The JJM Investment Group

June 08, 2021

View From The Street: From “Fiction” To “Fundamentals” as the Recovery Takes Hold

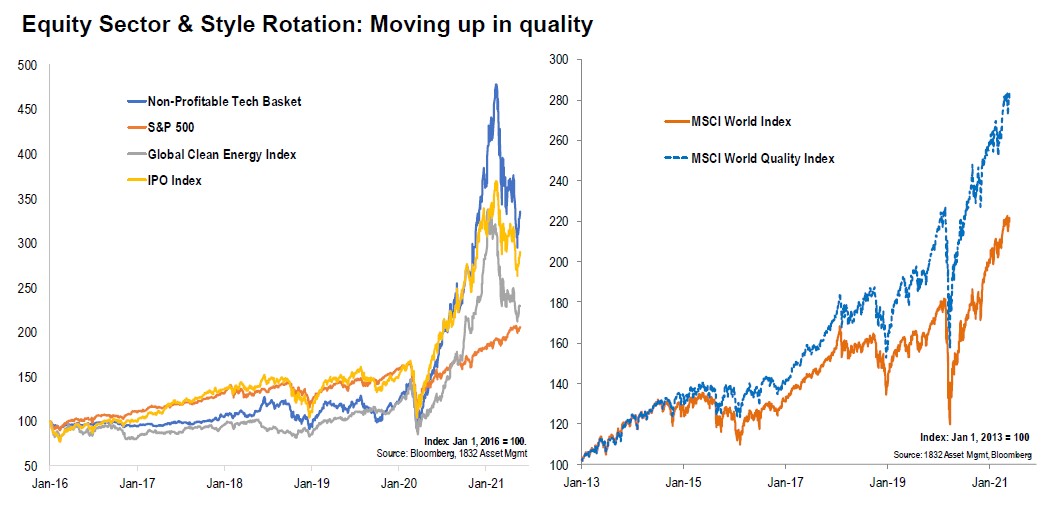

Stocks that were propelled higher by rousing stories and huge growth expectations are now coming under pressure as investors place more emphasis on fundamentals.

2020 was marked by a small group of stocks leading equity markets higher. A common theme amongst this group was that they had compelling stories yet little fundamental support to justify where their share prices were trading. This sort of “low-quality” leadership off a market low, like we experienced back in March 2020, is typical. However, now that we are starting to see material evidence of corporate improvement – for example, global earnings per share (EPS) are expected to rise by more than 50% this year (Chart 3) – we are seeing a transition take hold (Chart 1). The shares of companies that offer more visible and reliable earnings streams and trade at reasonable valuations, which we favour for the serious long-term investor, are being rewarded. Historically, fairly valued high-quality companies tend to outperform expensive issues over the long term. When we state expensive we are not implying low-quality. Many are in fact outstanding businesses that are growing rapidly. However, the expectations baked into their valuations present a real risk to the downside because investors are vastly overpaying for what these stocks should realistically be worth (see our July 2020 blog where we speak to this: The S&P 500 and Cisco: A Historical Perspective).

Chart 1

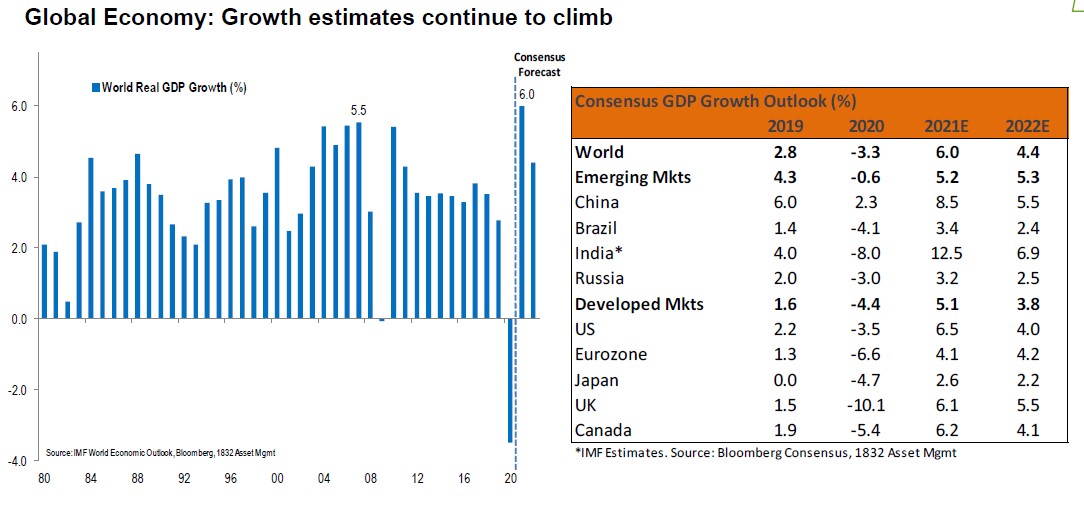

Touching briefly on the economy and corporate earnings, GDP growth estimates continue to climb and are coming in at 6% and 4.4% for the world economy in 2021 and 2022, respectively. 2021 GDP growth, albeit off very low levels (negative, in fact), will register the largest annual increase in over 40 years (Chart 2).

Chart 2

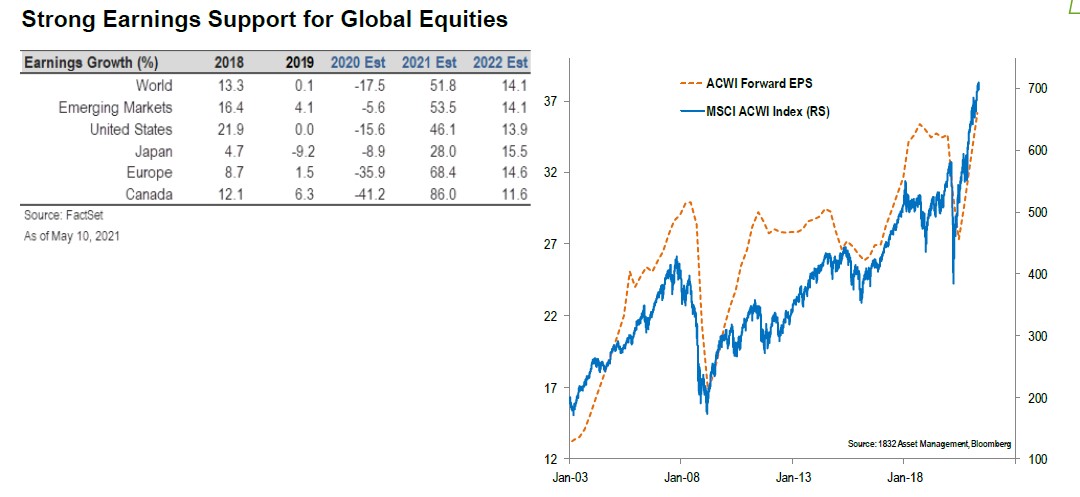

Also, as mentioned above, Global EPS is expected to increase by more than 50% this year and the stage is set for earnings to expand at an above-average pace over the next few quarters, which should provide support for share prices that are trading at modest valuations (Chart 3).

Also, as mentioned above, Global EPS is expected to increase by more than 50% this year and the stage is set for earnings to expand at an above-average pace over the next few quarters, which should provide support for share prices that are trading at modest valuations (Chart 3).

Chart 3