Calvin Tenenhouse and Peter White

November 11, 2025

Same As It Ever Was: Reflections on AI and the Internet's Early Days

History doesn’t repeat, but it does rhyme, and this generation of wealth managers and asset allocators has a unique opportunity to create (or impair) wealth with AI investments just as a previous generation did with the rise of the internet. With the excitement surrounding AI investments, its hard not to draw comparisons between the current investment landscape and the late 1990’s .com bubble. For background, The .com bubble was a period of rapid, speculative growth in U.S. technology stocks that peaked in March 2000, followed by a sharp crash in 2000–2002. Although the internet profoundly changed our world, its real impact was not felt till the mid-2000s. This longer-than-expected time scale caused a major sell-off, erasing trillions in market value.

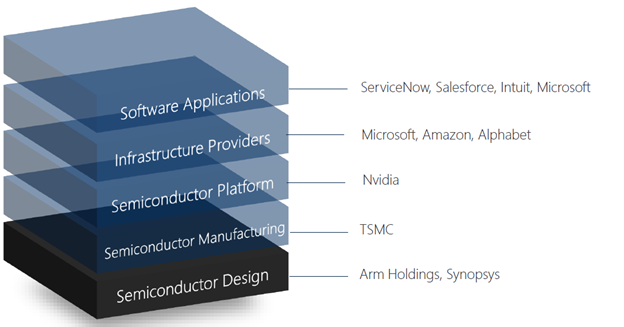

As was well written in an article by Sustainable Growth Advisors - the original internet plays, companies such as Cisco Systems, Sun Microsystems, Lucent, Nortel and JDS Uniphase did not prove to be the long-term wealth compounders. In fact, some proved to permanently impair investor capital who came late to the party. In hindsight, it was the consumer and business software application companies built on that infrastructure – such as Google, Amazon, Microsoft and Salesforce – that generated sustainable wealth creation for their owners.

With that in mind, let’s explore some of the key similarities and differences between the AI boom and what we saw in the late 1990’s.

Key Similarities:

- The 1990s were marked by a sustained period of U.S. market dominance

- Powell’s cuts in 2024 and 2025 resemble the Fed easing cycle of 1995

- Market behavior post-Liberation Day (April 2025) is tracking closely to 1998 post-Long Term Capital Management, where:

- The Fed cut rates 3 times

- Valuations expanded

- Markets entered a speculative phase

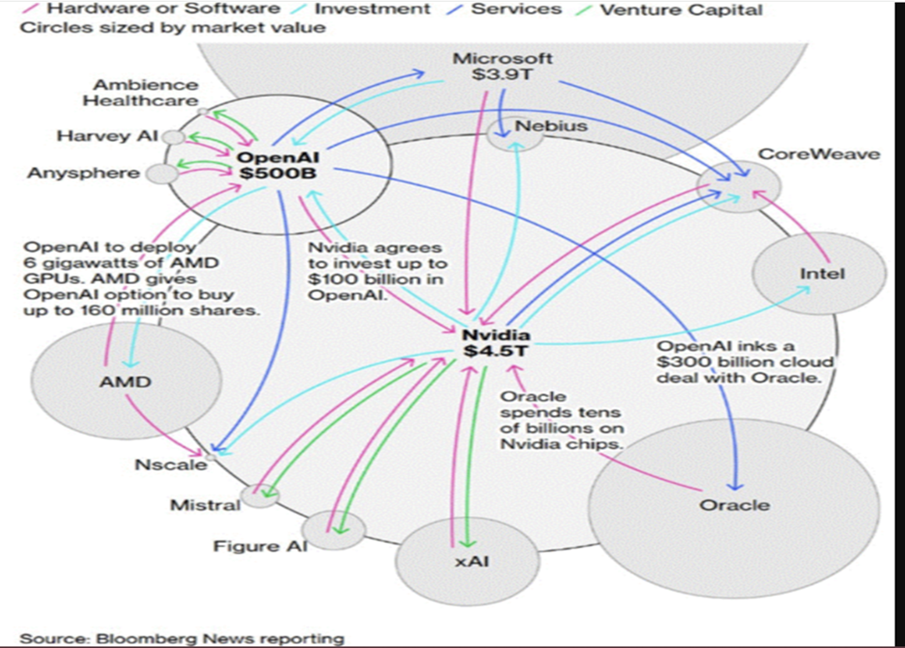

- Key players like OpenAI, and Nvidia are engaging in circular financing (figure1 ) – with equity investments being used to purchase digital infrastructure – as evidenced by the graphic below. This resembles the “reciprocal transactions” of the 1990s where among internet media and software companies, one firm would buy advertising from another, and in return, the second company would buy software or services from the first. These artificial arrangements boosted the reported revenues for both companies without generating any real value.

