Greenwood White Group

August 21, 2025

When Your Neighbor Stops Lending Sugar: Navigating Canada-U.S. Tensions

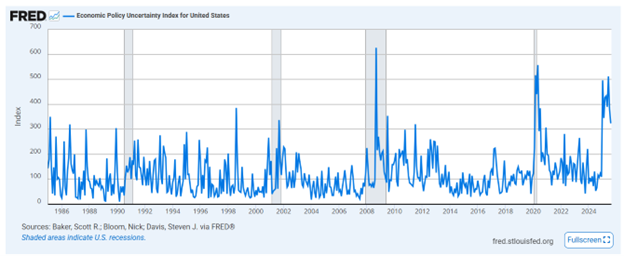

There is little doubt that we are living through uncertain times. According to the U.S. Federal Reserve, which has tracked economic policy uncertainty since the mid-1980s, only two periods have seen higher uncertainty than today: the COVID-19 lockdowns of 2020 and the Global Financial Crisis of 2008–2009.

When uncertainty is elevated, it’s no surprise that anxiety rises as well. At their core, markets are made up of people making decisions about how best to allocate their capital to achieve their goals. As Daniel Kahneman explains in Thinking, Fast and Slow, some decisions are made slowly, analytically, and deliberately—leading to better long-term outcomes. Others are made quickly, based on intuition or emotion, which can be useful for survival but are often prone to biases—such as overreacting to market swings, chasing fads, or panicking during downturns. You can probably guess which approach we advocate.

But before we allow the uncertainty to overwhelm us, let’s take a moment to reflect on where we stand.

The U.S. was Canada’s largest import partner last year and still remains so this year. While U.S. imports have declined, Canada’s other top trading partners have seen increases: China leads with a $3.85 billion (+9%) rise, followed by Mexico at $1.64 billion (+7%), and South Korea at $418 million (+5%) (Source: CBC).

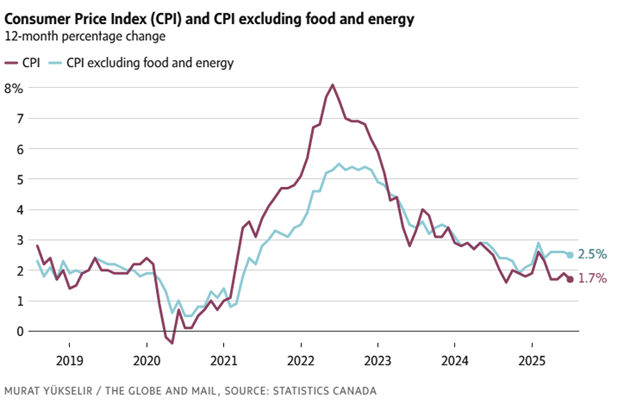

Yes, U.S. tariffs have slowed economic growth in Canada as exports take a hit, but the economy has not gone into freefall as some feared in April. The USMCA trade pact has allowed a significant portion of goods to continue crossing the southern border tariff-free, enabling many businesses to avoid the steep levies imposed by U.S. President Donald Trump. And in wake of all the noise, Canada’s inflation rate fell slightly more than expected in July, reaching 1.7%. Economists suggest this could pave the way for the Bank of Canada to resume cutting interest rates.

In a world dominated by social media and a 24-hour news cycle, we are constantly bombarded with headlines that trigger emotional responses—tariffs, the threat of war, the rise of AI—all powerful forces with uncertain outcomes. This environment can understandably lead to stress and anxiety. In times like these, it’s natural to focus on potential negative outcomes, even when positive ones are just as likely.

While we may wish we could influence the policies of our southern neighbors, that is beyond our control. It’s natural for Canadians to take a defensive stance as our relationship with our largest trading partner evolves. However, we believe a thoughtful, strategic approach will yield better results than a combative one.

Some might argue that Canada has been complacent in the past regarding productivity and nation-building, perhaps because it was easy to rely on our close relationship with the U.S. The current U.S. administration’s actions have challenged that complacency. The tariffs, provocative comments, and negotiating tactics are designed to elicit an emotional response. We must remember that these are simply part of the negotiation process, nothing more. The silver lining is that these challenges have prompted us to re-examine our position and strengthen our approach—whether by diversifying our trading partners, reducing inter-provincial trade barriers, or creating incentives to buy locally rather than relying on cheap imports. Canada is a great country, and we have been given an opportunity—a catalyst for change that was long overdue. Let’s embrace it and move forward with courage.