The JJM Investment Group

December 10, 2020

View from the Street: Some Subtle Signs of a Healthy Stock Market

We’re seeing some healthy activity in the markets recently beyond just the ‘growth’ to ‘value’ rotation that everyone was talking about last month.

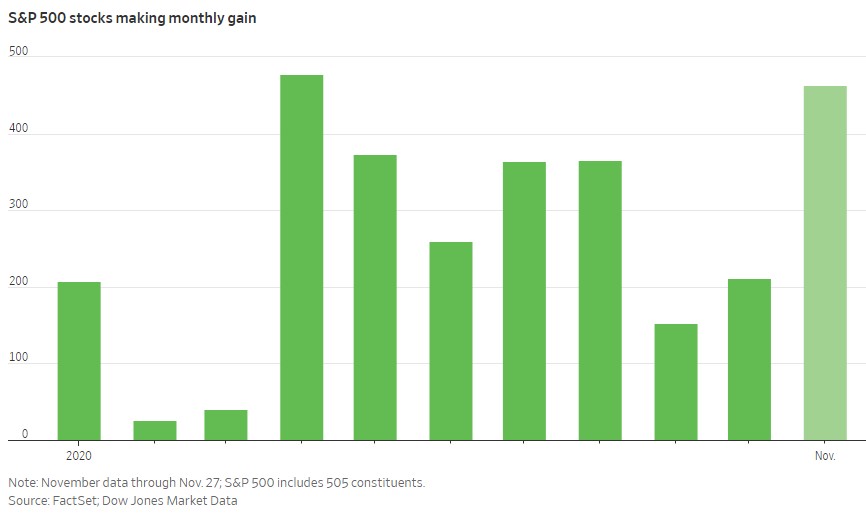

Pfizer’s announcement of its Phase 3 COVID-19 vaccine trial caused markets to rally and investors to start rotating out of the ‘work-from-home’ winners over to many of the ‘value’ laggards. Rays of optimism were peeking through and investors could begin to imagine a light at the end of the tunnel. Up until this point, this bifurcated market has been characterized by a small group of perceived Covid-19 winners, with the majority of companies being entirely overlooked. The narrowing of market breadth, a metric that captures the concentration of leadership in the market, has historically been a negative indicator for the health of the overall stock market. The fact that very few stocks were leading this market since the lows reached on March 23rd was not perceived as a long-term positive (Chart 1).

Chart 1

In a November 27th article, Karen Langley of The Wall Street Journal pointed out that so far in November, 464 stocks in the S&P 500 are up for the month, the largest share for any month since the April resurgence. In October, by contrast, 212 stocks in the benchmark index gained ground. In September, only 153 did so (Chart 2).

Chart 2

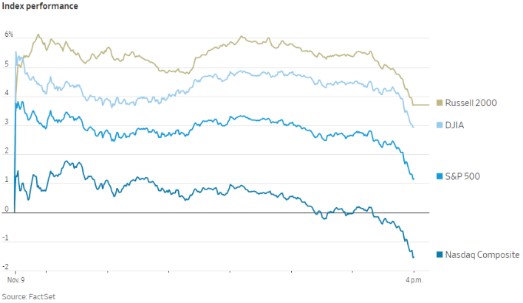

Lately, we have witnessed a structural shift from the tech heavy NASDAQ index, and more specifically, the FAANGM stocks (Facebook, Amazon, Apple, Netflix, Google and Microsoft), to the more value-oriented blue-chip Dow Jones Industrial Average (DJIA) and small-cap Russell 2000 indexes, which started immediately following the news from Pfizer on November 9th (Chart 3).

Chart 3

On that day ‘value’ stocks outperformed expensive ‘growth’ stocks by the widest margin of any single day since the 1930s. While many were quick to call this the inflection point where ‘value’ will begin to outshine ‘growth,’ we are not so quick to come to that conclusion. Our observation is that we are simply seeing more broad-based leadership and positive market breadth, something that has been lacking for many months. These are some subtle, yet positive indicators for the health of stock market currently.