The JJM Investment Group

July 30, 2021

View From The Street: Summary Thoughts

Inflation revisited, value investing, companies as users of technology and how are credit conditions?

The Question of Inflation, Revisited

Are the current rates of inflation in the United States transitory or likely to persist much longer than central bankers suggest? The answer to that question and the actual posted rates of inflation in the coming months are important issues for investors to consider when investing in equities, bonds or preferred shares. A recent report by Credit Suisse’s Jonathan Golub notes that the CPI (Consumer Price Index) rose 5% in the last 12 months but is closer to 8% based on the most recent annualized 3 months.

The debate rages on whether this trend in inflation is indeed a temporary phenomenon or about to become a serious longer-term threat. Both Jerome Powell, the Chairman of the Federal Reserve Board (the central bank of the United States) and the “collective bond market” believe the former scenario. Ten-year U.S. treasury bond yields, which have been stuck in a range of 1.20% to 1.60% and now stand at 1.28%, would be much higher if we “knew” that inflation was indeed going to remain at 5% or edge upward. (Over the long term, Interest rates track the moves in inflation.)

Meanwhile, consumers will tell you that they are feeling the effects of inflation. “Living is expensive” is how one acquaintance summarized the current state of consumer affairs.

Old-Fashioned Investing: Value Stocks

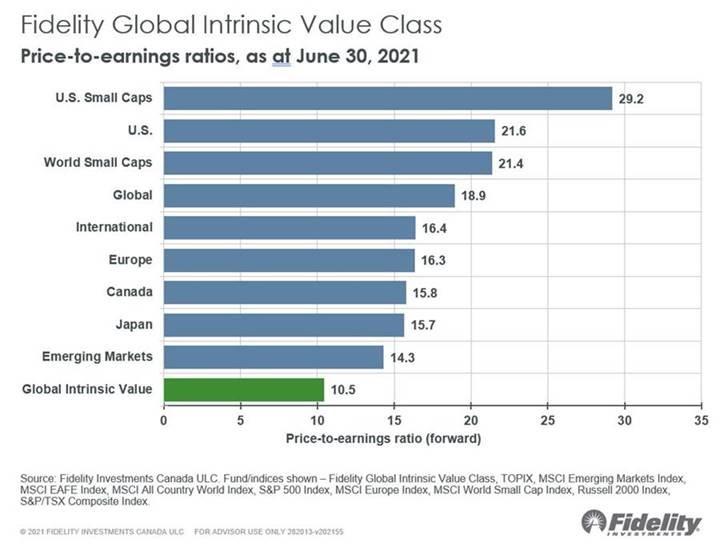

The forward price earnings multiple of value stocks is showing the greatest discount to growth stocks in over 20 years. That discount is now 50%. Certainly, Joel Tillinghast of Fidelity Investments is a proponent of value investing and has the numbers to prove it. As at June 30, 2021, the stocks in his Global Intrinsic Value Fund traded at (an amazingly low!) 10.5 times earnings in stark contrast to the price earnings multiples of major indices around the world.

Looking for Companies as Effective Consumers of Technology

A large Toronto-based portfolio manager, in a recent call to our investment group, suggested that competing technologies are becoming “pervasive,” suggesting to him an eventual loss of pricing power by some of these suppliers. His preference was to seek out companies that are using that technology as a means of staying ahead of the competition.

CEO Charles Brindamour, in the 2020 annual report of Intact Financial, Canada’s leading property and casualty insurance company, stated that “transforming our competitive advantages is key to our outperformance mindset.” Those advantages include the expansion of “digital options [for their customers] through our market-leading insurance apps and telematics capabilities… [and the company’s] unparalleled access to data.”

According to analyst Steven Alexopoulos at JP Morgan, First Republic Bank of San Francisco, which partners with over 100 fintech firms, “is emerging as one of the most digitally savvy banks in the US” (Alexopoulos, JP Morgan, January 15/21, p. 2) which is proving an important means to assist in growing the business and taking market share from its competitors.

Credit Suisse First Boston analyst John Walsh credits the purchase of Intelligrated in 2016, FLUX in 2017 and Transnorm in 2018 as key to the goal of Honeywell to gain market share in the automated warehouse business. Of course warehouse space, of which Dream Industrial REIT is a major international owner, remains fundamental in the push to grow e-ecommerce.

These four names, which can be found in our North American Equity Portfolio, represent just a few examples of the companies that are realizing market share gains in large part due to their commitment to invest in technology.

How’s Credit?

We keep a close eye on the difference in yields between the 10-year U. S. treasury yield and that of the 2-year. We also keep a watch on the general availability of credit in the markets for both consumers and businesses. The chart below still shows a healthy spread between the two bonds, a harbinger of strong credit conditions.