Calvin Tenenhouse

December 18, 2025

2025 in Review and Market Outlook

As 2025 draws to a close, it’s a good time to reflect on a year that required a steady hand on the wheel. While headlines focused on tariffs, Trump and narrow market leadership, the underlying story is one of broad-based earnings growth, central bank easing, market resiliency, and the continued importance of diversification. Here’s a look back at the key themes of the past year and what investors should keep in mind as we head into 2026.

Interest Rates: Central Banks Shift Course

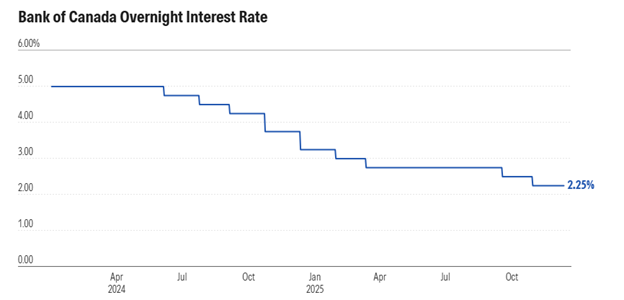

A defining feature of the year was the pivot by central banks. After raising rates aggressively to fight inflation in 2022 and 2023, policymakers across the globe signaled a new phase. A persistently weaker economy in Canada and cooling inflation prompted an earlier and more aggressive easing cycle by the Bank of Canada than markets anticipated. By October, the Bank had already cut rates to 2.25%.The US Fed also pivoted more quickly amid slowing economic momentum, now sitting at 3.5-3.75%.

(Source: Stats Canada)

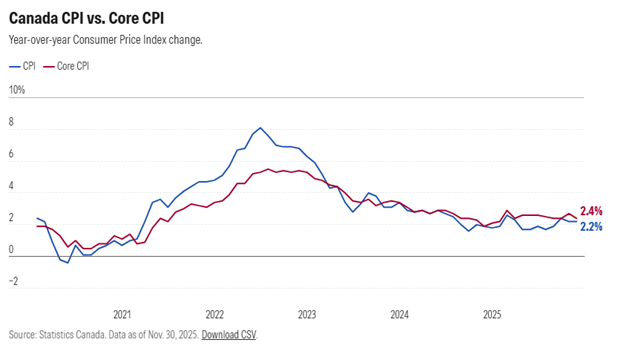

Inflation: Under Control.. For Now

After years of headlines dominated by price spikes, 2025 was the year inflation finally cooled. In Canada, inflation fell into the mid-2% range as supply chains normalized and energy prices eased. Inflation didn’t disappear entirely and the damage that was done since 2022 will not be reversed. Still, compared to the turbulence of 2022 and 2023, 2025 was a year of progress in restoring price stability.

Geopolitics Still at Large

Politics once again played a significant role in shaping investor sentiment throughout the year. During the first Trump administration, we observed a clear pattern: knee jerk market reactions would follow statements or posts about economic policy, often resulting in sharp, short-term moves that reverted as investors recognized much of the rhetoric is just “Trump being Trump.” More recently, the technology sector has found itself at the center of geopolitical tensions, with the U.S. banning the export of advanced AI chips to China. Unlike previous public negotiations, this move feels more substantial and will likely become a headwind for semiconductor revenues.

Index Composition and Returns: The Story Beneath the Surface

Market indices told a tale of robust returns. All major equity indices notched double digit returns. A closer look reveals that performance was heavily concentrated in a few sectors and stocks.

Canadian Stocks (S&P/TSX Composite): Gold had a standout year. Prices soared to record highs above $3,600 per ounce, gaining nearly 40% as investors turned to safe havens in the face of geopolitical uncertainty and anticipated central bank rate cuts. With the U.S. dollar weakening, gold regained its shine as a store of value, proving that even in an AI-driven market, traditional hedges still have a role. The materials sector of the TSX is up an astonishing 95% Year To Date and has driven the bulk of Canadian market returns this year. Strip out the yellow metal, and the Canadian market’s performance was far more subdued.

