The JJM Investment Group

September 01, 2021

View from the Street: Dividends Likely to Become More Important for Total Returns

A recently released report discussing how dividends are likely to take on increased importance as the growth component of equity returns are likely to moderate. The author of the report is CIBC World Markets portfolio strategist, Ian de Verteuil.

CIBC World Markets portfolio strategist, Ian de Verteuil, recently published a report entitled Diving Into Canadian Dividends, and we decided to summarize a few key points from his analysis. If you would like to read his entire report please reach out to Cole Desgagnes who can send you a copy: cole.desgagnes@cibc.ca.

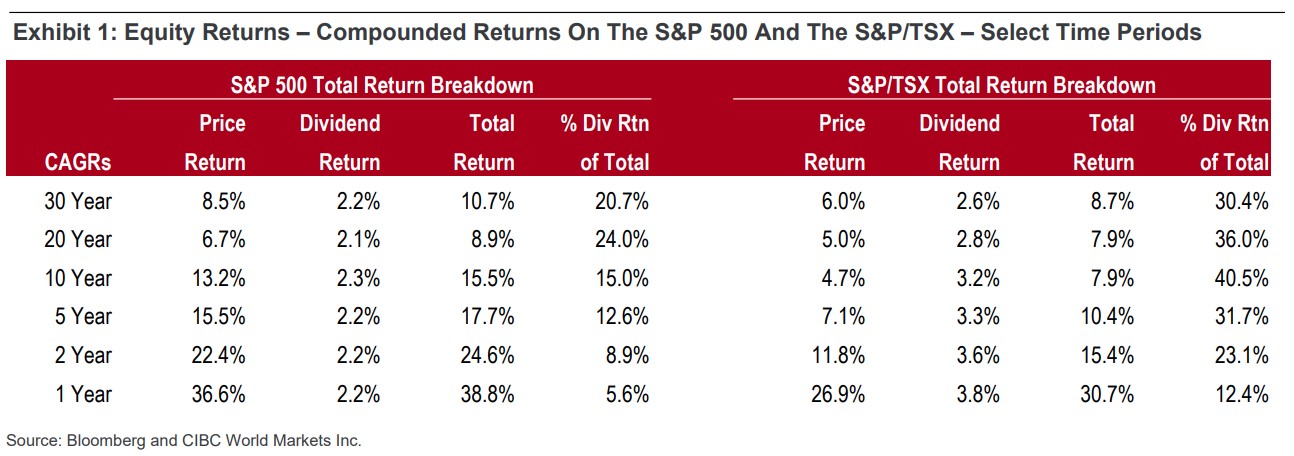

The crux of Ian’s report is that dividends are likely to take on a more important role in generating total returns and should not be overlooked, especially as he expects equity price increases to moderate. As you can see in the illustration below, which provides a breakdown between price and dividend returns, the latter has been responsible for over 20% of aggregate gains for the S&P 500 and over 30% for the S&P/TSX over the past 20 and 30 years.

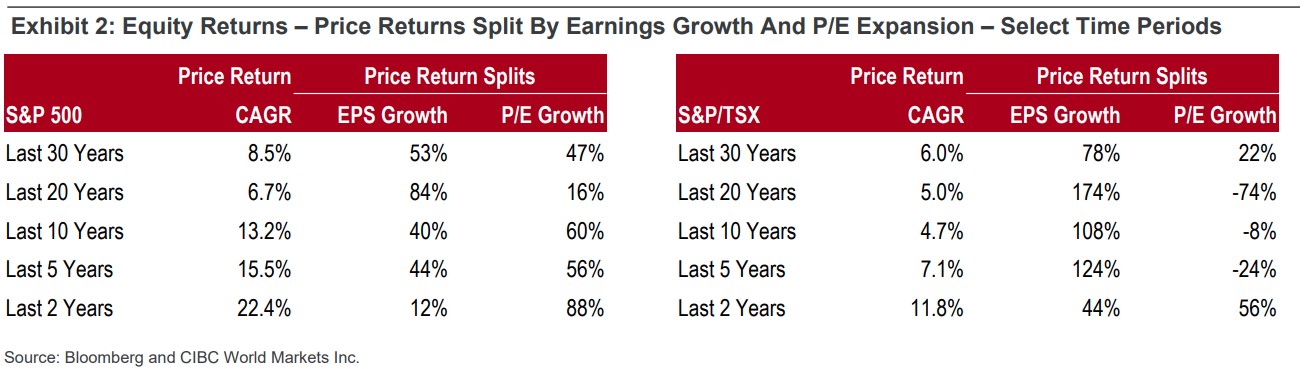

There is no question that price, not dividends, has been the key driver of investor returns lately. However, Ian believes that investors should anticipate more moderate growth in equity prices in the future. As he states, “against this backdrop, it is worth considering how much of recent returns have come from earnings growth (which will continue) and how much from multiple expansion (which cannot continue indefinitely).” He further states that “over the past two-, five- and ten-year periods, 88%, 56% and 60% of price returns, respectively, have come from P/E expansion within the S&P500.” See the illustration below.

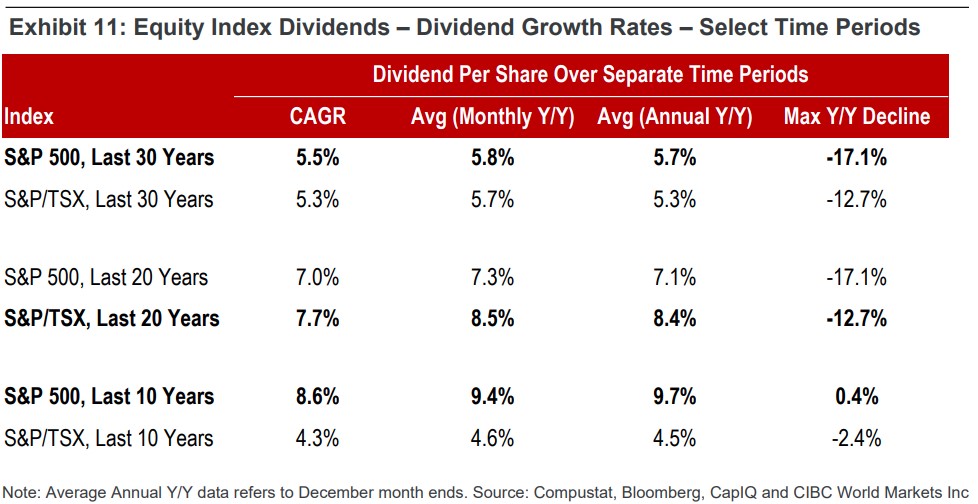

Another important aspect for investors to consider is the ability of a company to grow their dividend, something we are constantly on the lookout for when selecting stocks for our JJM North American Equity portfolio. The importance of dividend growth cannot be overstated. Looking at the chart below, the stocks in the S&P 500 have compounded their payouts at an annual pace of 8.6%. Put another way, an investor earning $1 in dividends 10 years ago is now receiving $2.28 today. Our clients have experienced a similar dividend growth rate in the JJM North American Equity portfolio.