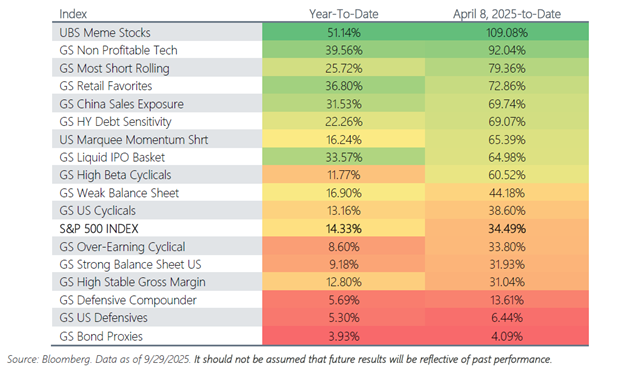

- Unprofitable tech stocks are surging in value, signaling wider risk-taking by individual investor.

Figure 1

Figure 2

Key Differences:

- The AI boom is fueling the rally, but IPO activity remains muted—a key difference from 1999-style mania. A true bubble would involve rampant IPOs and valuation overshoots, which aren’t yet visible.

- Mag 7 (Microsoft, Apple, Nvidia, etc) valuations are elevated, but not extreme. The Top 10 companies in the S&P 500 trade for 29.9x earnings, which is well above the market as a whole (19.5x), but still below the extremes of the 1990s, when their valuations peaked at 43x earnings (source: Bloomberg).

- The Mag 7 have generated steady double-digits earnings growth, have strong balance sheets, and massive moats around their businesses with dominant share of market - making them difficult to compete with. Even with the billions of dollars in AI investment, they aren’t running out of cash anytime soon.

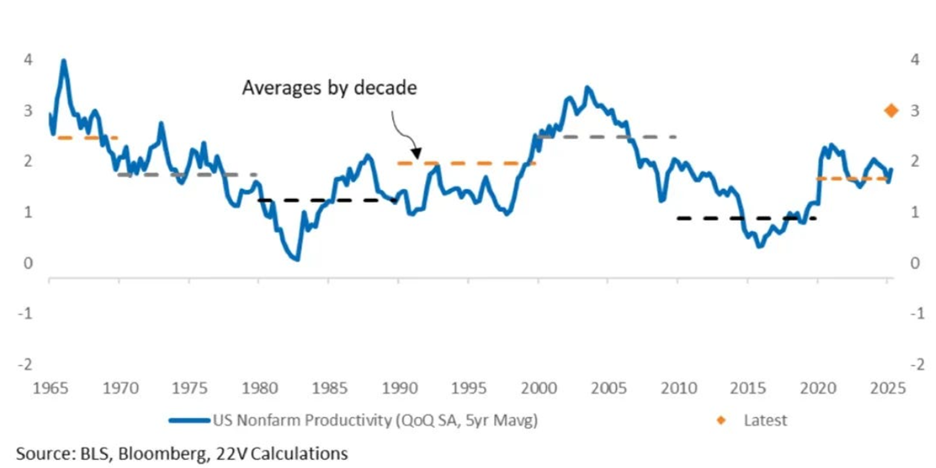

- While the increase in revenue from AI is limited in comparison to the hundreds of billions of dollars invested to date, there has already been a huge jump in productivity, a key driver of economic growth. The advent of the internet led to an unprecedented surge in productivity, but it emerged several years after the tech bubble burst (figure 3).

Figure 3

How we are navigating this market.

-

Recognizing the limitations of continued growth - AI infrastructure spending is undeniably strong at present. Many of us have seen the video at the white house where Mark Zuckerberg announces 600 Billion in Infrastructure and Data Center spend, much to Mr. Trumps delight. The duration of this continued spend is unknowable, but deceleration is inevitable given the magnitude of the sums already invested.

- Investing in companies across the computing stack - Although its easy to lump AI trades into a bucket, there are many players (both users and producers) in this space. Ensuring our portfolios have exposure across the sector remains a priority

- Buying proven business models - While it’s tempting to chase short term trades like unprofitable companies in quantum computing, drones and meme stocks, these trades come and go, and ultimately rely on market-timing, a very unreliable strategy. We’re focused on the sustainable earnings streams that will generate wealth for our clients in the decades to come.

- Enjoying the ride, while remaining cautious – We understand that the underlying dynamics of this market are inherently complex. Will productivity gains offset AI-related job losses? Will energy remain a bottleneck? Will a Chinese innovator disrupt the market? We continue to diversify our portfolio’s across geography and industry to provide protection against the unknown.