U.S. Stocks (S&P 500): Technology continued its dominance, with a handful of AI-driven giants accounting for much of the index’s advance. Nvidia and Microsoft accounted for 30.3% of the entire return of the index, but their returns this year were eclipsed by Google, and two new entrants to the trillion dollar club: Broadcom and Eli Lilly. The Market Cap-weighted S&P 500 is up 91% nominal / 73% real (net of inflation) since October 2022, but the equal-weighted index is up only 36% real, showing how narrow leadership and inflation have skewed the picture. This concentration means that, for investors holding broad market exposures, absolute returns may have lagged headline numbers unless their portfolios were overweight Big Tech.

For the first time in several years, the US market underperformed its global peers, a scenario few predicted as the year began. YTD the S&P 500 has lagged the TSX Composite, the MSCI Emerging Markets, MSCI Asia ex Japan, Japan TOPIX, and the UK FTSE. This reversal reinforced the importance of geographic diversification. Investors who broadened their horizons beyond the U.S. enjoyed smoother returns and greater resilience, a lesson worth carrying forward.

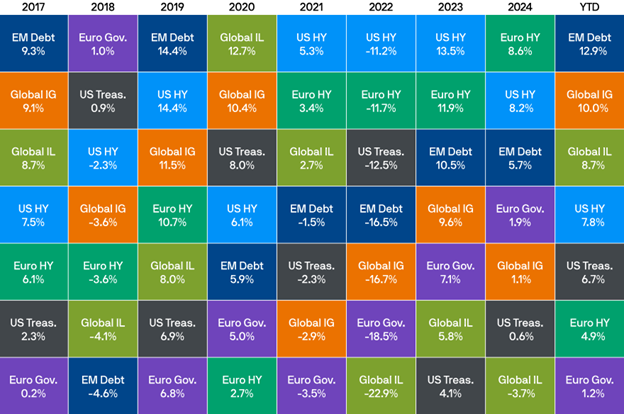

Bonds and Credit: Solid Returns and Portfolio Stability

Fixed income made a comeback in 2025, with credit markets delivering solid returns. Amid ongoing macroeconomic uncertainty, bonds remained a crucial element of portfolio construction, providing income and stability. Investors who maintained exposure to credit benefited from both yield and capital appreciation. Fixed Income Sector Returns shown below as of November 30, 2025.

(Source: JP Morgan)

2026 Market Outlook: Opportunities and Challenges Ahead

Companies remain resilient. Market discussions frequently portray companies as victims who are subject to macroeconomic forces such as geopolitical tensions, political instability, central bank decisions, and trade policies. While these factors do influence managerial decisions, the business we hold have repeatedly demonstrated capacity to prosper even when facing significant external challenges. Over the past 25 years, a series of disruptive events—including 9/11, the financial crisis, various wars, COVID-19, inflation, and periods of aggressive monetary policy have equipped management teams of major corporations to adapt, grow, and maintain profitability across diverse conditions. Although 2026 will likely bring its share of macroeconomic uncertainties, as is typical each year, investors should avoid making hasty judgments about individual companies or their earnings prospects.

While we continue to be optimistic about our portfolios we recognize that political uncertainty, high valuations, tight credit spreads, and unresolved tariff questions point to a more volatile environment. Investors should continue to expect choppy markets and be prepared for sudden shifts in sentiment. To mitigate this volatility, we continue to recommend a global equity mix, specifically in Europe and the Emerging markets where earnings growth now exceeds the US.

Year-End Planning Notes

As always, smart planning is essential as we enter the new year:

TFSA, RRSP, FHSA: Review your contribution limits and ensure you’re maximizing tax-advantaged accounts. The new First Home Savings Account (FHSA) continues to provide valuable opportunities for first-time buyers. The maximum contribution amounts for each type of account in 2026 are:

Prescribed Loan Rate: The declining prescribed loan rate (currently 3.00%, down from a high of 5.00% in 2024) makes income splitting strategies more attractive for families, potentially reducing overall tax burdens. If there is a significant income disparity between you and your spouse and we have not discussed the benefits of a prescribed rate loan, please reach out to your tax advisor to determine whether there are any strategies, such as those outlined here, that could work for you.

From everyone at the Greenwood White Group, we wish you a restful holiday season and a prosperous New Year.