Peter White

August 02, 2024

A Human take on AI

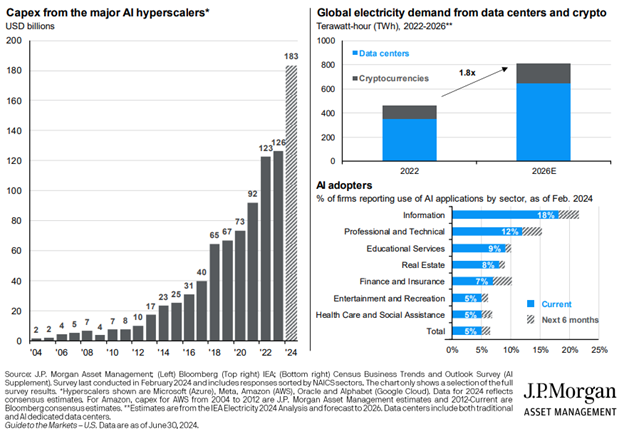

AI has absorbed a lot of airtime over the past year, and certainly has driven a lot of the market’s returns since the beginning of the year. What is very clear is that AI capital expenditures have been staggering, as evidenced by the chart below, while the value proposition (ie. profitability) of those investments remains to be seen. The oft-quoted figure (courtesy of Sequoia here) is that the industry spent $50B in chips from Nvidia in 2023 to generate only $3B in revenue. And that’s before we factor in the massive rise in costs (electricity, content licensing, etc) that should accompany the revenue growth to come.

Anyone who has used one of the user interfaces with large language models like Chat-GPT, Gemini or Claude with any degree of consistency can attest to the massive leaps in productivity they can provide. Let’s face it, I could have used Chat-GPT to write this blog post in seconds (I didn’t), and it would have produced a half-decent, loosely factual, well-constructed summary of what I’m writing now.

What we are confident in is that we are in the early days, and life will change for us all in the years ahead in ways that we can hardly imagine right now. I doubt many of us would have imagined 20 years ago how social media would have changed our communication modes, our social lives, and our politics in the manner it has 20 years later.

The New York Times columnist Ezra Klein has a fascinating podcast series on AI, which I’d encourage you to take a few hours to listen to if you’re so inclined. The first episode discusses how to use AI platforms right now, the second is how the internet and social media may evolve as AI-generated content comes to dominate the air waves, and the third is how AI’s capabilities may rapidly accelerate and evolve, and the ways we can shape policy and advance technology to harness its capabilities and manage its potential risks. I found the last podcast particularly informative, though a bit disturbing, since it takes the form of an interview between Klein and Anthropic’s co-founder, Dario Amodei.

The podcast is available on the New York Times here, here and here, on Apple Podcasts here , and on Spotify here, under the titles:

- How Should I Be Using A.I. Right Now?

- Will A.I. Break the Internet? Or Save It?

- What if Dario Amodei Is Right About A.I.?