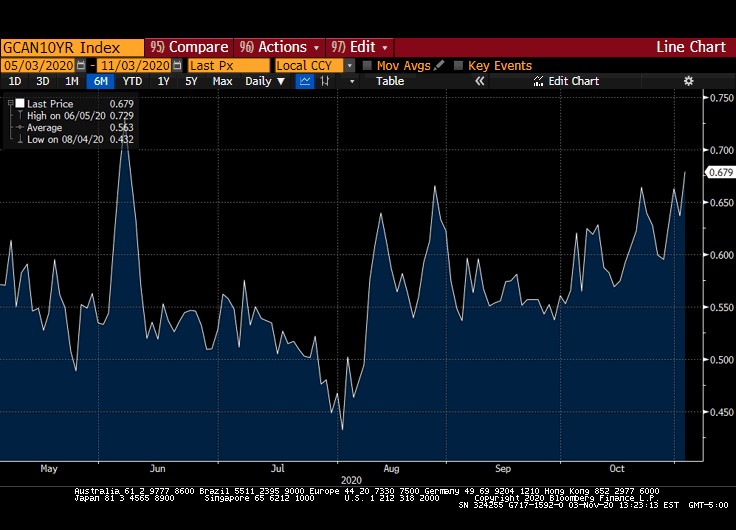

As long as interest rates remain low, the banks will be challenged to see an expanded NIM. The one hope on the horizon is that interest rates rise. After generally falling for almost 40 years and most recently reaching a record low of 0.43% as defined by the Government of Canada 10-year bond yield, just recently rates have shown some life to the upside. Now standing at “only” 0.69%, that is nevertheless 60% higher than the level hit in early August (please refer to chart 1).

Chart 1

The Government of Canada 10-year Bond Yield

Source: CIBC World Markets Inc. Fixed Income Desk

Provision for Credit Losses (PCLs), a guesstimate of what banks will eventually report as loan losses, have rightly gained a lot of attention as of late and are also a key consideration when assessing the profitability of banks. Credit Suisse bank analyst Mike Rizvanovic, in his September 3rd report, estimated that loan loss provisions are likely to be reported at $26 billion for the year ended October 31, 2020[iii] . However, and this is key, as time goes on, the banks may alter that number to the downside as it becomes clearer what amount of those provisions will actually result in true and permanent losses to the banks. He estimates the ultimate figure may be closer to “only” $19 billion, allowing the banks to recapture almost $7 billion into earnings. This would represent a big boost to bank profits in the year ending October 31, 2021.

It will not be long before we have a clear line on the annual PCLs report for the big six. Keep in mind that the banks provisioned almost $7 billion in the 3rd quarter and $11 billion in the 2nd quarter. The question is, will they collectively throw in the kitchen sink in the fourth quarter by provisioning a large number? We will soon find out. The irony is, that, all other factors remaining equal, such a negative report may provide opportunity for investors to buy since we take a long term view into 2021 and beyond.

For your reference, here are the reporting dates for each of the big six banks:

| Bank of Nova Scotia | December 1 |

| Bank of Montreal | December 1 |

| National Bank | December 2 |

| Royal Bank | December 2 |

| CIBC | December 3 |

| TD Bank | December 3 |